There were more signs this week that investment in Northeastern B.C.’s Montney formation will continue regardless of whether a liquefied natural gas industry ever develops in B.C.

On March 20, TransCanada Corp. (TSX:TRP) announced it had filed for a variance with the National Energy Board (NEB) on its North Montney Mainline project, which would add new pipeline links to bring new gas supplies into TransCanada’s existing NOVA Gas Transmission Ltd. (NGTL) mainline.

TransCanada already received NEB approval to build the North Montney Mainline, at a cost of $1.7 billion, but that approval was contingent on the Petronas Pacific NorthWest LNG project getting a final investment decision.

But TransCanada now wants to proceed with building out a slightly scaled back system, at a cost of $1.4 billion, regardless of whether the PNW LNG project gets an FID. It does not include the roughly 100 kilometres of pipeline that would be required, if the PNW LNG project goes ahead.

Eleven gas producers have signed 20-year commitments to ship up to 1.5 billion cubic feet of gas per day on the Nova Gas pipeline system, which gives those producers a variety of options for delivering gas throughout Canada and the U.S.

“The new commercial arrangements demonstrate a current and long-term market demand for North Montney gas supply in advance of, and independent of, the PNW LNG final investment decision,” said TransCanada communications manager Shawn Howard.

The long-term commitments made on the NGTL are completely separate from last week’s announcement of long-term commitments made by gas producers to move gas on TransCanada’s Canadian Mainline, which will take natural gas from Western Canada to Eastern Canada and into the U.S. Midwest.

Oil and gas companies have pumped billions into Northeastern B.C. over the last six years. Initially, a considerable amount of that was in anticipation of an LNG industry developing.

But it has become apparent that the promise of new markets through LNG is only part of what is driving that investment now.

The Montney has proven to be a highly prolific and low-cost producing region, on par with the Marcellus shale in the U.S. In recent analyst calls, a number of producers have remarked that their wells in the Montney are performing better than expected.

Western Canadian gas producers can compete with some of the lowest cost producers in the U.S., but that requires additional pipeline capacity.

"This project adds significant pipeline capacity that connects new gas supplies from the prolific Montney basin to the NGTL system and will provide access to markets across North America," Karl Johannson, TransCanada's executive vice president of natural gas pipelines, said in a press release.

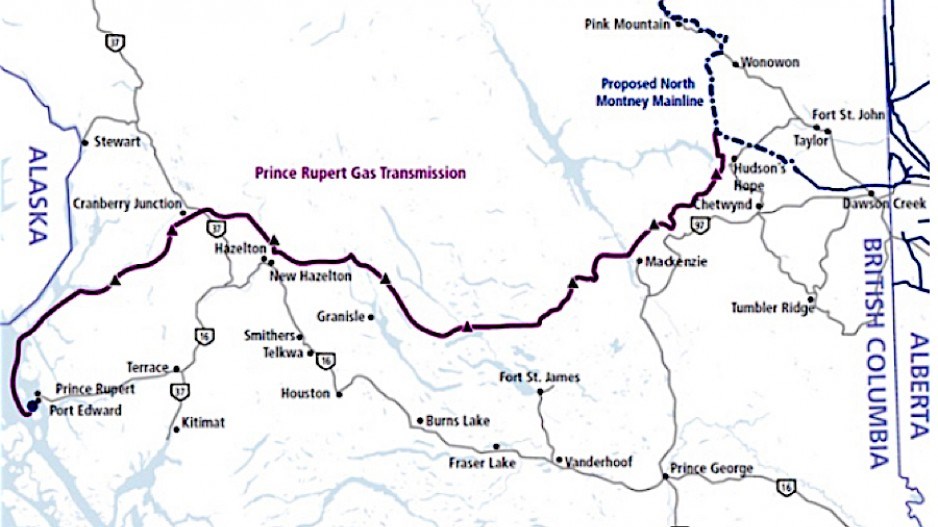

When it was approved, the North Montney Mainline project included the construction of more than 300 kilometres of new pipeline to bring gas from an area south of Prophet River, B.C. to Fort St. John.

The project included pipeline tie-ins with the Prince Rupert Transmission Line, which would feed the PNW LNG plant in Prince Rupert.

Under the revised plan – sans the PNW LNG project – the project would cost $1.4 billion on would include the construction of 206 kilometres of pipeline.