Business in Vancouverdatafrom its largest shopping centres list shows the number of mall stores has dropped by an average of 5.3% over the past five years.

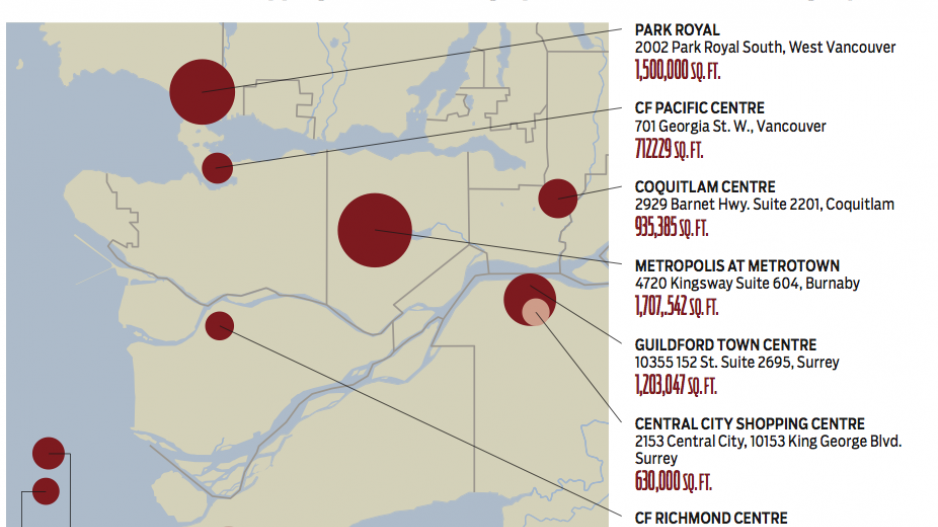

West Vancouver’s Park Royal had the largest decline in stores: 20% to 224 in 2018 from 280 in 2014. Its store-count drop is largely the result of remodelling Park Royal North in late 2016 and early 2017. The smaller storefronts that occupied the shopping centre’s north side were amalgamated and the centre hallway was removed to make larger spaces available for tenants like Sax Off 5th and Steve Nash Fitness centre.

Meanwhile, Metropolis at Metrotown reduced its number of stores by 11.2% to 340 in 2017 from 383 in 2014. Over the past year, Metropolis’ store count has rebounded by 2.9%, increasing by 10 stores.

In 2017, Metropolis secured leases with Muji and Uniqlo, two large retailers that each took over multiple storefronts and reduced the mall’s store count.

B.C.’s largest shopping centres appear to be bucking wider retail trends.

Typically big box stores are being replaced by smaller retailers. For example, Retail Insider editor-in-chief Craig Patterson said Metropolis at Metrotown is planning to replace Sears with several retailers to turn the former anchor store into a new shopping wing.

Consolidating small stores into bigger retail outlets is atypical for an industry that is trending in the opposite direction. Patterson said the trend to smaller stores is being driven in part by the fact that shopping centre owners and landlords can generate more sales and earn more rent per square foot from smaller retailers than their larger counterparts. He used the example of a department store paying much less per square foot than a jewelry store due to more concentrated sales and higher value per transaction in the jewelry store space.

Even Nanaimo North Tower Centre, which boasted a 4.4% rise in its number of stores in 2018, the largest one-year store count increase in the top 10, has recovered only the store losses it reported over the previous four years.