(Correction: Chart below on comparing Site C costs with alternatives has been corrected from KW/h to MW/h in third column).

Even if the Site C dam project goes over budget, completing it is still the best option while suspending it for completion at a later date might be the worst.

That’s the conclusion Marvin Shaffer, an adjunct economics professor at Simon Fraser University’s public policy program, came to last week after reading two Deloitte LLP reports.

But Marc Eliesen, who was CEO of BC Hydro in the 1990s under the Mike Harcourt BC NDP government, came to a diametrically opposed reading of the accounting firm’s reports.

“You’re better off cutting your losses at the present time,” Eliesen said, “and I think Deloitte confirms my analysis and my critique.”

Shaffer and Eliesen agree that Deloitte confirms their views that BC Hydro has historically overestimated power demand forecasts.

However, they disagree on whether the project should be completed or cancelled. Cancelling Site C would mean ratepayers and the government will have to absorb about $3.3 billion in sunk costs without getting a single additional electron of power.

“The first point is that there could be some cost pressures on Site C,” Shaffer said. “The second point is that we may not need Site C as soon as BC Hydro’s mid-point forecast suggests. And the third point is the cost of alternative resources is much higher than Site C. That’s what I’d take from this.”

The reports were commissioned by the BC Utilities Commission, which on September 20 is required to produce preliminary recommendations on whether the $8.8 billion project should be competed, cancelled or mothballed.

Deloitte had access to confidential BC Hydro documents that are not available to anyone outside of government.

Its first report assessed whether the project can be completed on time and on budget and the impacts on ratepayers of completion, cancellation or suspension.

The second assessed BC Hydro’s load forecasts – suspected by many to be exaggerated – and Site C alternatives for generating new power supplies.

The first report concludes that, should the project proceed with no major delays, there is a sufficient contingency fund to allow it to be completed within its $8.8 billion budget.

“As the project continues to operate within both the existing schedule and budget [and unallocated contingency], today the project remains on time and on budget,” it states.

But Deloitte warned there are significant risks that a critical river diversion could be delayed from starting in September 2019 and that a one-year delay could increase the $8.8 billion budget to between $9.1 billion and $10 billion; a delay of more than a year could push it to $12.5 billion.

The second report confirms criticisms that BC Hydro has historically overestimated load forecasts, especially for industrial demand. Should large liquefied natural gas plants never get built in the province, the estimates are especially exaggerated.

On the other hand, Deloitte suggested BC Hydro might be underestimating the demand for new power from electric vehicles.

Shaffer was a critic of the Site C project and argued that B.C.’s load demand did not justify it being built on the current timeline. But now that 20% of the work is done and $4.5 billion already spent or committed, he said the best option now is to complete it. He believes the Deloitte reports confirm that position.

“Even if our load forecast is wrong – which I think most people would say it is – and there will be surplus … the value of the surplus sales will offset the costs of having it in service,” Shaffer said.

Eliesen disagrees.

He said surplus power would have to be sold at a dramatic discount, compared with the cost of building the new dam, which he believes is almost certain to go over budget.

As of June, BC Hydro had awarded contracts totalling $4.5 billion, although only about $1.8 billion of the work is done. Another $300 million will have been spent by the end of December, which would put the sunk costs at $2.1 billion by year’s end.

Deloitte calculates that suspending the project would cost an additional $1.4 billion in contract termination fees and maintenance. Terminating it outright would cost an estimated $1.2 billion. So, terminating the project will mean a loss of $3.3 billion and no new power.

At some point, BC Hydro will still need to acquire or develop new sources of power to at least meet peak demand, and Shaffer believes Deloitte’s comparison of all the Site C alternatives confirms that completing the dam is the most cost-effective way of adding new generating capacity.

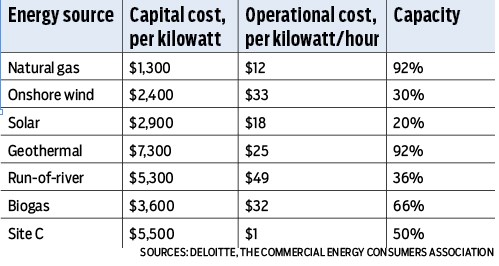

Deloitte analyzed 10 alternative power generation and two storage technologies (battery and pumped storage), but concluded that only three were economic over an 18-year period: onshore wind, geothermal and biogas.While wind is the cheapest of the three options, it has a generating capacity of only 30%. Geothermal had the highest generating capacity (92%) and low operating and maintenance costs but high upfront capital costs.

Deloitte also examined thermal power from natural gas and found it to be the cheapest new energy source, but it is excluded by virtue of the Clean Energy Act.

(Correction: Third column, O&M, should be MW/h, not KW/h).

David Craig, executive director for the Commercial Energy Consumers Association, said the critical comparison is levelized costs over the lifespan of the alternatives, and on that score, none can compete with large hydro, including Site C, even if it goes over budget.

“Not one of those competing alternatives ... comes anywhere close to that level of levelized cost. They’re more expensive.”