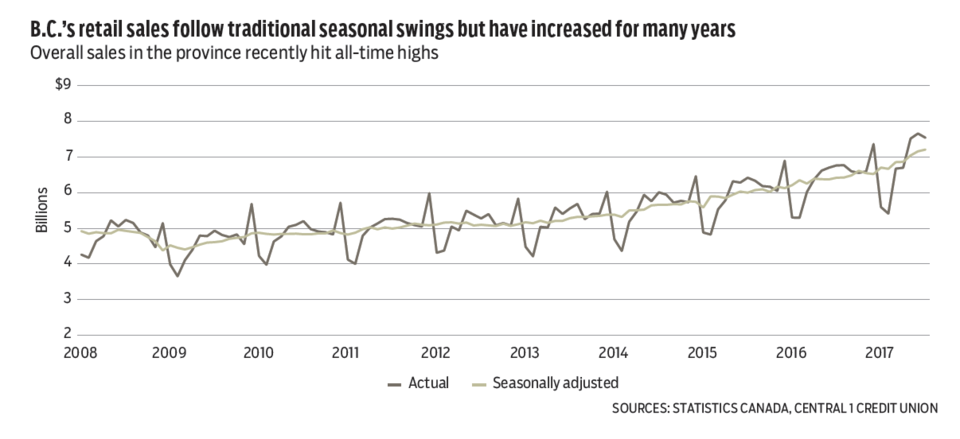

B.C. retail sales rose 0.7% in July to $7.2 billion. The increase continues a strong growth trend over the previous three months. So far this year, unadjusted sales have totalled $47 billion, up 9.3% from the same period last year. At this pace, 2017 retail sales will increase at the fastest rate since 1994, when sales rose 11.6%. Strong employment growth and tourism inflows have driven the upward cycle.

Year-to-July, growth in retail sales has been led by motor vehicles and parts dealers (13.5%), gasoline stations (20.7%) and building/garden supply dealers (25.8%). Idlers in growth were led by electronic/appliance stores and sport/hobby/book/music stores.

Regionally, retail sales have climbed 9.1% to $22.2 billion in Metro Vancouver through July from the same period last year, with a 9.5% increase in the rest of the province. Higher volume led growth; prices were up modestly.

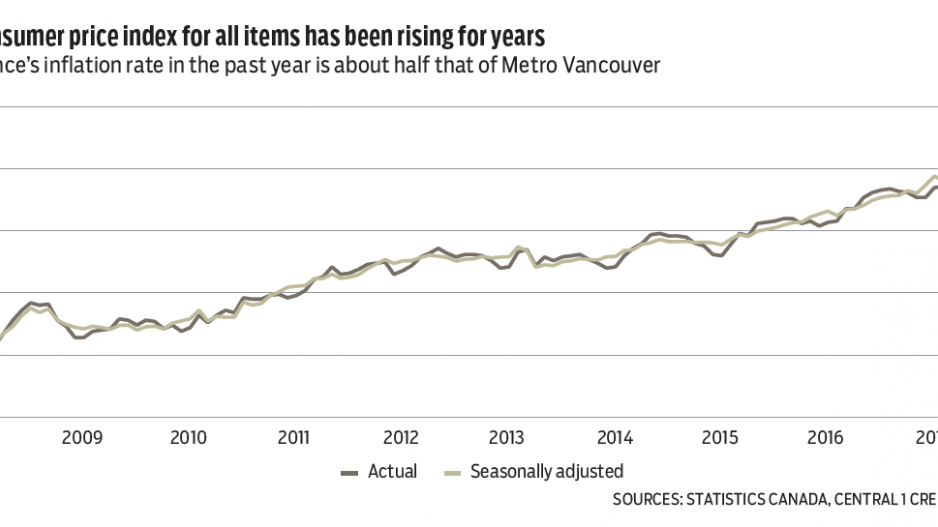

Consumer price inflation in B.C. was 0.26%, seasonally adjusted, in August and 2% unadjusted for the year ending in August, consistent with the trend since December 2015. Central 1 Credit Union forecasts British Columbia inflation at 2.3% in 2017, up from 1.8% last year.

B.C.’s monthly manufacturing sales in July fell for the first time since February, but the decline was less than that observed in most other provinces, while the trend remained positive. Total sales of $4.18 billion eased 1.6% from June, led by a retreat in primary metal (-9.3%), food products (-2.7%), electrical equipment (-12%) and motor vehicle parts sales. Wood product sales were the main offset. Nationally, manufacturing sales fell 2.6%.

Despite the slip, sales rose 7% year-over-year and 8% through July compared with the same period in 2016. Rising sales have been underpinned by a competitive Canadian dollar and capacity expansion.

A 7% increase in wood product sales reflects higher prices as physical lumber shipments declined at mid-year due to the ongoing softwood lumber dispute and associated tariffs. Short-term wood product gains are likely with August’s expiration of provisional countervailing duties before a final determination of duties set for late 2017.

A higher Canadian dollar is dampening the export picture, but we anticipate the currency to fall back near US$0.80. Adjusted for price levels, real manufacturing output is forecast to rise by 3% this year after a near 6% increase in 2016. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.