A 2016 report released by the Greater Vancouver Board of Trade, based on research conducted by the Conference Board of Canada, examined how Greater Vancouver performs in relation to 19 other international metropolitan regions on key economic and social indicators.

To achieve this, it first looked back to assess changes that have shaped the Greater Vancouver region and identify the industries that have contributed to its success. It then looked forward to consider the trends that will shape Greater Vancouver in coming years and decades.

And it asked: Is the region competitive and attractive to businesses and people? Can it continue to prosper and grow?

It created a scorecard from the results.

The highlights at a glance

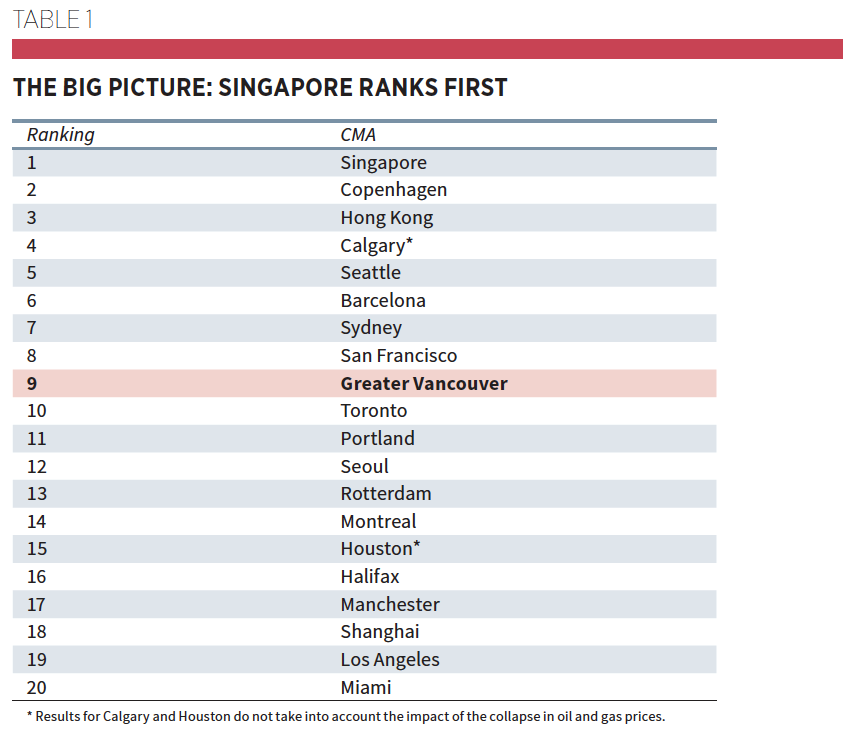

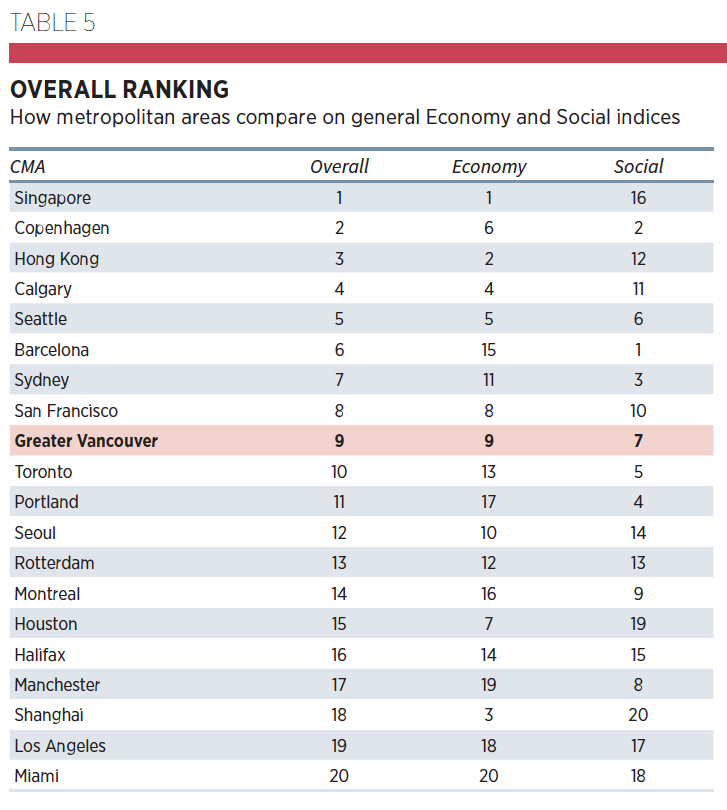

- Overall, the region places ninth in a ranking of 20 global metro regions that assesses attractiveness to highly skilled talent and business investment.

- The region places seventh of 20 on the social scorecard and ninth of 20 on the economic scorecard.

- Greater Vancouver got an A for clean air, its total tax index, its proportion of foreign-born residents, its homicide rates and its office rents, among the marks.

- Past, present and future successes of Greater Vancouver’s economy are closely linked to growing ties with Asia, with the transportation sector identified as a key industry cluster.

Greater Vancouver is defined as the Vancouver census metropolitan area (CMA), which encompasses 39 census subdivisions, including the city of Vancouver. It is Canada’s third-largest metro region, in population and economic activity, behind Toronto and Montreal. It boasts nearly 2.5 million residents and in 2014 produced goods and services valued at $119 billion – 58 per cent of British Columbia’s real gross domestic product.

On the surface, the results appear bullish. Greater Vancouver’s real GDP per capita growth has outpaced the national average since 2005. Between 2010 and 2014, the metro region’s annual average real GDP per capita growth was 1.9 per cent, 0.5 points above the national average of 1.4 per cent. Real GDP surpassed three per cent growth in four of the past five years.

The region’s recent economic success can be largely attributed to strong in-migration, an influx of businesses and private investment, and the growing importance of its role as Canada’s Pacific gateway to Asia.

There’s no doubt Greater Vancouver’s economy has benefited from its close and growing ties with Asia – the importance of transportation and warehousing is evident in the board of trade’s analysis, with these industries coming out on top in terms of recent performance. Foreign investment is also likely partly responsible for the region’s boom in residential real estate, even though evidence for this is still being gathered.

But Greater Vancouver has a lot more going for it. Financial services, insurance, tourism and information technology are some of the sectors, or clusters, where the metro region has demonstrated its competitive advantage in relation to the rest of Canada.

Overall, though, the service sector has dominated the labour market – on both the higher and lower ends of the skills spectrum.

In recent years, professional, scientific and technical services employment – largely knowledge-based occupations – has been on the rise. Today this broad sector is Greater Vancouver’s third-largest employer.

The region’s recent performance by no means guarantees future success. Looking ahead, globalization will continue to increase competition among nations and the regions within them. Lower trade and investment barriers and rapid advances in transportation and information communications technologies will drive this process. The information technology revolution has also accelerated the shift to the knowledge economy, increasing the demand for more highly skilled workers.

This is happening while aging populations are leaving the workforce in significant numbers in many countries. The situation will leave Canada and its metro regions competing for global talent.

Gateway to Asia ■ The importance of Greater Vancouver’s role as Canada’s gateway to Asia cannot be overstated.

Port of Vancouver and Vancouver International Airport have a geographic edge – both being the closest large North American facility in their respective industry to many fast-growth Asian markets.

Vancouver’s airport offers 110 non-stop destinations worldwide, served by 53 different airlines. Top global freight companies operate at the airport and skyrocketing volumes of e-commerce have boosted activity at its new mail processing facility – which handles over 30,000 parcels daily from Asia alone.

Likewise, Port of Vancouver is Canada’s largest, busiest and most diversified port, connecting the country to more than 160 trading economies annually, mainly those located in the Asia-Pacific region.

Trade with Asia will receive a boost if the recently signed Trans-Pacific Partnership (TPP) deal is ratified. Countries in the TPP accounted for almost two-thirds of British Columbia’s international exports in 2014. Many of these goods are shipped through Port of Vancouver. In addition, Canada is currently negotiating a comprehensive trade agreement with India, another big and growing destination for goods moving through Port of Vancouver. India and China are poised to generate continued robust growth in real income per household. Both countries will remain sources of growing demand for Canada’s resources, but more and more they are becoming consumer economies providing markets for Canadian goods and services that are higher up the value chain.

Having said that, it is important to note that the U.S. remains B.C.’s largest trading partner, with B.C. exporting nearly $18 billion of merchandise to the U.S. in 2014. It will remain the top trade market for the foreseeable future, given the size of the U.S. economy and its proximity to B.C. Indeed, B.C.’s export volumes to the U.S. jumped by over 15 per cent in 2014 and were up 4.5 per cent through 11 months in 2015. The continued weakness of the Canadian dollar and a healthy U.S. economy point to further strengthening in the province’s export volumes to the U.S., at least in the near term.

Key clusters ■ Traded clusters are groups of related industries that service markets beyond the region in which they are located. The board of trade’s report confirmed that the transportation sector is one of the key traded clusters in Greater Vancouver, along with tourism, information and culture, high tech and finance.

Greater Vancouver is an attractive destination for tourists from across Canada and the world, making this segment an important cluster. While many of the visitors are Canadian, growth in the number of international visitors has been solid. Asia’s influence on tourism is also growing. In particular, the number of Chinese tourists visiting Metro Vancouver reached 230,000 in 2014, up from 89,000 in 2009 when Canada was granted “approved destination status” by the Chinese government. A weaker Canadian dollar vis-a-vis the greenback is also helping to boost U.S. visits.

Overall, cruise ships, convention capacity and the “Whistler effect” of the nearby resort city helped spur more than 8.9 million people to visit and stay at least one night in Greater Vancouver in 2014. Spending by tourists on accommodations, food, travel and activities has a significant impact on Greater Vancouver’s economy, generating billions of dollars in revenue and supporting thousands of jobs each year.

The information and cultural sector, particularly the motion picture and sound recording industries, is an important and growing industry in Greater Vancouver. Generous provincial and federal tax incentives, proximity to Los Angeles, skilled crews, industry infrastructure and attractive scenery have made Greater Vancouver and British Columbia a popular location for foreign film and television production. Over the past few years, foreign producers spent roughly $1.1 billion annually in B.C. – an amount likely to grow, because the depreciated dollar lowers costs for U.S. producers filming in Canada.

Greater Vancouver ranks fourth in North America in motion picture and television production spending – behind Los Angeles, New York and Toronto. Many other jurisdictions in Canada and the United States offer tax credits and subsidies to attract producer spending, but the weak Canadian dollar coupled with the expertise of the local workforce in film, television and visual effects should help Vancouver maintain its status as “Hollywood North.”

Greater Vancouver’s information and communications technology sector is rapidly expanding, boasting well-established global companies like Telus and a steady stream of startups. Over the past five years, employment in this sector has risen by four per cent annually to more than 58,000 jobs in 2014 – 4.5 per cent of Greater Vancouver’s total employment. Specifically, two high-tech-related sectors – computer and electronic manufacturing and computer-system design services – have been identified as traded clusters.

Existing high-tech companies are attracted to Greater Vancouver by the highly skilled workers that call Vancouver home, many of whom are graduates of post-secondary institutions with campuses in the region, such as the University of British Columbia, Simon Fraser University and the British Columbia Institute of Technology.

Vancouver’s finance sector has been quickly rising in prominence internationally – ranking 14th as a global financial hub, three spots below Toronto and ahead of Montreal. In 2014, 41,900 people worked in finance, while 20,400 people worked in the insurance industry. Greater Vancouver’s well-educated workforce, strong economic growth and investments in transportation infrastructure are thought to be adding to the success of finance and insurance firms.

The future for the region’s finance and insurance sectors looks bright. Continued trade with the Asia-Pacific region in the coming years should help Greater Vancouver’s finance sector grow in worldwide importance. Rising trade with China opens the possibility that Vancouver could become a direct trade settlement hub using Chinese currency, the renminbi. Canada’s insurance industry has also been taking advantage of underserved markets in China and Asia.

The region has benefited from its close ties with, and proximity to, China and other fast-growth Asian markets. Growth in transportation infrastructure has bolstered gateway activity and attracted significant private investment. The economy has also benefited from the highly skilled workforce supplied by its many educational institutions, and its attractiveness to interprovincial and international migrants. Greater Vancouver’s continued success will likely depend on these very same factors – its ability to continue to draw private investment and skilled workers, competing globally with other metro regions.

The Scorecard ■ One of the main purposes of the report was to assess, through benchmarking, Greater Vancouver’s relative performance and potential in attracting labour and business investment against 19 other global metro regions.

Given the strategic importance of transportation to Vancouver’s economy, 18 of these 19 comparator regions were selected because they are also major transportation gateways. Calgary, the lone metro region without an outsized transportation sector, is included in the rankings because its relative proximity to Vancouver makes it a key competitive measuring stick.

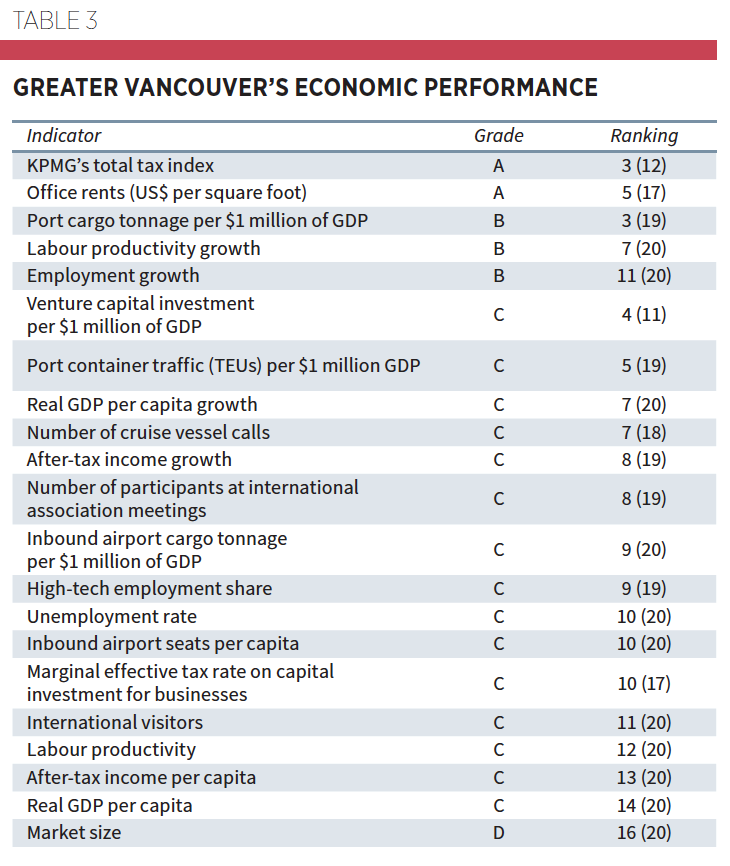

The results of the Greater Vancouver Scorecard are based on 32 indicators in two domains: Economy and Social. A report card-style ranking of A, B, C and D letter grades is used to assess the performance of metropolitan areas for each indicator.

The report assigned grades using the following method: for each indicator, it calculated the difference between the top and bottom performer and divided this figure by four. A metropolitan area received a scorecard ranking of A on a given indicator if its score was in the top quartile, a B if its score was in the second quartile, a C if its score was in the third quartile and a D if its score was in the bottom quartile.

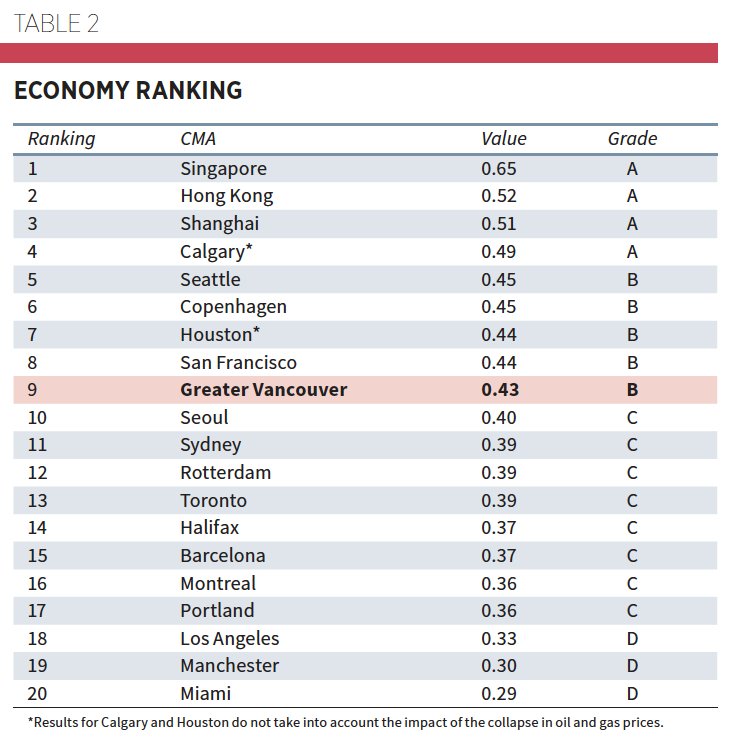

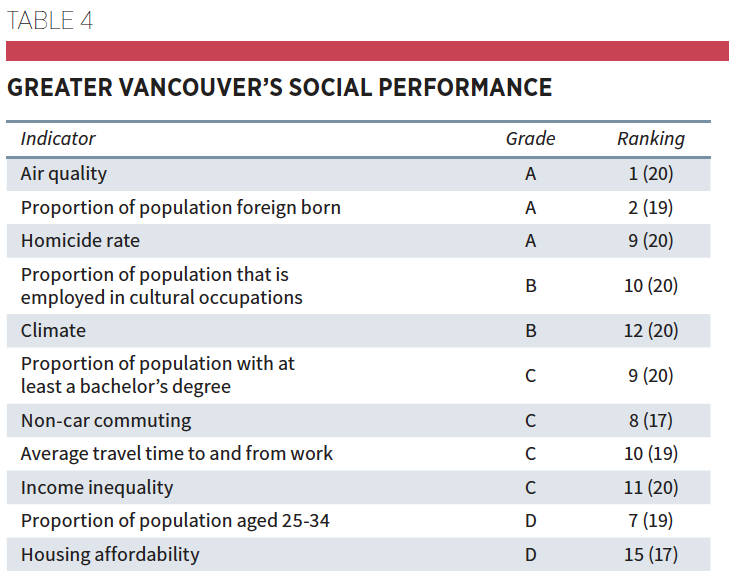

Greater Vancouver ranks ninth overall in the scorecard, the combination of a seventh-place finish in the Social domain and a ninth-place spot in Economy. Despite its relatively high Social ranking, the domain still highlights three factors that negatively impact the region’s livability: housing affordability, inadequate public transit and road infrastructure, and educational attainment rates that fall short of the scorecard’s leaders.

Greater Vancouver finishes in ninth place with a B grade in the Economy domain. It earns an A grade on KPMG’s total tax index, which measures the total taxes paid by similar corporations in a particular location and industry, calculated as a percentage of total taxes paid by similar corporations across the United States. Greater Vancouver’s high marks on this indicator are also a result of its lower statutory labour costs (payroll-based taxes) relative to its U.S. comparators.

Greater Vancouver ranks fourth out of 11 metro areas on venture capital investment per $1 million of GDP, but it remains well behind leaders San Francisco, Houston and Seattle.

On a positive note, Greater Vancouver performs well on the transportation-oriented indicators. In particular, it can boast North America’s top-ranked port for both container traffic and tonnage, relative to the size of its economy. Moreover, Greater Vancouver is home to Canada’s largest cruise ship port. Activity at Greater Vancouver’s airport is more middle-of-the-pack.

Finally, Greater Vancouver also gets good grades for its affordable office rents, which on a square-foot basis trail only Montreal’s among North American metro regions. But this is offset by very poor housing affordability, which limits Vancouver’s attractiveness to the highly skilled workers that businesses seek.

The Social domain shows how 20 metro areas are performing on 11 measures of a region’s socio-economic, environmental and quality-of-life attributes. These measures underpin a region’s ability to lure much-needed educated, creative and diverse people to fill cities now and in the future. They will consider regional quality of life as they choose where to live.

Greater Vancouver ranks seventh overall with a B grade, placing it higher than all of its Canadian counterparts except Toronto.

It gets high scores for its clean air – it leads all cities and regions surveyed for the report – for its large proportion of foreign-born residents, and low homicide rate, all of which are attractive to potential residents. Its ranking confirms that Greater Vancouver is one of the world’s most livable metro regions.

Greater Vancouver’s near-term economic outlook appears bright. Its many traded clusters seem poised to take advantage of growing trade, in both goods and services, with Asian markets, while a low-flying loonie should also help it leverage economic activity with an improving U.S. economy.

However, the region’s longer-term performance will depend on the ability of its leaders to deal with seven important challenges revealed in the study: housing affordability, land scarcity for enabling trade, lack of investment in roads and public transit, low productivity levels, educational attainment rates, high marginal tax rates for business, and attracting head offices.