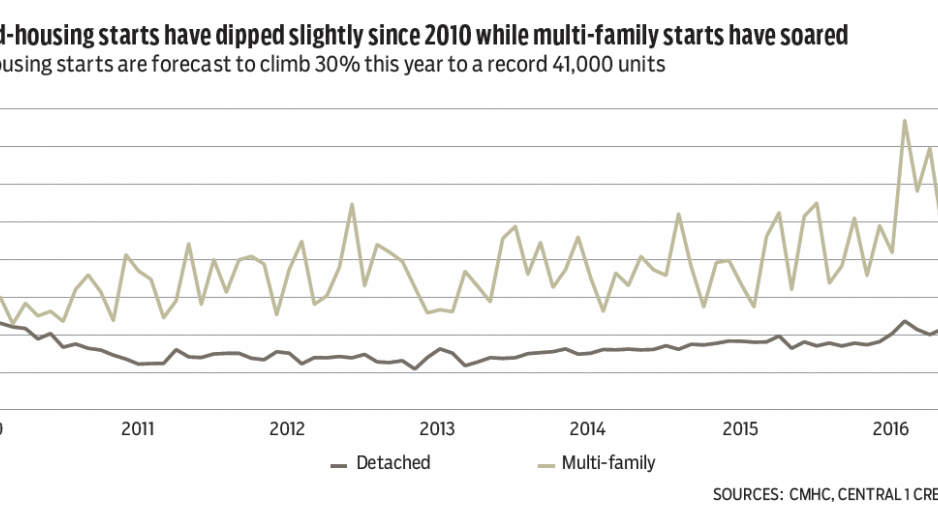

Metro Vancouver multi-family construction surged in September, pushing provincial housing starts back to the record-high pace observed earlier in the year. Total urban-area housing starts reached a seasonally adjusted annualized pace of 47,500 units, up 39% from August and 72% above a year ago.

While monthly housing starts are subject to substantial swings due to the effect of multi-family construction in any given month, underlying construction remained elevated. Strong housing demand and low inventories in recent years, successful pre-sale activity and a growing economy and population have contributed to the large gain.

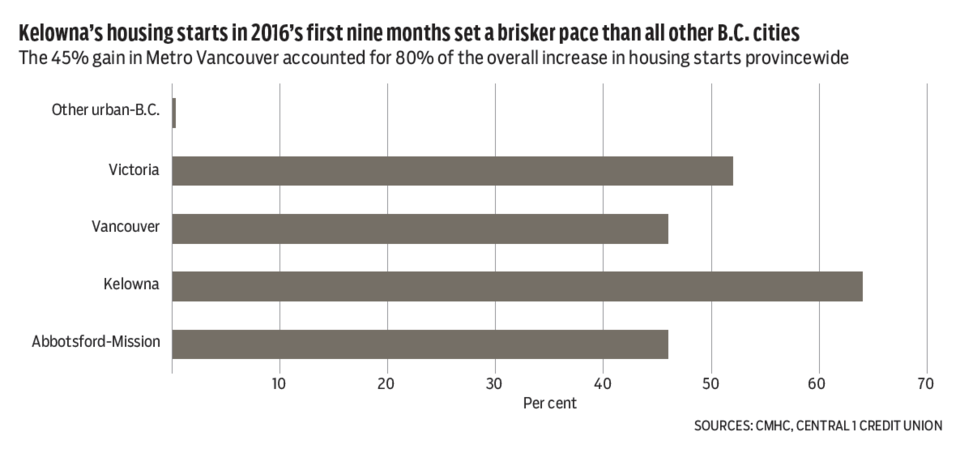

Through the year’s first three quarters, housing starts were up 39%. Among urban markets, a 45% gain in Metro Vancouver accounted for about 80% of the overall provincial increase. Meanwhile, Kelowna starts climbed 64%, Abbotsford-Mission 46% and Victoria 51%. Growth was more modest in medium-sized cities.

Annual housing starts are forecast to climb 30% this year to 41,000 units, but the trend will decelerate owing to the foreign-buyer tax and federal housing policies. Starts are forecast to decline 10% next year.

B.C. Multiple Listing Service (MLS) home sales slowed for a fifth consecutive month in September with declines across all regional real estate boards. Total sales fell 4.7% from August and 11% from the same month in 2015.

While B.C. sales are down 30% since April, owing mostly to a 40% drop in the Lower Mainland, it should be kept in context. Overheated conditions during the spring have returned to a more normal range. Outside the Lower Mainland, home sales are down 15% from early-year highs but are in line with peaks from the mid-2000s. Seller’s market conditions prevail in Vancouver Island and Kelowna-centred Okanagan-Mainline, albeit with northern B.C. and the Kootenay favouring buyers. In the Lower Mainland, the ratio still favours sellers, but is moving quickly into balanced – and in some sub-markets, buyer’s – territory.

The average provincial MLS price climbed 2.8% to $609,650 in September but was 18% lower than in March. This largely reflects a shift away from the higher-priced detached sales in the Lower Mainland. Benchmark price indexes were flat in the Lower Mainland but continued to rise on the Island. Further cooling in sales and modest price declines are expected over the next three to six months due to the tighter federal mortgage insurance policy. •

Bryan Yu is senior economist at Central 1 Credit Union