Every Canadian, even those who are opposed to it, now own the Trans Mountain pipeline, or will very soon.

The federal government announced Tuesday morning May 29 that it will buy out Kinder Morgan Canada's (TSX:KML) Trans Mountain pipeline and take over its $7.4 billion pipeline twinning project. It will then try to flip it.

Ottawa will pay $4.5 billion to buy Kinder Morgan's existing Trans Mountain pipeline, and indemnify the $7.4 billion twinning project. The Alberta government will also provide $2 billion in emergency funding to cover unforeseen costs.

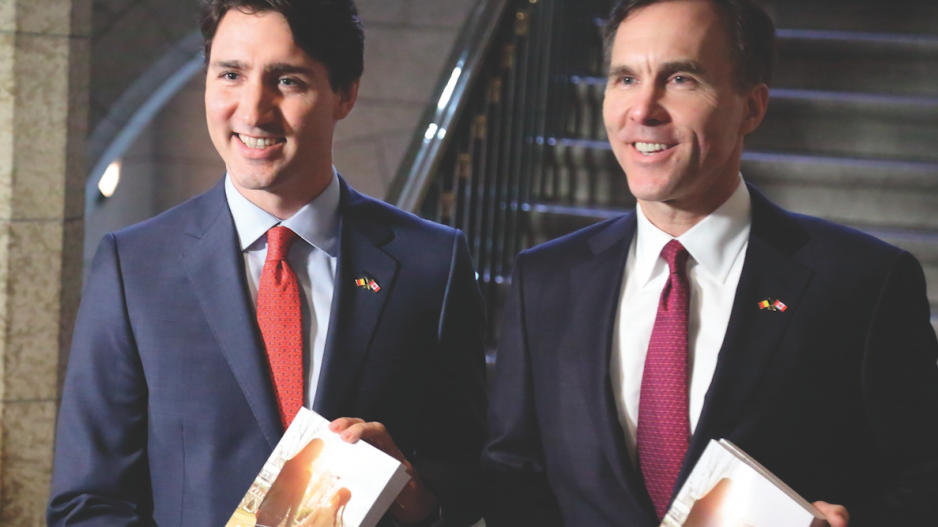

"It's not, however, the intention of the Government of Canada to be a long-term owner of the project," said federal Finance Minister Bill Morneau at a press conference this morning.

Between now and July 22, Ottawa and other parties will look for a third-party buyer, said Kinder Morgan (NYSE:KMI) CEO Steve Kean. The sale of Kinder Morgan's Trans Mountain assets are expected to close within the early fourth quarter, Kean said.

Ultimately, Canadian taxpayers could be on the hook for at least $12 billion, should the Canadian government not find a buyer-developer willing to take on the project and be forced to build the project itself.

That's not necessarily a bad thing, according to Brad Hayes, president Petrel Robertson Consulting, a petroleum industry consulting firm. He said the deal announced this morning is probably the best solution to the impasse.

He points out that the existing Trans Mountain pipeline is a money-maker, and so is the Hibernia offshore oil project in Newfoundland – something Canada owns an 8.5% share in through the Hibernia Holding Corp.

“They still own a piece of that and they’ve made a lot of money off of it,” Hayes said.

That said, he admits the industry is not thrilled with the idea that Canada has had to resort to nationalizing a pipeline in order to expand it.

“I’ve talked to lots of people here, and people aren’t really thrilled with more public money going into things, but better that public money go into it and it actually happens than to take a chance at having the whole thing fail.”

The expansion project will see the existing Trans Mountain pipeline, which runs from Alberta to Burnaby, will be twinned with a second line, nearly tripling its capacity, from the current 300,000 barrels per day to 890,000.

With increased pipeline access, Hayes expects to see some investment in Alberta's oil sands resume.

"If the pipeline is a certainty, then people are going to look at the existing properties and stuff that they've got and perhaps make more positive investment decisions," Hayes said.

The acquisition includes Kinder Morgan Canada's management team, which it needs to get shovels in the ground. It does not include Kinder Morgan assets that are not associated with the Trans Mountain pipeline, like a bulk terminal in Vancouver.

"Many investors have already expressed interest in the project," Morneau said.

After spending $1.1 billion on the pipeline expansion project, Kinder Morgan announced in April it was putting the project on hold and gave the federal government until May 31 to provide the certainty the company needed to move forward, without which it might cancel the project.

The project has been harassed by anti-pipeline activists, and opposed by the cities of Vancouver and Burnaby and, more recently, John Horgan's BC NDP government, which is seeking clarification from the BC Court of Appeal on whether it can limit the flow of diluted bitumen from Alberta through B.C.

Sen. Doug Black and others have urged Ottawa to use its constitutional powers to effectively expropriate the pipeline corridor through a special bill declaring the Trans Mountain pipeline expansion to be in the national interest.

But rather than flex its constitutional muscle, the Trudeau government has opted to open the public purse for a project that a private company was willing to build.

The price Ottawa is paying for Kinder Morgan Canada's existing pipeline assets amounts to $13 per share. But that is only for the existing pipeline, terminals, tank farms and other associated assets. It doesn't include non-pipeline assets, such as a sulfur terminal that Kinder Morgan owns in Vancouver.

While the federal government may not need Kinder Morgan to build the new pipeline, it needs its existing infrastructure because the twinning project is inextricably tied to the Westridge Marine Terminal and other infrastructure that Kinder Morgan owns and which must be expanded.

But if a top-tier midstream company like Kinder Morgan doesn't have confidence that it can complete the project, it begs the question who can or will.

Enbridge (TSX:ENB) spent $500 million advancing the Northern Gateway project, only to have the Trudeau government kill the project, and TransCanada Corp. (TSX:TRP) may have its hands full with the resurrected Keystone XL pipeline project.

Rafi Tahmazian, an analyst with Canoe Financial, said he couldn't imagine Kinder Morgan allowing a competitor to take over the twinning project and use its terminal, tank farm and other infrastructure as well, which explains why Ottawa has opted to buy the existing Trans Mountain pipeline and infrastructure as well.

He said a publicly built pipeline is likely to cost more than one built by private investors, and sends a bad signal to the international investment community.

"From an international investor perspective, I say they now see us having made it unbearable for a major global private sector entity to operate in Canada," he said. "But we turned around and found a solution that makes it look self serving. It costs us more and we lose international credibility as a country to invest in."

As environmental groups have pointed out, nationalization of the Trans Mountain pipeline won't make protestors go away, and it still has a recalcitrant provincial government in B.C. to deal with.

Asked how assuming ownership of Trans Mountain obviates the problem of B.C.'s opposition to the project, Morneau said: "This allows us to get rid of the political risk because we have federal jurisdiction over the project."

Politically, had Ottawa and Alberta not found a solution to the Trans Mountain impasse, Alberta Premier Rachel Notley had the most to lose of all political leaders involved, said University of BC professor Richard Johnston. She would have faced an electorate in the next provincial election without having secured a pipeline that is critical to Alberta oil industry.

The deal struck Tuesday "definitely helps Notley," Johnston said.