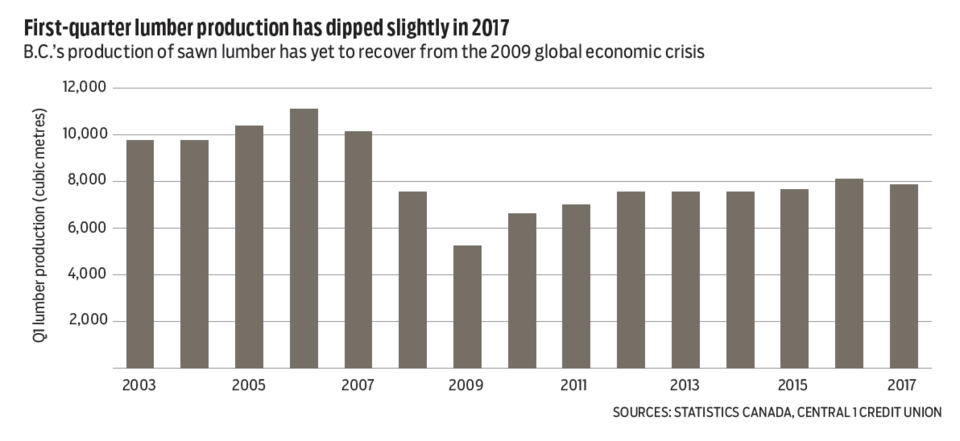

As expected, policy uncertainty related to the softwood lumber dispute weighed on first-quarter forestry activity.

Aligning with a shallow export trend, B.C. sawmill production in March was up slightly from same-month 2016 at 2.8 million dry cubic metres, but followed an 8% drop in February and a series of significant declines in prior months. Through the first quarter, production fell 3%.

While preliminary countervailing duties averaging about 20% were not announced until April, and with anti-dumping still to be determined, the high likelihood of implementation – and unknown magnitude and degree of retroactivity – likely affected early-year production decisions. The one-year grace period after the expiry of the softwood agreement ended last October, giving way to duty determination.

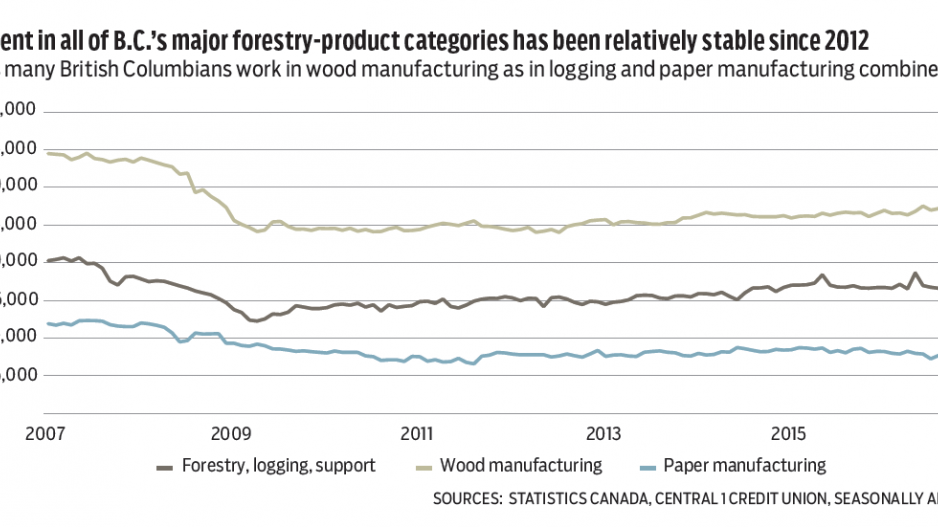

Small and less efficient producers will be less able to absorb the duty. A 4% decline in direct forestry and related manufacturing employment, or about 2,000 workers, would not be a surprise as production declines.

That said, a number of factors could provide some offset for B.C.’s lumber sector, namely rising U.S. housing demand and absorption of tariffs into lumber prices.

A Consensus Economics survey shows an average U.S. housing forecast of 1.27 million units in 2017 and 1.35 million units in 2018. Key price composites have shifted higher with the Random Lengths composite index up about 20% since the beginning of the year and the Bank of Canada forestry composite tracking a similar pace.

Rising demand and higher prices will mitigate some but not all the drag on the forestry sector.

In further confirmation of robust real estate conditions throughout much of B.C., the Teranet-National Bank home price index pointed to a strong pace of price appreciation in May among the province’s metropolitan regions.

The Victoria census metropolitan area (CMA) remained a national housing market hot spot with the index accelerating nearly 2.5% from April, driving a year-over-year gain of nearly 20% to a record high. Both the Vancouver CMA (1.5%) and Abbotsford-Mission (3.4%) also posted strong gains from the previous month.

Recent gains have erased any declines observed in late 2016. Year-over-year growth in the Vancouver CMA was 8.2%, with weaker-than-average gains reflecting policy measures designed to cool the regional market in 2016, including additional taxes on luxury homes and the foreign-buyer tax. Price growth in Kelowna reached 1.4% from April, retracing some of the dip since a January peak. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.