News that TransCanada Corp. (TSX:TRP) plans to divest up to 75% of the natural gas pipeline that is part of the $40 billion LNG Canada project is being read by some as one more exit in a greater exodus from Canada’s oil and gas sector by big players, including Canadian companies.

After all, TransCanada also recently announced it plans to change its name to TC Energy – a move that some observers read between the lines as a sign that Canada’s brand has become so tarnished with energy and resource investors that even Canadian companies are dumping Canadian assets and scrubbing the Maple Leaf from their letterhead.

Jihad Traya, a natural gas analyst for Solomon Associates, doesn’t see it that way.

“I don’t see this necessarily as a statement that TransCanada wants away from Canada,” Traya said. “The more diversity of ownership in infrastructure assets in Canada, the much better and beneficial for everyone.”

TransCanada announced in October 2018 that the company would seek joint venture partnerships to build the Coastal GasLink, just as it is also considering a joint venture partnership to build the resurrected Keystone XL pipeline.

TransCanada has $36 billion worth of capital spending planned in Canada, the U.S., and Mexico.

It is worth noting that TransCanada plans to retain at least a 25% stake in the Coastal GasLink project, which is now in the early stages of being built.

The timing of the divestment, however, and the way in which it was recently revealed, could be read as a non-confidence issue by Canadian energy hawks who point to divestments as a sign of waning confidence in Canada.

Canadian companies like Enbridge Inc. (TSX,NYSE: ENB) have been making acquisitions and investments that are more focused on the U.S. than on Canada. While investment in the U.S. oil and gas sector has soared in the last couple of years, it has plunged in Canada.

And last year, Kinder Morgan Canada (TSX:KML) found the regulatory, legal and political landscape in Canada so untenable that it bailed on the Trans Mountain pipeline expansion, and sold the existing Trans Mountain pipeline to the Canadian government for $4.5 billion.

TransCanada’s plans to divest up to 75% of Coastal GasLink were recently revealed in filings with the National Energy Board (NEB.)

The $6.2 billion Coastal GasLink pipeline – a critical part of the $40 billion LNG Canada project – was approved and permitted through a provincial environmental review process, and work on the pipeline is already underway.

But an objection from a single citizen, Michael Sawyer, has potentially threatened to move the project back into regulatory purgatory. Sawyer asked the NEB to consider whether the Coastal GasLink pipeline should have been a reviewable project at the federal level.

The NEB had determined that the project was not a reviewable project, since the pipeline lies entirely within the province of B.C., and the NEB typically only becomes involved when it’s an interprovincial pipeline.

But B.C.’s natural gas pipeline system is part of a greater integrated network of pipelines that do cross other jurisdictions, so Sawyer’s argument may have at least some technical merit.

The NEB is now obliged to consider whether the project is something that should be reviewed by the NEB – just one more regulatory headache in a process that, in Canada, can seem interminable.

In filings with the NEB, TransCanada notified the NEB that it has retained RBC to assist with a divestment of interests in the Coastal GasLink pipeline.

TransCanada has stated that it would retain 25% to 50% ownership in the Coastal GasLink pipeline, so it would not be a wholesale divestment.

It’s possible that First Nations that support the pipeline could end up taking equity stakes in the project, said Karen Ogen-Toews, CEO of the First Nation LNG Alliance.

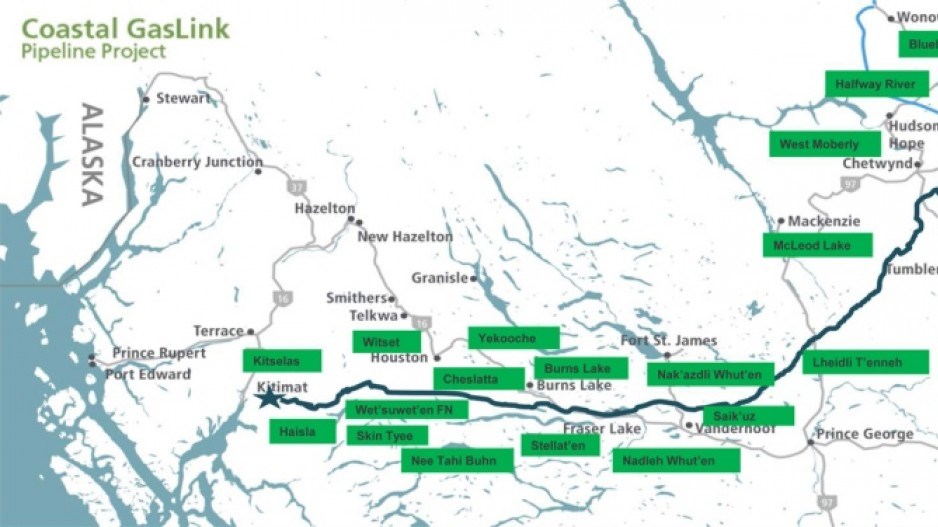

Twenty First Nations along the pipeline corridor already have signed more than $600 million worth of benefits agreements in support of the project.

“The thought of First Nations taking a stake in the Coastal GasLink pipeline is well worth pursuing, since the elected councils of all 20 First Nations on the pipeline route have approved the pipeline, and others have endorsed the LNG Canada project that it will feed,” Ogen-Toews said.

“It will obviously take time to explore the potential for First Nations to invest in the Coastal GasLink line. The First Nations LNG Alliance is ready to help, although any decisions will of course be up to each Nation and its people.”

Despite unanimous support for the project among elected band councils, a few hereditary chiefs with the Wet'suwet'en recently blockaded roads to prevent pipeline workers form doing their work, resulting in 14 arrests.