Former high-flying Vancouver medical device company Neovasc Inc. (TSX:NVC; Nasdaq: NVCN) saw its shares plunge more than 37% on November 1 after the company revealed details of damaging court rulings.

Shares in the heart-valve maker are down more than 87% compared with a year ago.

Neovasc announced the results of post-trial motions in the U.S. Federal District Court which followed a jury verdict in May that ordered Neovasc to pay competitor CardiAQ US$70 million for stealing intellectual property.

The new information included that Judge Allison Burroughs has ruled that CardiAQ was the inventor of Neovasc's ‘964 Patent.

Burroughs also upheld the jury’s May verdict and its US$70 million award against Neovasc. She then awarded CardiAQ US$21 million in enhanced damages to come from Neovasc.

The only good news for Neovasc was that Burroughs denied CardiAQ’s motion for an injunction to stop Neovasc from continuing to develop what Neovasc calls Tiara heart valves.

Those valves are groundbreaking technology because they can be inserted into a patient via catheter and fix a leaky heart valve without requiring open-heart surgery.

Neovasc said in a release that it would “immediately seek to stay the payment of the US$70 million damages award, and the enhancement to that award, until after an appeal of the validity of the award, as well as the ruling on inventorship.”

The current ordeal is a giant comedown for Neovasc, which had been a high-flying, stock-market darling and a gem in Vancouver’s life science industry.

In 2014, Neovasc was coasting on success earned when surgeons at St. Paul’s Hospital successfully implanted one of the company’s Tiara devices into a patient to fix a leaky heart valve without requiring open-heart surgery.

It was only the second time that doctors had done such an operation.

Surgeons have used similar devices for years to fix problems in the aortic valve, but only once before in the mitral valve via catheter.

Neovasc’s shares, then listed on the TSX Venture Exchange, jumped 35% post-operation and proceeded to more than triple in the lead-up to February, 2015, when the shares on Nasdaq hit a peak of US$9.90.

Those same shares closed at US$0.64 on November 1.

The downfall came after privately held, California-based CardiAQ Valve Technologies sued Neovasc in mid-2014 alleging that Neovasc committed “fraud, misappropriation of trade secrets, breach of contract and unfair and deceptive trade practices.”

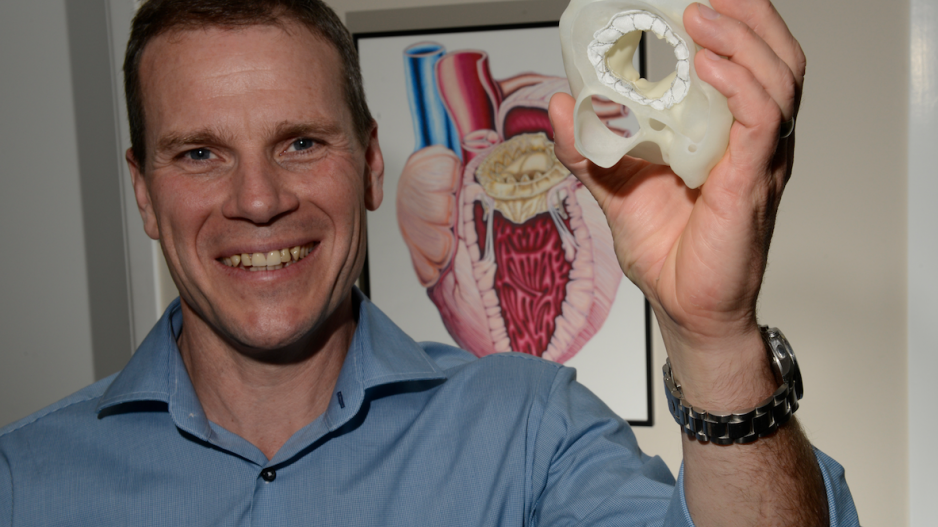

(Image: Neovasc's Tiara valve | Dominic Schaefer)

Neovasc’s CEO, Alexei Marko hinted to Business in Vancouver at the time that the lawsuit was a case of sour grapes.

“Unfortunately the medical device space is one that tends to be littered with [lawsuits],” Marko said in 2014.

“Whoever is at the lead of the pack unfortunately gets suits filed on them by all the folks who aren’t.”

For CardiAQ lawyers, such as in-house counsel Vito Canuso, the case was much more than that.

He explained to BIV in 2014 that CardiAQ had originally partnered with Neovasc to gain a better understanding of how to link tissue with CardiAQ’s valves.

CardiAQ wanted to meld tissue with CardiAQ’s valve prosthetic and it paid Neovasc a fee for the service, Canuso said.

“Essentially we were opening up our kimono to them,” Canuso said.

“What we didn’t learn until after the fact was that they had taken all [our] confidential information and started their own competing micro-valve prosthetic program.”