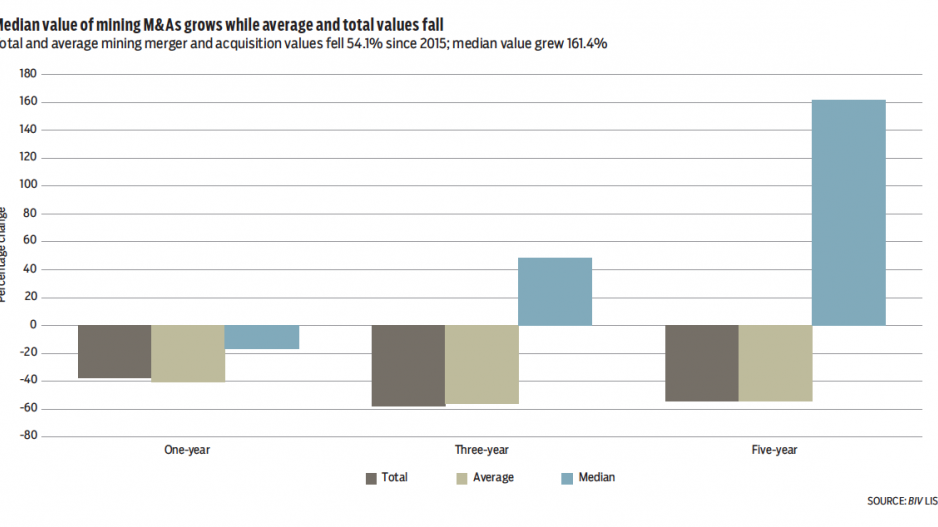

The value of the biggest mining mergers and acquisitions (M&As) in British Columbia totalled $4.6 billion in 2017, less than half the 2013 value of $9.6 billion. The average value of the top mining M&As fell at a similarly steep rate, declining 54.1% to $219.6 million in 2017 from $478.5 million in 2013.

The billion-dollar mergers that once characterized Business in Vancouver’s Biggest B.C. Mining Mergers and Acquisitions list have disappeared.

While the average value of mining M&As has fallen since 2013, the opposite can be said for the median value. Although the province has reported fewer multibillion-dollar mergers, a steady increase in mergers valued between $100 million and $200 million has meant that the median value of mining mergers has increased.

The median value for the top mining M&As grew 161.4% to $200 million in 2017 from $76.5 million in 2013. While this value has grown significantly since 2013, 2017 experienced a one-year downtick, with the median value of mining M&As falling 16.7% from $240 million in 2016.

The largest mining M&A of the year was valued at $600 million and involved two Canadian gold goliaths, Goldcorp Inc. (TSX:G) and Barrick Gold Corp. (TSX:ABX). Goldcorp acquired two 25% stakes in the Cerro Casale gold and copper project in northern Chile, one from Barrick and one from Kinross Gold Corp. (TSX:K). Goldcorp and Barrick will jointly own and operate the mines located in Chile’s gold belt.

The largest mining acquisition in 2017 was 11.8% the size of the largest mining acquisition in 2013, when First Quantum Minerals Ltd. (TSX:FM) and its subsidiary purchased all the outstanding shares of Inmet Mining Corp. in a deal valued at $5.1 billion. •