B.C.'s jobs juggernaut plowed ahead in February, signalling continued momentum for the economy. Estimated employment rose 0.8% from January to a seasonally adjusted 2.44 million persons with net growth of 19,400 entirely reflecting full-time hiring.

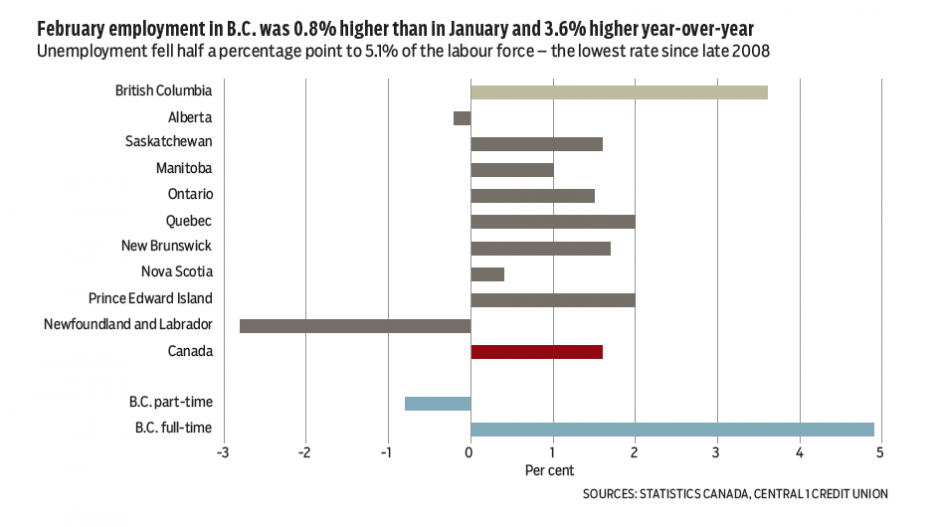

February’s gain added to a recent accelerated trend that propelled year-over-year employment growth to 3.6%, well ahead of all other provinces and the national increase of 1.6%. Further rotation toward full-time employment was another strong economic signal and could reflect part-time employees gaining full-time status.

Unemployment fell half a percentage point to 5.1% of the labour force, pointing to the tightest labour market in the country and the lowest rate for B.C. since late 2008. While unemployment rates can fluctuate significantly, B.C.’s strong hiring conditions support a low unemployment rate, which will lift wage pressure.

Employment momentum is expected to decelerate over the coming months, with average annual employment growth forecast at a moderate 1.5% following 2016’s 3.2% gain.

Following three months of surging sales, B.C. international goods exports partly retraced in January. Despite the drop, the underlying trend remained positive, setting the stage for a moderate gain this year.

Seasonally adjusted, sales reached $3.75 billion, marking a monthly drop of 8%. Energy product exports, which drove gains in recent months, were largely responsible for January’s slowdown and reflected a partial pullback in coal prices after last year’s surge.

Year-over-year export growth decelerated from December but was still a robust 26%. Energy product sales more than doubled from a year ago. Dollar-volume sales of natural gas doubled, while coal sales climbed 160%. However, the former was driven mostly by higher physical shipments, while growth in coal was entirely price-related.

Dollar-volume gains were also recorded for metal and mineral products (39%) led by molybdenum and unwrought aluminum, and there was a mild uplift in forestry (4.1%). However, exports of machinery and motor vehicle parts eased.

Adjusting for the lift from commodity prices, we estimate that real exports rose about 10% year-over-year.

Exports will remain a growth driver for B.C.’s economy this year due to a low Canadian dollar and increased mine production, but they face risks associated with the softwood lumber dispute and uncertainty over potential policies of the new U.S. administration.•

Bryan Yu is senior economist at Central 1 Credit Union.