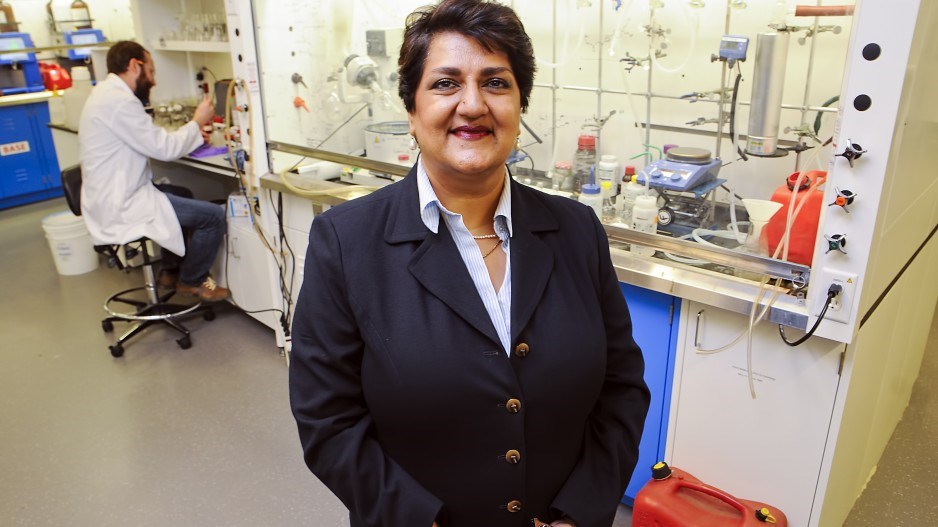

Funding for the biotech and life sciences sectors in Canada “really has been a desert,” according to Karimah Es Sabar, CEO of Vancouver-based Quark Venture Inc.

“A lot of these companies go to Europe or go to the U.S. for funding. We’ve just never had that kind of capital available.”

But Es Sabar envisions a re-energized and more competitive B.C. life sciences sector following last week’s launch of a US$500 million ($656 million) venture fund backed by Quark and Chinese investment bank GF Securities Ltd.

The Global Health Sciences Venture Fund, the largest of its kind in Canada, will be headquartered in Vancouver.

It’s the second high-profile fund bolstering the innovation sector to launch in this province over the past year.

Victoria announced on October 21 that Kensington Capital would manage its $100 million B.C. Tech Fund on the condition the Toronto-based group agreed to open a local office and hire a managing partner already based in the province.

Another big difference between the two funds is that Quark’s, which is privately held, won’t be targeting B.C. firms exclusively.

“In our minds it didn’t matter which biotech cluster the fund sat in,” Es Sabar said. “But we’re here, and we think there’s a real opportunity having it in Vancouver to build this bridge between North America and China.”

While the fund is headquartered in Vancouver, it will be backed by an office in Boston and two offices in China.

“The fact that [Es Sabar] is based in Canada means she won’t have a bias against Canadian companies,” said Nancy Harrison, president of MSI Methylation Sciences Inc.

Harrison originally cut her teeth in the venture capital industry, serving as a partner at Ventures West Management Inc. before founding MSI in 2008.

“It’s not that the U.S. guys do [have a bias],” she said. “It’s more difficult to invest in a company that’s further away from you.”

MSI has raised US$60 million since its launch almost a decade ago. Half of that came from an investment Quark announced in mid-October.

Of the US$30 million coming from Quark, Harrison said about $22 million has been earmarked to fund clinical trials for the antidepressant medication her company is developing.

Despite capital funding challenges, the B.C. life sciences sector has had some recent success stories.

In May, Zymeworks CEO Ali Tehrani told BIV his firm could realize as much as $4.4 billion in payouts from agreements made with pharmaceutical companies like GlaxoSmithKline, Celgene (Nasdaq:CELG) and Eli Lilly and Co. (NYSE:LLY). The Vancouver-based company specializes in cancer treatments.

Meanwhile, Es Sabar, who led the Centre for Drug Research and Development before joining Quark in late September, said basing the fund in Vancouver also gives investors the chance to look at oft-ignored Canadian companies.

“Canadian companies will benefit enormously from having a fund of this calibre at their doorstep,” she said. “But it won’t be that Canadian companies will have a lower bar to [access investments].”

@reporton