The board of directors for the Pembina Pipeline Corporation has approved the development of its proposed liquefied petroleum gas (LPG) export terminal.

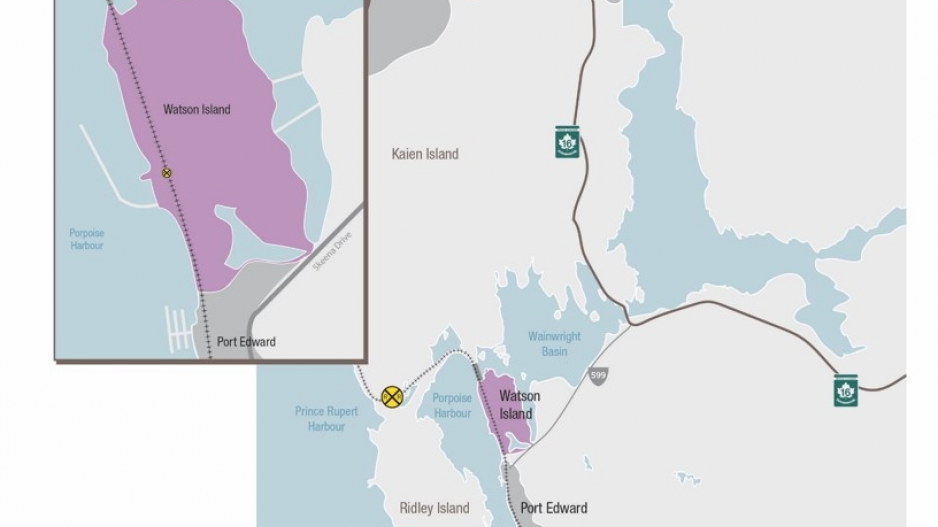

The Prince Rupert Terminal will be located on Watson Island, British Columbia on lands leased from a wholly-owned subsidiary of the City of Prince Rupert. Through site assessments and engagement with key stakeholders, the company has confirmed Watson Island as the ideal location for the project to be developed and has executed definitive commercial agreements with the city.

"Since our initial announcement of potentially developing the Prince Rupert Terminal, we've worked diligently with municipal and other stakeholders and are now able to move forward with our final investment decision," said Stuart Taylor, Pembina's senior vice-president, NGL & Natural Gas Facilities.

The Prince Rupert Terminal is expected to have a permitted capacity of approximately 25,000 bbls/d of LPG and is expected to be in service mid-2020, subject to Pembina receiving necessary regulatory and environmental approvals.

"We are very excited to progress the Prince Rupert Terminal and continue working with the local communities, stakeholders, First Nations and governments in the area," added Taylor. "This project will provide significant economic benefits to the Prince Rupert area including 150 to 200 construction positions and, once operational, it will create between 20 to 30 full-time positions in addition to generating annual property tax revenue and lease payments."

"We are thrilled to work with Pembina to finally get Watson Island back in business," said Lee Brain, the mayor of Prince Rupert. "What was once the story of economic downfall and hardship is now the story of prosperity and renewal. Getting Watson Island back on the tax roll has been the key priority of this council, and receiving this final investment decision from Pembina will provide us with additional lease and tax revenues to support community services and infrastructure."

Pembina has completed a class three estimate for the project and due to minor scope changes, dock maintenance and additional site preparation the expected capital cost has been adjusted to $250 to $270 million. LPG supply for the Prince Rupert Terminal will primarily be sourced from Pembina's Redwater fractionation complex.

"Advancing the Prince Rupert Terminal, alongside continuing to progress our proposed integrated propylene and polypropylene production facility, is a meaningful step towards our strategy of providing new market solutions for our customers, helping to add incremental value to western Canadian hydrocarbons and ultimately increasing producer netbacks," said Taylor.

In announcing its overall budget, Pembina said that its board of directors has approved approximately $400 million of new capital projects, as well as a capital program of approximately $1.3 billion for 2018.

"2017 has been a transitional year in Pembina's history," said Mick Dilger, Pembina's president and chief executive officer. "Since the beginning of 2015, we have placed approximately $8 billion of predominately contracted assets into service, marking the culmination of an unprecedented growth strategy implemented in 2013. In addition, we also completed the largest corporate acquisition of our company’s history during the year.”

He added: “We expect to continue this positive momentum into 2018, as we remain focused on completing the remaining growth portfolio and advancing our strategy of creating new market access for our customers. With increased size and scale, greater diversification and a broader service offering, the future is bright for Pembina. We are also excited to continue pursuing the expanded growth opportunities available to us in support of value creation for our shareholders."

North Central Liquids Hub

In addition to the Prince Rupert Terminal, the board of directors have sanctioned the development of the North Central Liquids Hub, which supports operations for the Cutbank Ridge Partnership (CRP) within the world class Montney formation. This project is being advanced through Pembina's midstream limited partnership with Kohlberg Kravis Roberts & Co. L.P., in which the company owns approximately a 46 per cent interest. The estimated capital cost for this project is $320 million ($150 million net to Pembina) and is expected to be placed into service in late 2018. The North Central Liquids Hub will provide separation and stabilization of increased condensate volumes from CRP to support the recently in-service Sunrise and Saturn gas plants. The North Central Liquids Hub can also be further expanded to serve the future requirements of the CRP as well as other potential third-party producers. Additionally, the North Centrals Liquids Hub will be connected into Pembina's pipeline systems.

2018 capital expenditures

The company expects to fund the approximately $1.3 billion 2018 capital program through internally generated cash flow and debt financing. Pembina's 2018 capital spending plan is expected to be allocated as follows:

Conventional Pipelines

Pembina plans to spend approximately $540 million in its Conventional Pipelines business next year, 40 per cent of its overall 2018 capital spending plan.

Pembina will allocate the majority of capital spending within its Conventional Pipelines business to completing the Phase IV and Phase V expansions of the company's Peace and Northern pipeline systems. The company expects to bring both projects into service in late 2018.

The 2018 capital budget for the Conventional Pipelines segment includes funds allocated to the right-of-way cleanup costs associated with Pembina's Phase III expansion, which was placed into service at the end of the second quarter of 2017, as well as the company's northeast British Columbia pipeline expansion and its Altares lateral, both of which were placed into service in October 2017. The associated cleanup costs that are budgeted to be spent in 2018 for the respective projects have been included in the previously announced final in-service capital costs.

Additional capital will be spent in the Conventional Pipelines segment on various improvements and upgrades to the communications, pipeline system monitoring and electrical and integrity programs designed to continue to support the safe and reliable operations of the growing business.

Midstream

In 2018, Pembina expects to spend $260 million, or 19 per cent of the overall budget, in its Midstream business.

In Pembina's NGL Midstream business, the company expects to spend $235 million in 2018, of which the largest single component will be approximately $80 million related to the initial development and construction of the Prince Rupert Terminal as well as approximately $30 million directed to the completion of the Burstall Storage Cavern. Additional spending within NGL Midstream will be directed towards progressing the Redwater cogeneration facility, completion of the Redwater rail yard expansion and liquids handling facilities, and other minor projects across the Redwater West and Empress East facilities.

In its Crude Oil Midstream business, Pembina expects to spend approximately $25 million in 2018, primarily focused on adding additional connectivity at Pembina's Edmonton Terminal and Canadian Diluent Hub.

Gas Services

Pembina plans to allocate approximately $175 million, or 13 per cent, of its 2018 capital budget to new facilities within the Gas Services business. This includes the development and construction of a 100 mmcf/d Duvernay II gas plant and additional infrastructure located at the company's Duvernay Complex. Pembina anticipates bringing Duvernay II and the additional infrastructure into service mid to late 2019, subject to regulatory and environmental approval.

Oil Sands and Heavy Oil

Pembina expects to spend approximately $20 million, or approximately two per cent, of its 2018 capital budget to the Oil Sands and Heavy Oil business, with all capital being directed towards system enhancements which will be added into the rate base of the associated pipeline system.

Joint Venture Working Interest Capital

Pembina plans to allocate approximately $170 million (net to Pembina), or approximately 13 per cent of its 2018 capital budget to new facilities within the company's joint venture partnerships. The majority of the spending will be directed to capital projects within the Midstream Partnership, including the completion of the second 200 mmcf/d gas processing train at Saturn, which is expected to be placed into service in the first half of 2018 and the construction of the North Central Liquids Hub. Of the $170 million expected capital, Pembina plans to contribute $145 million to the joint venture partnerships while the remaining capital will be funded by liquidity available within the joint venture entities.

Proposed value chain extension projects

Pembina is expecting to allocate $35 million (net to Pembina) to complete the front end engineering design (FEED) for a proposed combined propane dehydrogenation (PDH) and polypropylene (PP) production facility. Pembina and Kuwait's Petrochemical Industries Company K.S.C. are 50/50 joint venture partners of Canada Kuwait Petrochemical Company (CKPC). CKPC expects to complete the FEED process by late 2018.

The company plans to spend approximately $135 million towards progressing its proposed Jordan Cove LNG project. Jordan Cove officially filed its application with the Federal Energy Regulatory Commission (FERC) in September 2017 with the company expecting an outcome during the second half of 2018. Pembina continues to focus on securing binding agreements for the long-term sale of natural gas liquefaction capacity at the export terminal, as well as securing the regulatory and environmental permits for both the terminal and the associated pipeline.

Commercial Update

On Nov. 1, 2017, Pembina re-contracted approximately 220 mmcf/d at its Cutbank Complex with an existing anchor tenant under a new long-term, take-or-pay processing agreement. The new contract provides the company with long-term revenue certainty and utilizes a large portion of the existing shallow and deep cut contract capacities which were due to expire. “The agreement also demonstrates Pembina's commitment of working with its customers to provide low cost, safe and reliable services,” the company stated.