An independent report on money laundering in B.C. paints the province as a "high-intensity" destination for people funnelling the proceeds of crime through casinos.

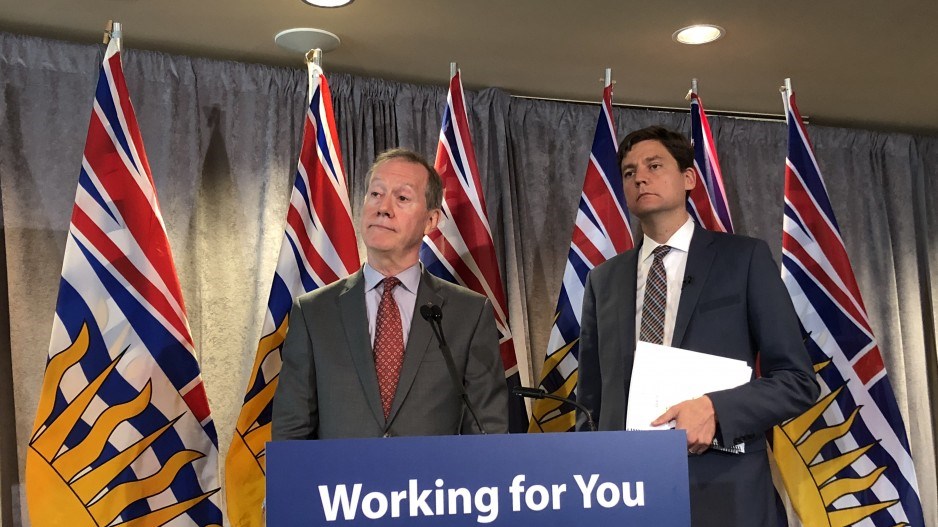

To fight the problem, the report, by independent investigator Peter German and released by B.C. Attorney General David Eby Wednesday morning (June 27), recommends replacing the British Columbia Lottery Corp. as the chief regulatory body for casinos in the province.

The report also recommends that the province lobby the federal government for new money-laundering laws and for closer scrutiny of industries that have historically been targeted by criminals, like automobiles, luxury goods and real estate. It also asks that a designated police unit for the gambling industry be created, emphasizing on the Lower Mainland.

It points the finger at a dysfunctional relationship between regulatory bodies like the British Columbia Lottery Corp. (BCLC) and the Gaming Policy and Enforcement Branch (GPEB) as a key reason for illegal money laundering activities that peaked in 2015.

The report said at one point one B.C. casino had $13.5 million in cash – mostly in money launderers’ preferred $20 bills – pass through its cash cage in one month.

“[The money laundering] represents a collective system failure, which brought the gaming industry into disrepute in the eyes of many British Columbians,” the report said. “The problem grew over time until it outdistanced the ability of existing legislation, process and structure to effectively manage the problem.”

The key recommendation is the removal of BCLC as the local industry’s key regulator, and the creation of an independent regulator in the form of a service-delivery Crown corporation.

The new organization will also be the regulator of the BCLC and provide a round-the-clock presence in major Lower Mainland casinos until designated police units are in place.

The report recommended funding the regulator through gambling revenue.

Although the report acknowledges the existence of Chinese gamblers locally involved, it cautions against targeting a specific demographic for these activities.

“It must be remembered ... that many of the high-limit gamblers who used dirty money to feed their gambling activities were dupes. Others were simply attempting to remove their own money from China, in order to make a life for themselves in Canada.

“We must always be mindful of the fact that organized crime survives because there is a market for its products. Those who purchase goods and services from organized crime are we, the public. This is not an Asian problem.”

Eby said the problem has affected the B.C. housing market and has an impact on the opioid crisis in the Downtown Eastside.

“The problem escalated, and the government turned a blind eye. The first report was in 2011; nobody said no [to the dirty money].”

He added that the province is now undertaking a second phase of money-laundering investigation, focused on the real estate industry. Officials found out about casinos through news reports, but “government has to be able to detect money laundering,” he said. “This dynamic has to change.”

According to German, the “high-intensity money laundering activity picked up in 2010. While the River Rock Casino was a focal point, no major Lower Mainland casino was spared. Why did this occur? Because it could.”

German added it is crucial that the entirety of the report's recommendations be adopted, since money-laundering activities from organized crime may shift to another area of the B.C. economy - increasing the need for federal oversight in segments like certain luxury goods sales, automobiles, boats and horse-racing.

"We know that organized crime is flexible and has already been giving casinos wide berth due to the scrutiny in recent months and years," German said. "What we don’t know is where it went. What vehicles are currently being used to launder drug cash in Greater Vancouver?

"You have other areas [outside casinos] that aren’t regulated federally. So it’s like whack-a-mole; you deal with casinos, and people could well be going to another sector of the economy. So you want to look at the areas that traditionally are of interest to organized crime."

B.C. Gaming Industry Association executive director Peter Goudron attended the release announcement of the German report. Goudron said that - while members are still reviewing the full findings of the report - they are supportive and committed to working with the province to improve enforcement of anti-money-laundering rules at local casinos.

"I don't think there's anything we can do about the past at this point to change people's views," Goudron said when asked if he feels the gaming industry's reputation has been irrevocably damaged by the German report's findings. "But what will change people's views is showing our commitment and demonstrating meaningful action as we move forward."

Read the report here.