There were few surprises in Canada Mortgage and Housing Corp.’s recently released semi-annual scan of B.C. rental markets in the purpose-built segment.

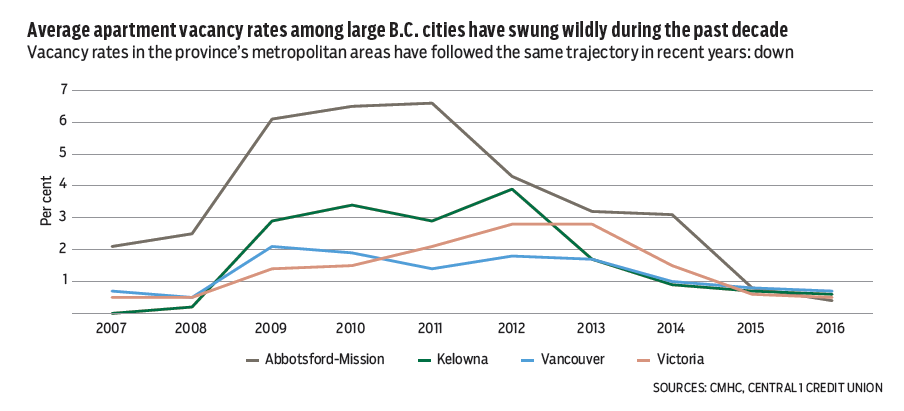

The province’s average apartment vacancy rate held steady at 1.3%, up from 1.2% in 2015. On average, B.C.’s rental market was tightest among Canadian provinces, with a 3.4% national vacancy rate. B.C.’s census metropolitan areas (CMAs) had the lowest vacancy rates in the country.

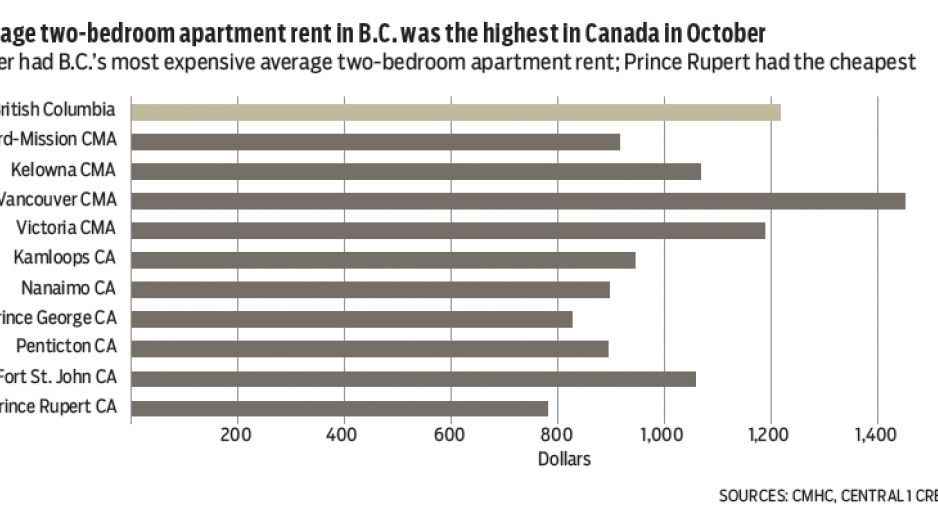

The average monthly rent for a two-bedroom apartment reached $1,215, the highest in Canada, while also posting the sharpest growth in same-sample rents at 5.1%. Nationally, same-sample rents rose 2%.

Low vacancy rates and rent inflation in B.C. reflect the combination of higher economic and employment growth, population inflows, higher home prices in large urban markets and lack of supply.

Among the four largest urban CMAs, vacancy rates were microscopic and down from a year ago, with Abbotsford-Mission at 0.5%, Kelowna at 0.6%, Vancouver at 0.7% and Victoria at 0.5%. Regions more dependent on the energy sector, mining and global trade have the highest rates of vacancy – particularly northeast B.C.

The most substantial average rent gains were observed in the large urban areas of Vancouver CMA (6.4%), Victoria (5.5%), Abbotsford-Mission (4.9%) and Kelowna (4.5%).

Foreign real estate purchases climbed as a proportion of total purchases in October, according to the B.C. Ministry of Finance, based on property transfer tax transactions.

The proportion of property transfers with a foreign-owner share reached 3% in Metro Vancouver, up from 1.8% in September and 0.9% in the month following the introduction of the foreign-buyer tax.

The tax has cut into sales, due to the effect on foreign purchasing decisions. Higher absolute foreign buying levels in October and increased share point to a return to the market from this segment.

We believe much of the drop in foreign purchasing will be transitory. While speculators will leave the market, those looking at longer-term residency and investment, or who have children in the post-secondary system, will still make purchases.

This continuing flow of data provides a better indication of how much foreign purchasing is now occurring, but the limited data before the tax implementation means we are still in the dark about previous foreign buying. •

Bryan Yu is senior economist at Central 1 Credit Union.