Vancouver medical-device maker Neovasc (TSX:NVC) has closed the US$75 million financing pact with life sciences giant Boston Scientific (NYSE:BSX) that sent Neovasc shares soaring after it was first announced on December 2.

Neovasc shares closed at $0.70 on December 1, before the deal with Boston Scientific was announced. By December 13, after Neovasc confirmed that the deal had closed, its share price had more than quadrupled to $3.05.

Boston Scientific’s shares rose about 6% during the same time frame and closed at US$21.34 on December 13.

Boston Scientific has agreed to buy Neovasc’s tissue processing technology and facility for approximately US$67,909,800 and invest an additional US$7,090,200 in Neovasc in exchange for a 15% equity interest in the company.

The transaction was controversial with at least one entity: medical device maker CardiAQ.

CardiAQ won a jury verdict in May that ordered Neovasc to pay CardiAQ US$70 million for stealing intellectual property.

U.S. Federal District Court Judge Allison Burroughs then ruled in late October that CardiAQ was the inventor of Neovasc's ‘964 Patent, upheld the jury’s May verdict as well as its US$70 million award against Neovasc, and awarded CardiAQ an additional US$21 million in enhanced damages to come from Neovasc.

The litigation and court rulings prompted Neovasc shares to plummet from a high of $6.91 in January to a low of $0.50, before the recent rebound.

On December 12, however, the U.S. District Court for the District of Massachusetts held a hearing in connection with Neovasc’s ongoing litigation against CardiAQ.

Ruling from the bench, the court denied CardiAQ’s motion for a temporary restraining order to prevent the transaction between Neovasc and Boston Scientific from closing.

The court also indicated a willingness to stay enforcement of the judgment against Neovasc pending appeal (the judgment is currently temporarily stayed), subject to Neovasc posting a partial bond valued at US$70 million, as well as other terms and conditions to be determined.

Those terms and conditions generally relate to CardiAQ's ability to register its U.S. judgment in Canada, and requirements for Neovasc to inform CardiAQ and the court about potential future transactions outside the ordinary course of business, Neovasc announced December 13.

The roller-coaster year of 2016 has been a huge setback for Neovasc, which had been a high-flying, stock-market darling and a gem in Vancouver’s life science industry.

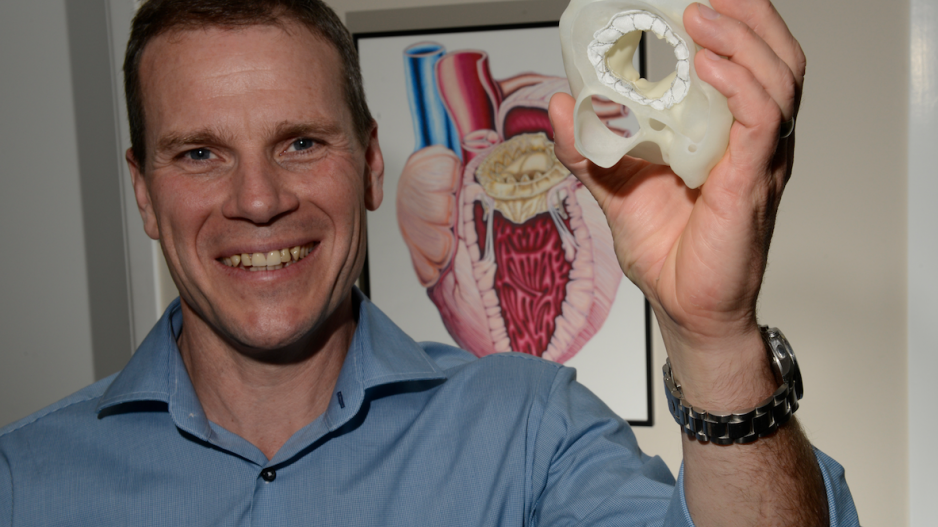

In 2014, Neovasc was coasting on success earned when surgeons at St. Paul’s Hospital successfully implanted one of the company’s Tiara devices into a patient to fix a leaky heart valve without requiring open-heart surgery.

It was only the second time that doctors had done such an operation.

Surgeons have used similar devices for years to fix problems in the aortic valve, but only once before in the mitral valve via catheter.

Neovasc’s shares, then listed on the TSX Venture Exchange, jumped 35% post-operation and proceeded to more than triple in the lead-up to February, 2015, when the shares on Nasdaq hit a peak of US$9.90.