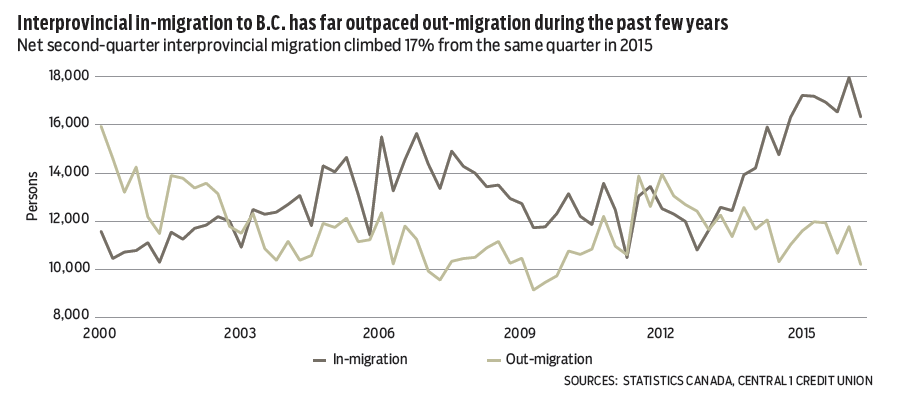

An increase in net international inflows and continued high interprovincial gains from other provinces helped drive B.C.’s population growth during 2016’s second quarter.

As of July 1, B.C.’s estimated population was 4.75 million, marking a gain of 1.2% from a year ago. As annual population is reported on a July-over-July basis, this also marked the strongest annual gain since 2014 but ranked sixth among provinces for population growth for the year.

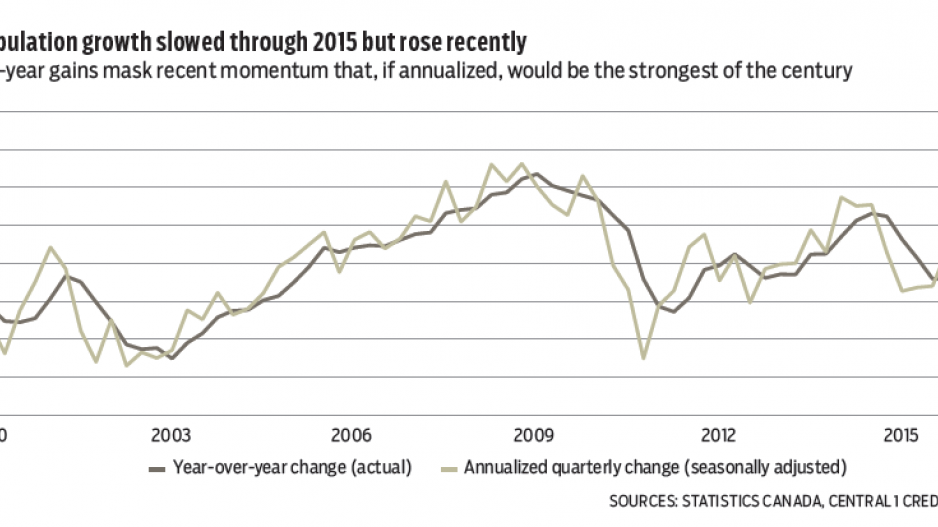

Year-over-year gain understates recent momentum. Adjusting for seasonal factors, quarter-over-quarter population growth reached an annualized 1.6%, accelerating from a pace of 1.4% in the first quarter.

Net international migration rose in the second quarter but reflected a jump in non-permanent residents. While the underlying trend of landed immigrant entry remained positive, the seasonally adjusted flow fell about 10% from the first quarter.

Nonetheless, quarterly landed immigrant entries were still 23% higher than the same quarter of 2015, though it represented a deceleration from a 73% gain in the first quarter.

Net interprovincial migration climbed 17% from same-quarter 2015. Relatively strong performance of B.C.’s economy, a robust labour market and demographic drivers underpin the shift westward. B.C.’s population cycle has particularly gained from Alberta’s economic struggles as residents move to B.C.’s greener economic pastures.

Central 1 forecasts population growth to average 1.3% in 2017 and 2018.

B.C. employment insurance (EI) counts jumped in July to a seasonally adjusted 55,860 beneficiaries, up nearly 9% from June but only 1% up from a year ago.

While the uplift seems to contradict strong employment gains in the province, it likely reflected federal EI policy changes.

EI increases were concentrated among areas outside the Lower Mainland-Southwest and Vancouver Island regions that recorded declines, while increases in other regions were more than 30%. This is likely explained by the extension of EI benefits, starting in July, for hard-hit commodity-producing regions.

Labour market conditions remain very strong in the Lower Mainland-Southwest and Vancouver Island markets, owing to strength in the consumer economy, housing and tourism.

In contrast, subdued conditions persist in other areas that are affected by low commodity prices and interprovincial labour market linkages with the Alberta oilsands. •

Bryan Yu is senior economist at Central 1 Credit Union