As expected, the Bank of Canada announced April 12 it is once again maintaining its overnight rate target at the historic low of 0.5%, where it has sat since mid-2015.

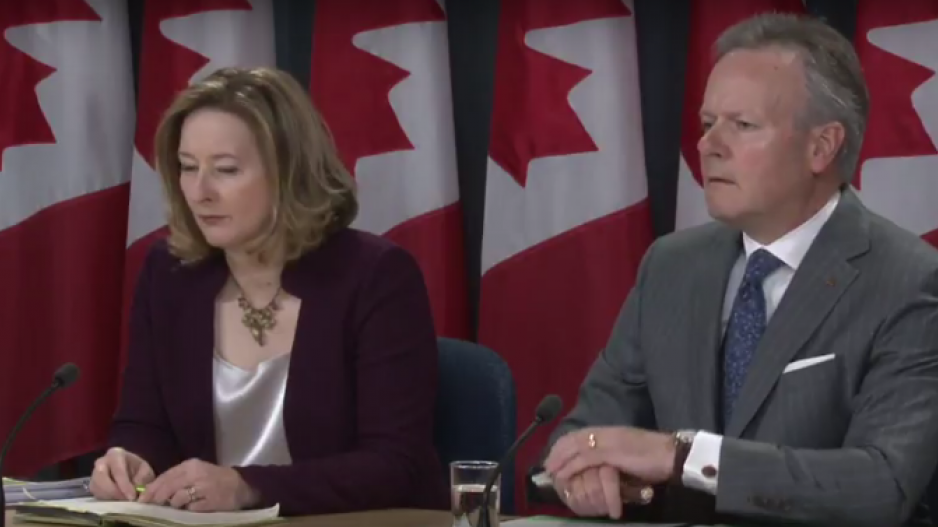

While keeping rates steady, Governor Stephen Poloz said the central bank has increased its projections for 2017 GDP growth to 2.6%; at the last rate announcement in January, it had projected 2.1% economic growth for the year.

“In Canada, recent data indicate that economic growth has been faster than what was expected in the January Monetary Policy Report,” the Bank said in a press release. “Growth was temporarily boosted by a resumption of spending in the oil and gas sector and the effects of the Canada Child Benefit on consumer spending.”

The release also pointed to better-than-expected residential investment and steady employment growth, but cautioned that gains in hours worked were still weak. As well, export growth has been uneven due to strong competition, and business investment has been relatively weak, given the strength of economic recovery seen in recent months.

“Accordingly, while the recent rebound in GDP is encouraging, it is too early to conclude that the economy is on a sustainable growth path,” the Bank said.

Growth into 2018-19 is expected to moderate someone but “remain above potential.” In 2018, GDP is now projected to increase 1.9%, down from 2.1% forecast in January. GDP is forecast to increase 1.8% in 2019.

CPI inflation is at the 2% rate target, which the Bank said is due in part to higher oil prices. Core inflation measures have been falling and that, in combination with slow wage growth, is consistent with excess economic capacity. The Bank said it expects CPI inflation to fall in the upcoming months but increase to 2% “later in the projection horizon.”

TD Economics’ Brian DePratto pointed out that although the outlook has improved, today’s announcement was “all about the negagives” for Poloz.

“The statement accompanying today’s decision attempted to throw cold water on discussions of the recent improvement in Canadian economic indicators,” DePratto said in a note to investors. “Despite a generally improved forecast, Poloz remains focused on the soft spots in Canadian labour markets and exports and is not yet ready to declare Canada ‘out of the woods’ when it comes to unevenness in economic growth.”

According to DePratto, inflationary pressures are likely to increase, making it difficult for Poloz to maintain his dovish tone.

“That’s not to say that a hike is imminent, but rather than the calculus has begun to shift,” he said.

The Canadian dollar increased on the morning’s announcement; as of press time, it was trading at 75.17 cents U.S., up from around 74.96 cents prior to the release.

@EmmaHampelBIV