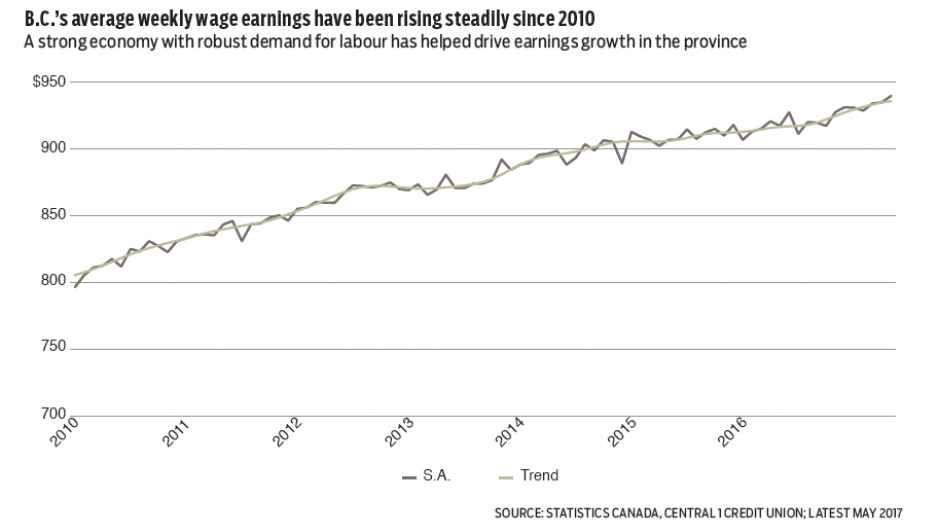

B.C.'s labour market showed further signs of tightening with a firming of average weekly earnings (AWE) in May. Wage earnings rose 0.5% from April and 2.5% from the same month in 2016 to $940, outpacing the national performance on both counts. Since late 2016, weekly earnings growth in the province has tracked at an annualized pace of between 2% and 3%.

While various factors influence AWE, including hours worked and sectoral composition, average earnings are rising in most sectors, which points to the influence of stronger economic growth. Sectors driving a 2.1% year-to-date increase have included manufacturing (4.3%), finance and insurance (6.5%), management and support (7.0%) and education (4.8%), although solid gains were observed in most sectors.

Strengthening growth in weekly earnings reflects robust labour demand. Non-farm payrolls climbed 0.2% from April, led by broad service sector gains, to lift year-over-year payroll counts by 2.9% and just over 3% year-to-date. The latter was the highest among the provinces and well above the national gain of 1.6%.

Growth points to an economy firing on nearly all cylinders, albeit with clear pillars of strength, including utilities (14.8%), accommodations and food services (3.8%), information and culture (9.6%), construction (4.0%), and professional/scientific/technical services (5.4%).

Growth in hiring reflects various factors such as a strong housing construction, Site C dam work, growth in service exports such as tourism and technology and broader consumer demand. It’s worth noting that job creation has been well dispersed across high- and low-wage industries this year.

Aligned with strength in non-farm payrolls, the number of employment insurance (EI) recipients in B.C. fell sharply in May to the lowest levels since January 2015, largely reflecting more unemployed persons finding work, although existing benefit expiration also contributed.

Seasonally adjusted, EI counts fell 3.5% from April to 50,910 recipients while the number of initial and renewal claims continued to track lower. Unadjusted, provincial EI counts fell 6.6% year-over-year.

The largest relative declines were recorded in the Lower Mainland-Southwest, Kootenay and northern markets. EI counts remained higher than a year ago outside the South Coast markets, reflecting weaker economic conditions elsewhere and policy factors that extended EI benefits to areas harder hit by the commodity cycle. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.