Part of Business in Vancouver’s ride-hailing report series, Life in B.C.’s uber slow lane. BIV delves into the long and winding road to nowhere, taxi licence devaluation, Uber driver revenue realities, ride-sharing traffic jams and the apps already servicing Metro Vancouver’s Asian community.

Debate about the merits and drawbacks of Uber, Lyft and other ride-hailing apps in Metro Vancouver usually neglects to mention that one local community has been in the market for more than a year, despite B.C. regulations prohibiting such services.

And these ride-hailing services – as many as five in Richmond, largely formed by the newly immigrated Chinese community and serving almost exclusively Chinese speakers – might provide regulators with valuable data on how ride hailing could fit into Metro Vancouver’s transit scene, one academic says.

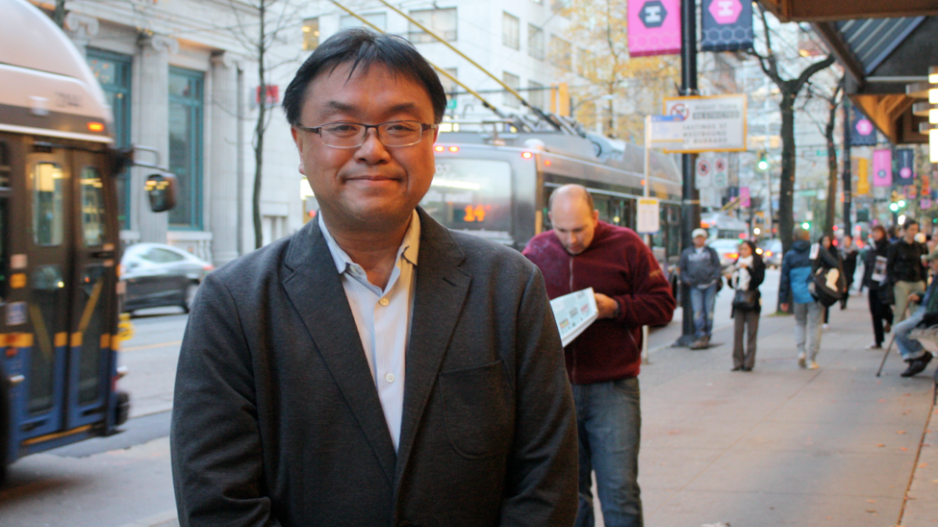

Still, the existence of this “grey-area” parallel economy within Vancouver’s transportation network is potentially problematic, said Andy Yan, director of Simon Fraser University’s city program and an urban-planning expert, who noted the existence of “Chinese Ubers” still faces many questions ranging from insurance coverage and liability to effects on citywide traffic congestion and services for those with mobility issues.

Yan added that, if unregulated, services such as Kabu-Ride and CoolGo Chuxing could proliferate before B.C. rolls out its decision on ride-hailing services, which would have a spillover effect on Metro Vancouver’s mainstream transit economy.

Kabu is the most prominent ride-hailing service accessed through Chinese social media app WeChat and is therefore difficult for non-Chinese-speakers to reach. Launched in March 2017, the ride-hailing service’s website says that it has more than 1,558 drivers, most of whom work part time, and 1,298 orders per day.

Neither Kabu-Ride nor parent company GoKabu Technologies Inc. responded to requests for comment, but a company spokesman told the Richmond News last year that it will apply to the B.C. government as soon as the province announces a regulatory system for the industry, adding that the service is acting within the law “because there are no regulations for B.C. yet.”

Richmond officials have said that the service is operating without a licence and is therefore currently illegal.

Christian Perea, head of operations for TheRideshareGuy.com, said a similar community existed in San Francisco (where Perea is based) – and that the community might still exist in northern California.

Perea noted that, because ride hailing has a history of operating in the absence of regulation, the existence of these car services could encourage Uber and Lyft to do the same in B.C.

But Perea added that there is no sign of that happening now.

The wildcard, however, might be ride-hailing apps like China’s Didi Chuxing, which has joined forces with taxi companies in some cities to create a new, mobile-app-driven service model that urban Chinese citizens in cities like Beijing and Shanghai are already accustomed to.

These consumers, when they visit a city abroad, might bring their consumption habits with them, giving services like Kabu, which focuses on the Chinese-speaking demographic, a niche in the Lower Mainland.

One Kabu driver said the company’s platform is based on the Didi concept and that “demand in Metro Vancouver is very strong because Chinese consumers are used to having a service” like Uber and Didi Chuxing, which took over Uber’s Chinese operations in 2016.

“It’s not absolutely necessary, but it doesn’t hurt,” said Edward Dai, director of Canada China Business Council’s Shanghai chapter, on whether a foreign city with services that Chinese nationals are used to would attract more business from the Chinese market.

“There are many cities in China that don’t have Didi and Mobike. [But] Uber was truly popular in China, and bike-sharing apps like Mobike have many foreign [non-Chinese] cities using their bikes, mainly because of Chinese tourists.”

Ultimately, Yan said, the key might be acquiring consumer-use data from services like Kabu, because it is one of the few sources of information government officials can use to get an idea of how ride-share traffic would affect the local transportation system.