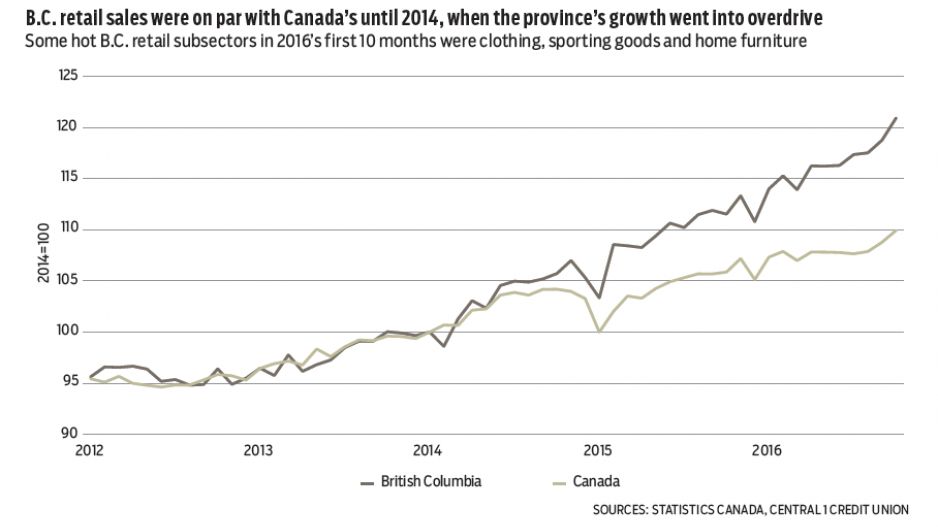

B.C. retailers posted another hefty sales gain in October driven by strong consumer demand and higher gasoline prices. Total dollar-volume retail sales reached $6.45 billion, up 1.8% from September and 8.4% from same month in 2015. B.C.’s gain outpaced the national performance.

Year-to-date sales growth of 6.3% reflects B.C.’s enviable environment of high employment growth, population expansion, elevated tourism and strong housing demand. However, housing in Metro Vancouver has slowed in recent quarters due in part to more restrictive government policy. Year-to-date retail sales growth in the Vancouver census metropolitan area, at 7.6%, helped drive the provincial gain. Most B.C. retail store segments contributed to October’s pickup with accelerated year-over-year growth for clothing stores (9.3%), sporting goods and recreation (8.8%) and home furniture and furnishing (8.4%). Higher prices pushed year-over-year growth for gas stations to 16%, while building material and gardening stores posted a 15% gain from last year. We anticipate that retail momentum, while remaining strong, will slow with a softer housing cycle.

Meanwhile, average weekly earnings in B.C. nudged lower by 0.1% from September to about $918, which matched the national change. Year-over-year, B.C.’s 0.5% gain in October outpaced a flat national performance and was third among provinces but extended the pattern of weak earnings growth of about 1%. National growth has been pared by contraction in Alberta.

Low growth in weekly earnings comes despite nation-leading employment growth, which was up 2.6% year over year in October and 3% year to date – well exceeding a national gain of 1%.

At the industry level, earnings growth was modest in both the goods-producing (0.3%) and services-producing (1.1%) industries. The strongest growth was in the forestry sector (2.8%), trade (2.4%), finance, real estate and leasing (3.5%) and information and cultural industries (6.5%), which includes some high-tech sectors.

Job losses in some high-paying sectors including mining and management, and stronger gains in lower-paying sectors contributed to low overall wage growth. However, adjusting for a shift in job market composition shows only a mild impact.

Other factors that could explain weak wage gains include higher incidence of part-time work and a growing supply of workers from other provinces.•

Bryan Yu is senior economist at Central 1 Credit Union.