A legal fight has broken out between a Vancouver stock promoter, who is a central figure in an alleged illegal share distribution scheme, and one of the many penny stock companies he was involved with.

In November, BC Securities Commission (BCSC) executive director Peter Brady named West Vancouver certified public accountant Anthony Jackson in an investigation of the alleged multimillion-dollar scheme involving more than two dozen respondents, dubbed the “BridgeMark Group,” and 11 junior companies listed on the Canadian Securities Exchange.

Montego Resources Inc. was not one of the companies named in the investigation, but its new board recently announced it is conducting its own internal probe of former management, which includes former CFO Jackson and his father-in-law, former City of North Vancouver CAO Kenneth Tollstam, who is also a respondent.

The mineral exploration company filed a civil claim March 20, at B.C. Supreme Court, against Jackson and his accounting firm, Jackson and Co. Professional Corp. Montego is seeking an injunction against Jackson in order for him to provide login credentials for Montego’s online bank accounts as well as the company’s financial and accounting records.

The BridgeMark Group refers to 26 purported consultants and their respective consulting firms. Many have close ties to Jackson, either personally or through Jackson’s financial services company, BridgeMark Financial Corp., which happens to share the same office as Montego on West Hastings Street.

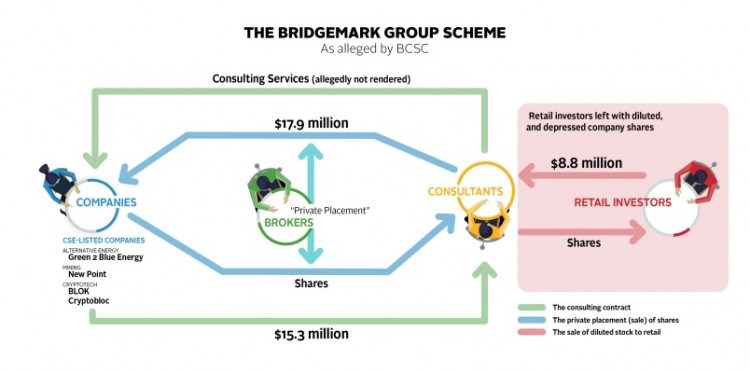

The alleged scheme, outlined by Brady last November, saw the consultants buy newly issued shares from the CSE-listed companies, which in turn used most of the money to pay for consulting contracts with the consultants. Investigators described the transactions as “cash swaps.”

The consultants are then alleged to have performed no such consulting work. Instead, they allegedly re-sold their shares at a fraction of what they paid for them. The contracts more than made up for any trading losses they incurred.

Meanwhile, the companies, which had little to no revenue, touted investor interest, pointing to the millions of shares being sold. But the long-term result was that retail investors were stuck with depreciated and diluted shares.

BCSC investigators are looking into whether the companies illegally distributed these shares under consultant exemptions defined under the Securities Act, and whether the consultants facilitated such distributions and acted contrary to the public interest with “conduct abusive of the capital markets.”

To halt the activity, temporary and limited trade orders were placed on the consultants and the companies last November. But in January a BCSC panel assessed interim evidence submitted by investigators and lifted orders on some, including BridgeMark Financial Corp. and Jackson’s accounting firm. But the panel determined there was enough evidence Jackson was involved in pitching the issuance of shares, introducing companies to the consultants and negotiating contracts, to maintain and strengthen those trade orders.

The allegations will to be tested at a hearing following the full investigation. The trade orders expire April 10.

BCSC enforcement staff have not alleged any wrongdoing on Montego’s part. And they will not say whether more companies are under investigation.

However, the company, now trading at $0.04 per share, showed a similar pattern of transactions and activity as the other 11 CSE-listed companies being investigated.

For instance, Jackson served as a director for Montego as he did for three of the 11 named companies. And many of Jackson’s associates, who were named as respondents, also figure in Montego’s affairs, most notably as private purchasers of shares, according to CSE filings. Furthermore, following the sale of these shares, Montego’s 2018 audited statement shows a sharp spike in consulting fees with no revenue stream.

Jackson became Montego’s CFO on Aug. 24, 2016, while Tollstam became a director and CEO on Oct. 4, 2016, according to corporate records. Tollstam left in September 2018 (shortly after retiring as City of North Vancouver’s CAO). A press release from Montego indicates its corporate secretary, Von Rowell Torres, who is also a respondent, was fired on March 1.

Montego was incorporated in 2012. Since then it has failed to materialize any revenue and in 2017 it abandoned the property it had initially stated it was going to explore.

Despite relatively little investment in its exploration sector, Jackson oversaw the raising of over $6.2 million from private placements (sale of newly issued shares) in November 2017, according to CSE filings.

Purchasing shares were several respondents including Jackson, Ryan Venier, Hunton Advisory Inc., Northwest Marketing and Management Inc., David Schmidt, Justin Liu, Cam Paddock, Danilen Villaneuva, Von Rowell Torres and Tara Haddad.

Insider trading reports show Jackson reported buying 3.5 million Montego shares at $0.13 on Nov. 20, 2017, and selling them Feb. 2, 2018, at $0.15.

Subsequently, Montego’s most recent audited financial statement showed the company spent $1.79 million on consulting fees in 2018 and $1.14 million in 2017 (and no such expenses in 2016). Management fees rose from about $49,248 in 2017 to $251,737 in 2018. Between that same period “travel and promotion” costs spiked from $74,686 to $797,702.

Montego claims in court filings that Jackson has refused several requests by CEO Adam Cegielski for the credentials and records. The claim comes after Montego terminated Jackson as its CFO March 1 and announced “an internal investigation into former management of the company over the last three years.”

Jackson subsequently took Montego to court, filing a petition March 7 to have the company hold an overdue annual general meeting of shareholders in order to receive and consider audited financial statements and to elect directors, among other things.

Jackson has claimed to be an elected director of the company whereas Cegielski was not. Jackson also claimed Cegielski was not responsive to his AGM requests. In Montego’s claim, Cegielski claims Jackson became “hostile and defensive, and refused to provide Montego with access to its accounts or financial records” after the company attempted “to confirm that Mr. Jackson and/or the BridgeMark Group had not engaged in any unlawful conduct with respect to Montego.”

In another court filing March 20, Jackson is seeking an order against Cegielski to have Cegielski pay back a $100,000 loan that was to be repaid to Jackson upon demand. When Jackson asked for the money in December, he claimed Cegielski told him to wait until the New Year.

Neither party has filed a response. Jackson is represented by Taylor Veinotte Sullivan while Montego has hired Norton Rose Fulbright Canada LLP.