Rising stars on Business in Vancouver’s Top 100 Public Companies list are giving B.C.’s biggest companies a run for their money when it comes to revenue growth.

BIV data shows that the average total revenue of B.C.’s top 10 publicly owned companies increased 10% between 2012 and 2016 – to $5.4 billion from $4.9 billion. But that percentage increase was dwarfed by the growth of the top 100’s other 90, whose average revenue growth jumped 45% during the same period – to $420 million from $290 million.

Many of the top 10, companies like Telus (TSX:T; NYSE:TU), Finning International (TSX:FTT) and Westcoast Energy Inc. (TSX:W), have retained their top ranking on BIV’s list for the last five years. However, companies like Turquoise Hill Resources (TSX, NYSE, Nasdaq:TRQ) are hot on their heels. Turquoise Hill has moved up 48 spots on the list since 2013 and is now ranked 16th. Its 2016 revenue was 10 times what it was in 2013.

Pacific Insights Electronics Corp. (TSX:PIH) has also risen rapidly up the list.

It was close to breaking into the top 50 in the current rankings after entering the top-100 list at 98 in 2013.

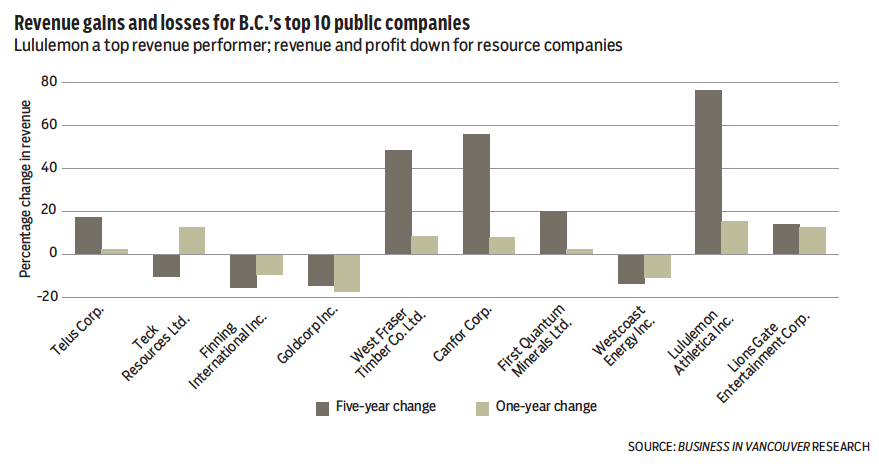

Most of the top 10 have increased revenue but not profit over the past five years.

Revenue and profits for top resource companies like Goldcorp (TSX:G; NYSE:GG) and Teck Resource Ltd. (TSX:TECK.B; NYSE:TECK) dropped between 2012 and 2015.

Goldcorp’s revenue continued to recover from its 30% drop between 2012 to 2013, but it has yet to return to 2012 levels. The company reported losses of more than $5 billion in 2015.

Teck also posted a multibillion-dollar loss in 2015, and First Quantum Minerals Ltd. (TSX,LSE:FM) reported a $780 million loss.

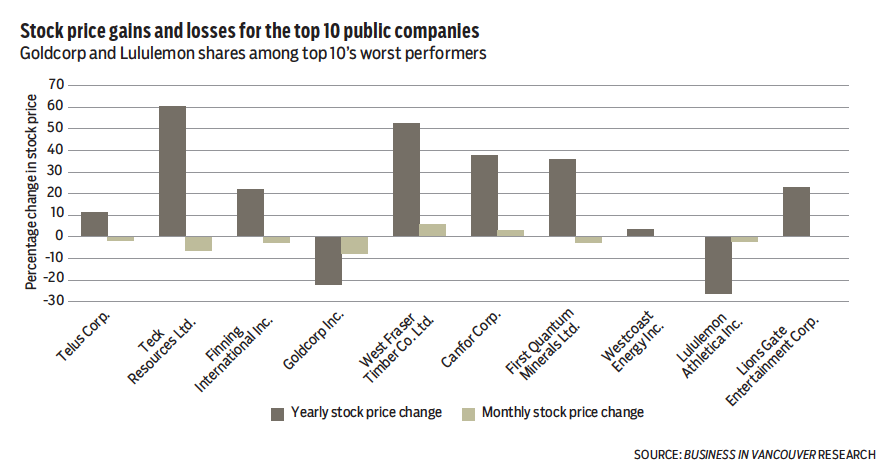

Goldcorp’s stock was one of the worst-performing among B.C.’s top 10. The company’s stock price has dropped 22% since June 2016.

The only top-10 stock to perform worse than Goldcorp’s was Lululemon Athletica Inc. (Nasdaq:LULU).

It has dropped 26% since June 2016 even though the yoga-

wear maker’s most recent annual report showed revenue up 15% compared with 2015, the highest of any of the top 10.

The company has also generated the largest five-year revenue growth in the top 10 and is one of only three top-10 companies to post profit and revenue growth consistently over the past five years.

Lululemon’s stock price decline has slowed somewhat, dropping 2.3% since mid-May.

West Fraser Timber Co Ltd. (TSX:WFT) and Canfor Corp. (TSX:CFP) are the other two companies in the top 10 that have generated consistent profit and revenue growth.

Although the revenue growth of the two B.C.-based forestry companies pales in comparison to Lululemon’s 76% over five years, both have posted better earnings than the yoga-wear maker.

West Fraser Timber’s profits jumped 213% between 2015 and 2016; Canfor’s grew 122%.

Unsurprisingly, the two forestry companies have had two of the strongest-performing stocks in the top 10 between 2012 and 2016, with average yearly price increases of 51.5% and 37.9%, respectively.

The only stock to outperform the two forestry companies was Teck Resources.

It has jumped more than 60% over the past year after Teck’s recovery from posting a $2.5 billion loss in 2015. •