Pipeline delays and cancelations have a greater effect on competiveness than carbon taxes according to a C.D. Howe energy competitiveness report.

“Canadian energy producers are at a competitive disadvantage relative to producers in the United States,” said Benjamin Dachis, Associate director of Research for C.D. Howe and author of the report. “Much attention has been paid to carbon taxes, but a lack of market access for oil and taxes on investment, not emissions prices, are the main policy-induced competitiveness problems for conventional energy producers in Western Canada.”

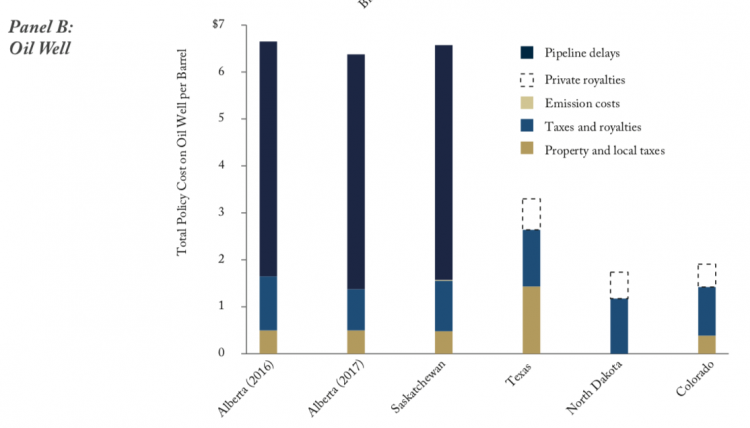

If Canada had built more pipelines, light oil producers would have been paid roughly $5 more per barrel of oil according to the report. The lack of pipeline infrastructure caused Canadian oil’s profitability to drop. With more pipelines, an oil well could have increased its cash flows by $600,000 or 15%.

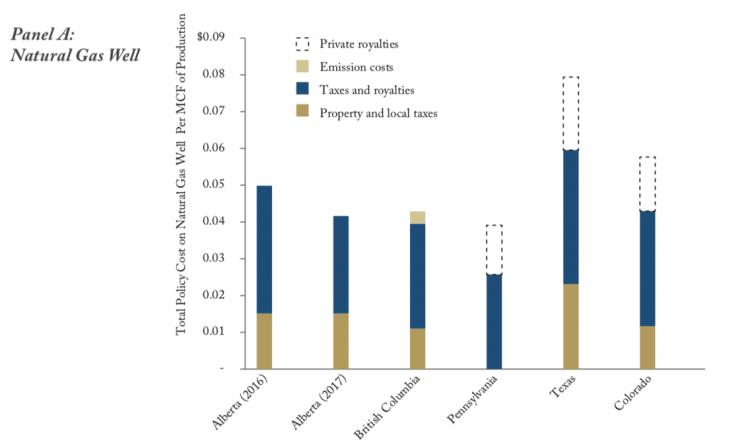

Canadian jurisdictions are much more competitive when it comes to natural gas production than oil, with the total policy induced cost of a gas well being cheaper in Alberta and B.C. than the United States. In B.C., additional policy induced costs on a natural gas well is $164,000, 46% less than the $304,000 in costs that natural gas wells in Texas have to absorb and 25% less than the $221,000 in policy induced costs that wells in Colorado incur.

Private royalties as well as property and local taxes are a large part of the reason why U.S. natural gas wells are more expensive to operate than Canadian ones. In Texas,$164,000 per well is paid just to cover private royalties and property and local taxes, that equates to the entire additional policy costs paid by a well in British Columbia.

In the province, emission costs account for $13,000 per natural gas well, or 8% of the total policy induced cost.

For oil wells, the emissions costs are considerably less, $1,000 per well in Alberta and $2,000 per well in Saskatchewan.

Even with much lower rates on carbon pricing, the policy induced cost of an oil well is $773,000 in Alberta and $764,000 is Saskatchewan.

The policy induced cost of an oil well in Alberta is $571,000 greater, or 73.8%, than it is in the cheapest state, North Dakota. All of the additional cost is a result of pipeline delays.

In Alberta, pipeline delays add an additional $581,000 dollars to the cost of an oil well. Even with an emissions tax, the policy cost of an oil well would be $10,000 dollars cheaper than one in North Dakota if it wasn’t for pipeline delays. In Alberta, pipeline delays account for 75% of the policy induced cost of a well and 76% in Saskatchewan. Carbon emissions account for 0.1% of the policy induced cost in Alberta and 0.2% in Saskatchewan.

While emissions taxes are an incredibly small part of the policy induced cost of a well, the report warned that policy makers need to be aware of the cumulative effects of their policies including taxes, delays and emission costs.