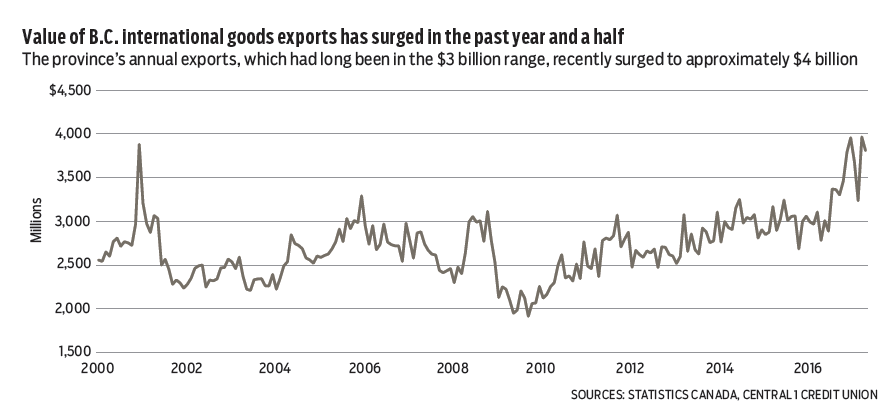

B.C. dollar-volume exports remained robust through April on surging non-renewable resource sales. Total merchandise exports to global markets reached $3.85 billion, marking a same-month gain of 34.9% from 2016, and an accelerated gain from a 26% increase in March.

Upturn in momentum since late 2016 lifted year-to-date growth to nearly 24%, driven by a doubling of energy sales, which contributed nearly 80% of the increase. Metal and non-metallic mineral products and forestry exports rounded out most of the remaining gain. While a low Canadian dollar and U.S. economic growth contributed to demand, higher export prices have been the key source of growth. While not to downplay the importance of dollar-volume exports, as it represents income flows to the province and drives profits, investment and spending, export contribution to real economic activity is much less than headline numbers suggest.

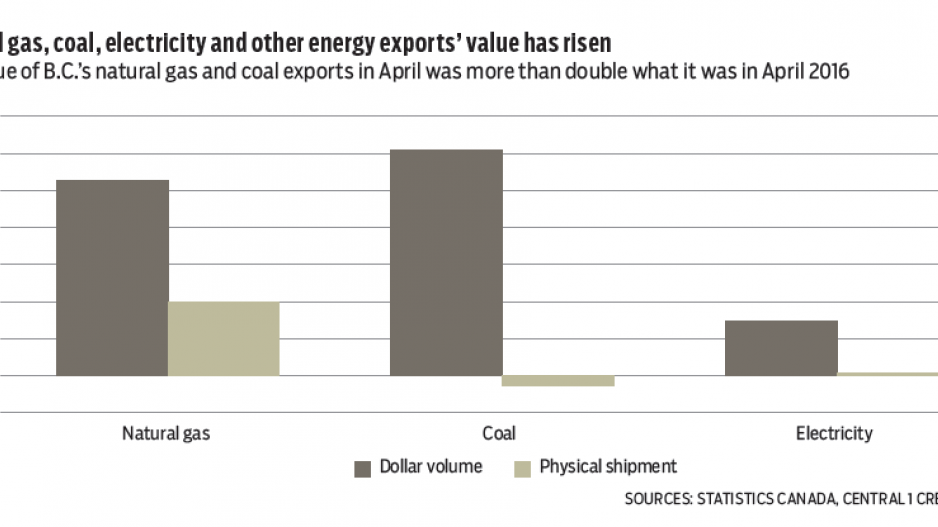

Specifically, growth in energy-product sales, comprising natural gas, coal and electricity sales, has been dominated by higher commodity prices relative to a year ago. Coal exports, which account for more than 60% of sales, rose 150%. With a drop in physical shipments, this gain is entirely due to higher prices owing in part to constrained supply in Australia following Cyclone Debbie. Natural gas sales growth of 130% was a mix of physical shipment growth (50%) due to higher demand this year from the U.S., and production growth in B.C. fields, but was again dominated by higher prices. Adjusting for prices, we estimate a 10% gain in real energy sales.

Higher prices also drove forestry product exports, as softwood lumber exports and production have been flat. Sales growth in metals and mineral products was likely tied to production growth following completion of the Rio Tinto smelter rebuild in Kitimat.

Real international goods export growth is tracking a moderate 5%, but is expected to decelerate further as tariffs weigh on lumber shipments.

On the labour front, the number of employment insurance (EI) beneficiaries in B.C. declined for a fourth consecutive month in March as the strong economy and job growth kept counts range-bound at low levels. Total EI counts edged down to 52,660 persons in March, a decline of 1.3% from February, and about 2% below a year ago.

Relatively low initial and renewal EI claims in March point to minimal stress in the provincial labour market.

However, regional differences persist, with declines concentrated in the strongest economies in southwest B.C., and increases in the southern and northern Interior. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.