B.C. retail retraced part of its previous month’s surge in November as sales declined for the first time in six months.

Despite the dip, consumer spending remained robust as total sales reached $6.37 billion. That was down 0.7% from October but 5.5% ahead of a year ago. Sales growth accelerated from October in the home furniture/furnishing segment and in electronics and appliances. In contrast, sporting goods and gasoline sales declined.

Strong gains in B.C. employment, tourism and elevated housing activity have underpinned year-to-date gains of 6.4%. Key contributors included an 8.5% increase in motor-vehicle-related sales, a 14% gain in building materials and supplies and a 12% increase in health-product-related stores.

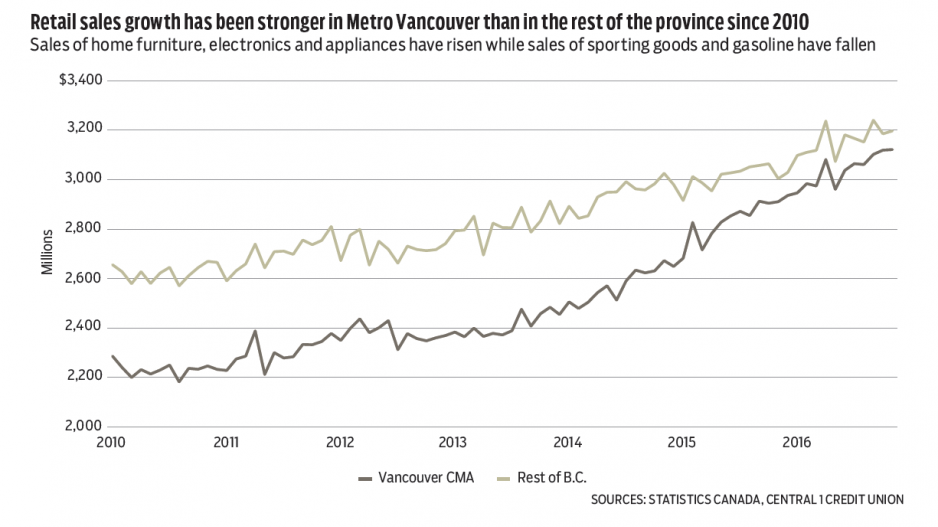

Regional spending patterns have been stronger in the Vancouver census metropolitan area (CMA). Growth was 7.7%, compared with 5.2% elsewhere in B.C. Housing-related sales growth in the Vancouver CMA was particularly strong.

B.C.’s growing economy, population and high tourism flows will continue to underpin retail activity with growth in 2017 a still-healthy 5%.

Meanwhile, B.C.’s housing market found some solid footing to end the year, but sales activity enters 2017 well short of last year’s early pace and is below historical norms with further downside momentum expected.

Provincial Multiple Listing Service (MLS) home sales were virtually unchanged from November at a seasonally adjusted 7,649 units, but were down 28% year-over-year. Strong uplift in B.C.’s central and southern Interior markets and slightly higher sales in the Lower Mainland relative to November offset declines in Chilliwack and northern B.C. and Vancouver Island markets outside Victoria.

Despite a sharp shift in momentum during the year, provincial MLS sales still climbed 9.5% to a record-high 112,200 sales. Annual sales growth was strongest outside the Lower Mainland and northern B.C. Vancouver Island markets recorded more than 25% gains in annual sales. Lower Mainland home sales edged up on gains in the Fraser Valley.

Monthly provincial sales have declined 30% since the spring. After an unsustainable run-up that also drove up prices, Lower Mainland sales reversed sharply, cooled by rapid affordability erosion and policy measures, including a luxury tax on high-priced properties and a foreign-buyer tax. Prices remain firm in most markets despite lower sales. Inventories remain tight with the sales-to-active-listing ratio indicating seller’s markets in most areas. •

Bryan Yu is senior economist at Central 1 Credit Union.