Cannabis-sector CEOs are bullish about the prospect for sales once Canada legalizes marijuana and say that the market will soar far above many estimates.

At the Arcview Group’s cannabis investment conference on May 2, the CEOs of three Canadian cannabis companies were united in predicting the legal cannabis market in Canada will fast outpace expectations.

A recent New Frontier Data report pinned the domestic cannabis market in Canada at $9.2 billion by 2025, sustained by higher average medical consumption. More conservative estimates pin federal sales at $4.5 billion by 2027.

“$4.5 billion is a very low number,” panel member Mike Gorenstein of Toronto-based Cronos Group (CVE:CRON) said at the conference.

“I’d be very surprised if it’s not higher than that.”

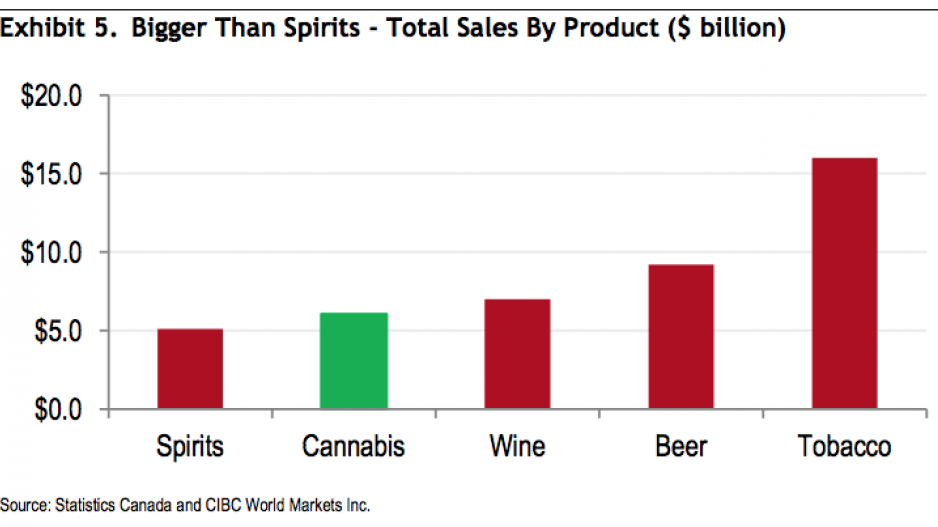

A CIBC study released May 7 provided a detailed analysis of why its authors believe the Canadian cannabis market will reach $6.5 billion in retail sales by 2020. That is greater than the $5.1 billion that Canadians spend on hard liquor, and is approaching the $7 billion that Canadians spend annually on wine.

Joining Gorenstein on the panel were George Robinson of Vancouver-based RavenQuest BioMed Inc. (CNSX:RQB), and Myrna Gillis of Nova-Scotia-based Aqualitas. They tackled issues from the effectiveness of regulations to technologies being adopted by the industry.

Robinson said baby boomers will drive higher sales, and added that insurance companies are lobbying heavily at federal levels, eager to move the generation over to medical marijuana from other drug treatments.

“That’s about a 3.4-million-person number they’re talking about coming over, off of opioids or other pharmaceuticals,” said Robinson.

“For those insurers, that’s about a 90% savings in cost versus a pharmaceutical product that’s out there.”

But there are potential headwinds in new regulations, the panellists said – among them Health Canada’s packaging rules, which limit brand visibility and include health warnings.

“When you’re putting medical warnings on products which are being used for medical purposes, there’s a bit of a conflict for the consumer,” Gillis said.

She voiced concern about Canada having lower consumer participation compared to U.S. states due to potential restrictions on marketing and selection – a worry echoed by Gorenstein: “We [still] don’t know how stores are going to be set up, if it’s going to be different, or how products will be pushed.”

The CEOs welcomed one element of the new regulatory regime – the involvement of First Nations in the cannabis economy. A Senate committee recently proposed that at least 20% of cannabis production licenses go to Indigenous groups.

“Obviously there’s a positive economic impact [for Indigenous groups] of having your own facilities and then selling on your own land,” Robinson said, adding that involvement in cannabis production could bring benefits to First Nations communities beyond immediate economic impact.

“Many times people get trained for types of work but can’t do that work on their own nation.”

With files from Glen Korstrom