A junior stock exchange popular among venture startups is moving to close a loophole allegedly exploited by so-called consultants in a far-reaching share distribution scheme now under investigation by the BC Securities Commission.

The move should pique the interest of any retail investor in CSE-listed companies.

The Canadian Securities Exchange announced Feb. 22 it is applying a four-month resale restriction on shares distributed to consultants, under prospectus exemptions, by any CSE-listed company.

The exchange hopes this will mitigate potential abuse of the capital markets by preventing consultants from immediately ditching their shares after receiving contracts.

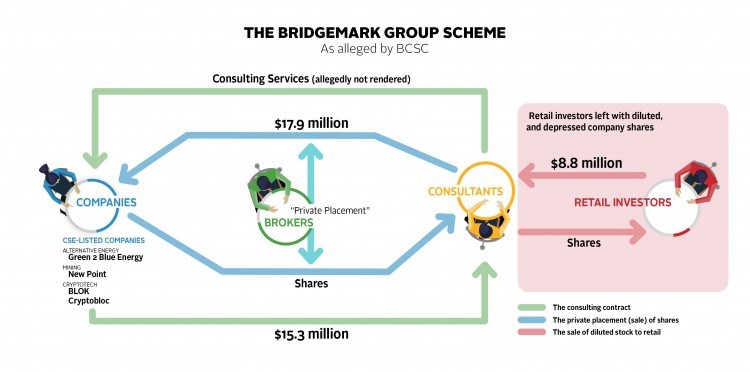

The changes stem from BCSC allegations that, between February and August of 2018, consultants known as the Bridgemark Group privately bought tens of millions of dollars worth of stock at pennies per share but had most of the money returned in allegedly phoney consulting fees. The so-called consultants then quickly dumped the diluted shares into the market, at a fraction of the original purchase price, where retail investors picked them up.

Meanwhile, noted BCSC, the companies publicly said they had raised and secured all the money via the private placements, as evidence of investor interest.

The dumping of shares was allowed because the CSE had the resale restrictions only on newly listed companies (of four months or less), meaning practically all CSE companies had no hold periods for shares sold under these consultant exemptions.

“As a result, shares issued under the s. 2.24 exemption (for employees, executive officers, directors and consultants) are often freely trading,” noted the exchange last November, when it proposed the change.

“The CSE has identified instances of what it considers inappropriate use of s. 2.24 that have resulted in excessive dilution and increased selling pressure on listed securities,” the exchange noted in a reference to the Bridgemark case.

Now, these resale restrictions must be disclosed in a news release describing the share issuance, stated the CSE last week. And if a company wants to lift the resale restrictions, or issue shares without a hold period, it must receive approval from the exchange.

Ahead of the CSE decision, investor advocate FAIR Canada welcomed the move, stating: “The allegations in the recent enforcement proceeding launched and temporary order issued by staff of the British Columbia Securities Commission in the BridgeMark Group matter … demonstrate the type of conduct abusive to the capital markets which can result from” not having such a hold period.

The CSE claimed in June 2018 that it “became aware of a potentially inappropriate use of s. 2.24 in connection with a private placement financing of a CSE-listed company. The exchange halted trading in the shares of the company to prevent further sales and to confirm the number of freely trading shares of the issuer.”

The CSE also made another consultant-related adminstrative change back in December when it removed the identity of those using the consultant exemptions on its “Form 9 Notice of Proposed Issuance of Listed Securities and Policy 6 Distributions.”

Online Form 9 disclosures in the Bridgemark case publicly revealed a pattern of relationships between those consultants involved in the numerous companies they purchased shares from, under the consultant exemption.

However, “no other Canadian stock exchange requires public posting of the identity of arm’s length investors on the Internet,” stated the CSE.

FAIR Canada did not respond to the Form 9 proposal last August, which was implemented Dec. 22.

The Bridgemark case is expected to be heard by a BCSC panel in April, should securities investigators conclude their investigation.