In the 1990s, when flip phones were still pricey and 56K modems were a luxury, B.C.’s tech scene was not the guaranteed money-maker that now employs more than 100,000 people.

“My dad told me, ‘You’ve got to get a job in mining or forestry because then you’ll have a job forever,’” recalled Edoardo De Martin, director of the Microsoft (Nasdaq:MSFT) Canada Excellence Centre.

New funding from Ottawa’s $950 million supercluster initiative will afford De Martin, who now leads the tech giant’s office in Vancouver, the opportunity to bridge the gap between his chosen profession and his father’s suggestion.

The supercluster program is intended to jump-start public-private partnerships within specific regions across the country to facilitate collaborations between companies and post-secondary institutions that don’t normally work together.

On February 15 the federal government gave the green light for a West Coast-led consortium featuring Microsoft and more than 260 partners to share nearly $1 billion in funding with four other consortiums across Canada.

The B.C. entity, known as Canada’s Digital Technology Supercluster, is focused on finding better ways to collect, analyze and eventually visualize data across industries such as natural resources, transportation, manufacturing, health and the creative economy.

“To collaborate with Finger Food [Studios Inc.] was easy because we’re all nerds,” said De Martin, referring to the Port Coquitlam tech company specializing in the mixed-reality tools that Microsoft is developing.

“But when you sit down with someone from Canfor (TSX:CFP) or Goldcorp (TSX:G) or Shoppers Drug Mart and talk about their businesses, it’s fascinating because in tech you don’t really understand their business. And when you spend time with them … you start to think, ‘Wow, there’s so many creative applications of technology that help accelerate innovation.’”

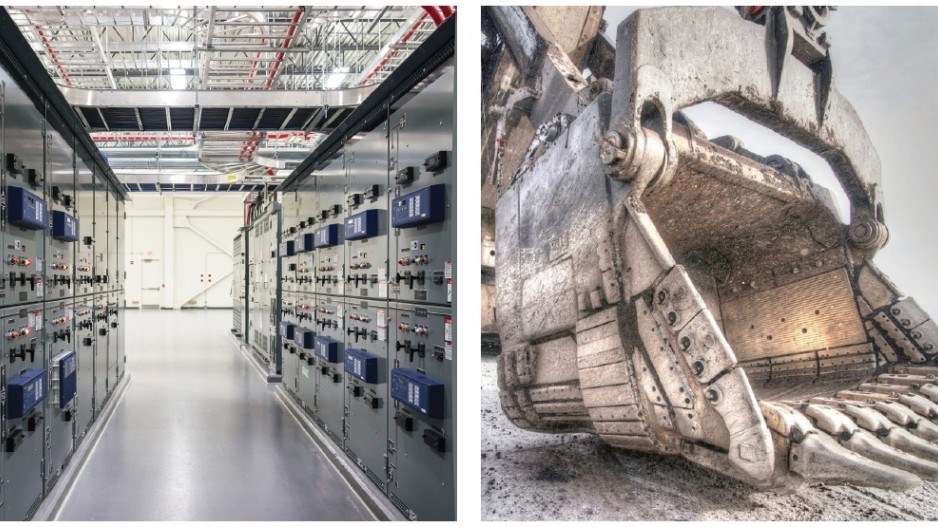

De Martin said the collaboration has the opportunity to further develop digital twinning. One example would be to use this process to create a virtual-reality replica of a mine to improve worker safety and improve efficiency in mining operations.

Greg Brouwer, general manager of technology and innovation at Teck Resources Ltd. (TSX:TCK.B), said the supercluster initiative is still in its early days but his Vancouver-based mining company sees a major upside to collaborating with tech companies on data analysis and machine learning.

Teck currently records hundreds of millions of data points from sensors from pieces of equipment, such as trucks and shovels.

“Partnering with some of these companies to find ways to analyze and interpret that data could lead to some very significant improvements in efficiency, productivity and safety,” Brouwer said.

Bill Tam, who co-chairs Canada’s Digital Technology Supercluster, said the consortium will operate as a not-for-profit entity with full memberships for founding partners and for those that join later.

He added that the division of funding among the five consortiums has not yet been finalized.

Although the supercluster is still in its embryonic stage, Telus Corp. (TSX:T) chief corporate officer Josh Blair said his company already has a number of projects in mind.

One such collaboration involves a health initiative that would create a database of Canadians’ genomic profiles to assist with everything from ideal prescription medications to the most effective cancer treatments.

“We’ll be quite involved in two different ways. From a sector perspective, we want to put our money and energy into the health vertical,” said Blair, who is also executive vice-president of Telus Health.

“But also given our broadband networks … and our internet-of-things practice, on a cross-sectoral basis, we’ll really be helping with the transmission of data [to other supercluster partners].”

The private investment on Telus’ part makes economic sense, according to Blair, since the supercluster is pulling together collaborators who don’t typically interact, to speed up technological progress that would take Telus longer to achieve on its own.

Before funding from Ottawa was confirmed, the West Coast bid had secured more than $500 million in funding commitments from its 260-plus partners.

The B.C. supercluster estimated in a November 2017 executive summary that participants could eventually invest $1.4 billion to fund 100 collaborations involving 1,000 organizations over a decade.

“If we’re successful at building this so that we have resonance on a global stage, then I think we’re going to attract more than our fair share of talent, investment and ultimately companies that will come to Canada and preferably to locate in B.C.,” Tam said. “While the nucleus of this originated from British Columbia, the effects of this and the participation level will be across the country.”