Vancouver continues to be Canada’s least affordable major market, and became even less affordable in 2018’s first quarter, according to RBC data released this week.

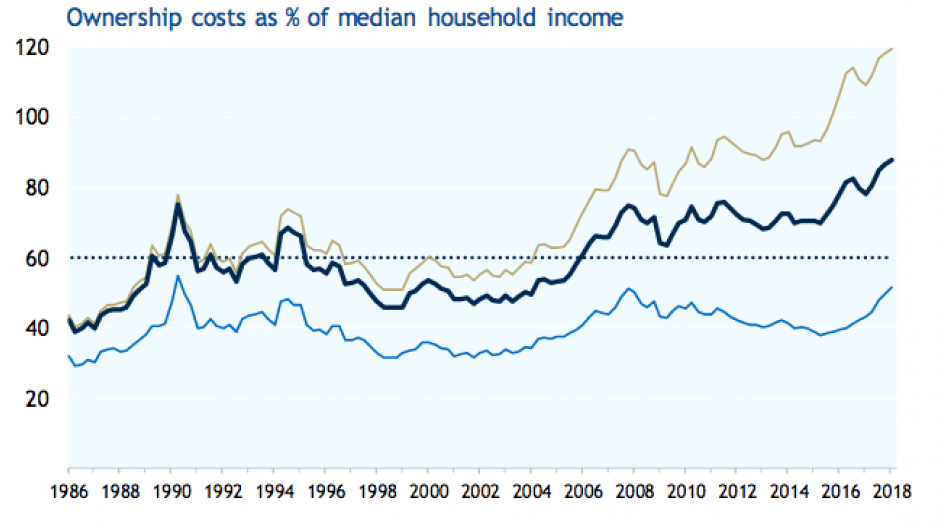

At today’s housing prices, owning a home in the city will cost 87.8% of the average household’s income in the quarter. This is the highest aggregate percentage ever recorded since the financial institution began tracking data in the 1980s.

“It’s increasingly hard to dismiss concerns that housing unaffordability is at crisis levels in Vancouver,” RBC said in its quarterly Housing and Affordability Measures report. “And things could get worse if – or when – interest rates rise further.

“Clearly, current price levels are an impossibly high hurdle for many would-be buyers to clear.”

RBC pointed out that home resales dropped in the first quarter, in part because of the new mortgage stress test but largely because prices are simply too high.

Recent market slowdowns may take prices down a notch, according to the report, but “this is unlikely to do much to ease affordability tensions.”

@EmmaHampelBIV