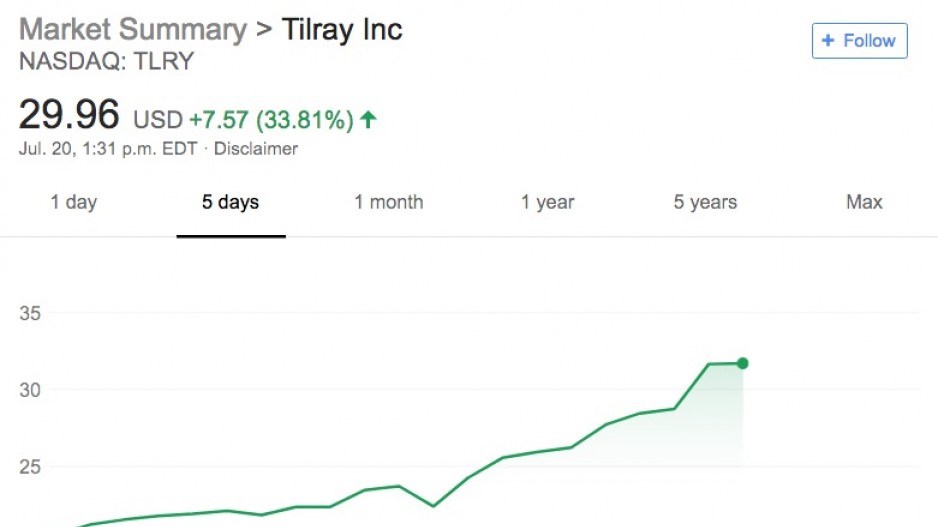

Shares of Nanaimo-based licensed producer Tilray (Nasdaq:TLRY) surged nearly 32% on July 19, as the company launched a banner initial public offering (IPO) on Nasdaq and raised US$153 million.

The next morning, shares continued to spike up to a high of US$31.80, or 87% more than the IPO price, by around 10 a.m. Vancouver time.

The excitement over the stock was partly because Tilray is the first cannabis-sector company to launch an IPO on a major U.S. stock exchange. It is not the only cannabis company to list on a major U.S. stock exchange, as other Canadian cannabis companies, such as Canopy Growth Corp. (NYSE:CGC) and Cronos Group Inc. (Nasdaq:CRON), are already listed on major U.S. exchanges. Those other companies, however, were public in Canada before they listed south of the border.

Tilray, which produces and distributes medical cannabis and has plans to do the same thing for legalized recreational cannabis in Canada, recorded a US$7.8-million net loss in 2017. In the first quarter of this year, Tilray lost US$5.2 million, which was substantially more than the US$700,000 that it lost in the same quarter a year ago.

Nonetheless, investors on July 19 purchased nine million Tilray shares at US$17 per share.

Seattle’s Privateer Holdings controls five-year-old Tilray through a share-ownership structure that gives it multiple votes per share.

U.S. exchanges, like the Toronto Stock Exchange, do not allow cannabis-sector companies that have operations in the U.S. to list. Companies in the cannabis space that have operations entirely in Canada's current medicinal marijuana regime are able to go public.