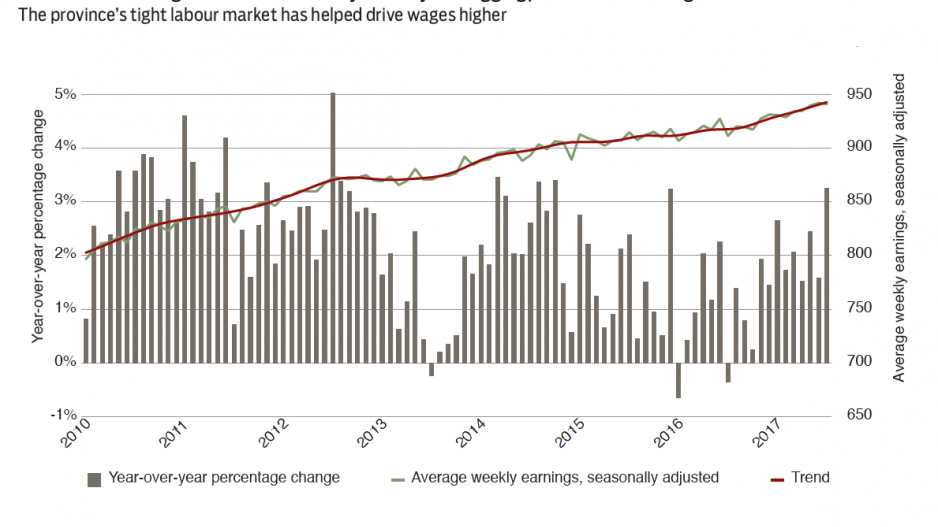

Despite easing in July, B.C.’s labour income remained solid to start 2017’s second half. Average weekly earnings sat at $941 in July, down 0.1% from June but up 3.3% year-over-year. Similarly, month-to-month non-farm payroll counts edged down but rose 3.1% from a year ago. In both cases, B.C. led all provinces in year-over-year growth, which was led by forestry and logging, utilities and mining/oil and gas in the goods sector, and transportation and warehousing, real estate and leasing, and accommodations/food services in services. While various factors contribute to headline weekly earnings, including sector composition and hours worked, the fixed-weight hourly index points suggest that most of the increase is underlying wage inflation. A tight labour market observed in low unemployment is lifting B.C. wages.

Non-farm payrolls climbed across sectors. On the goods front, mining/oil and gas employment rose 12.5%, while construction and utilities are up significantly. Meanwhile, service-sector leaders include tech jobs, tourism-oriented arts/recreation and accommodations/food services.

Increased wage earnings and job growth point to a stellar year for labour income gains, contributing to personal income growth of 7% this year and a 5% increase in 2018.

B.C. population growth is healthy, climbing 0.35%. Seasonally adjusted July-over-July annual population rose 1.3% (59,500 persons) to 4.82 million persons. That aligned with 2016 and near the upper end of the range observed since 2000.

While the overarching trend is solid, migration patterns have shifted. The net interprovincial migration trend has declined with a modest drop in inflows and higher outflow. Cumulative net July-to-July interprovincial migration came in at 16,100 persons compared with 26,570 a year ago. Increased outflow of B.C. residents to Ontario, Alberta and Quebec and decreased inflows from these provinces drove the downshift. Strengthening economies across the country and lower real estate values have lessened the attraction of the “Left Coast.”

In contrast, net international migration continued the erratic upward trend seen since 2015. Full-year international gains reached 36,682 persons, up 35% from 2016. However, this was almost entirely the result of a surge in net non-permanent residents following net declines in the previous two years. While factors such as rising student populations and other temporary-status workers contribute, refugee/humanitarian inflows and timing of status are likely drivers. •

Bryan Yu is deputy chief economist at Central 1 Credit Union

.jpg;w=120;h=80;mode=crop)