B.C.'s average construction start value for projects over $50 million fell 30.7% to $197 million in 2018 from $284.9 million in 2014, according to data on Business in Vancouver’s list of the biggest B.C. construction starts in 2018 (page 15).

However, the five-year analysis understates the volatility of the province’s high-value construction starts. In 2015, average construction start values spiked to $668 million, more than doubling the average value in 2014. The province has been unable to match the 2015 peak since.

In, 2016, the average construction start value crashed, falling 70.4% to $193.1 million.

While the average deal value has grown just 2% from its 2016 low, the median has suggested a different trend.

After falling 51.7% to $95 million in 2016 from its 2014 high of $196.5 million, median construction start values began to rebound. While not recovering to its 2014 peak and reporting a five-year decline, the median construction start value in 2018 has rebounded 36.8% from its 2016 low to $130 million.

This suggests that the construction starts lower on the list have experienced greater growth in recent years than larger-value construction starts higher on the list.

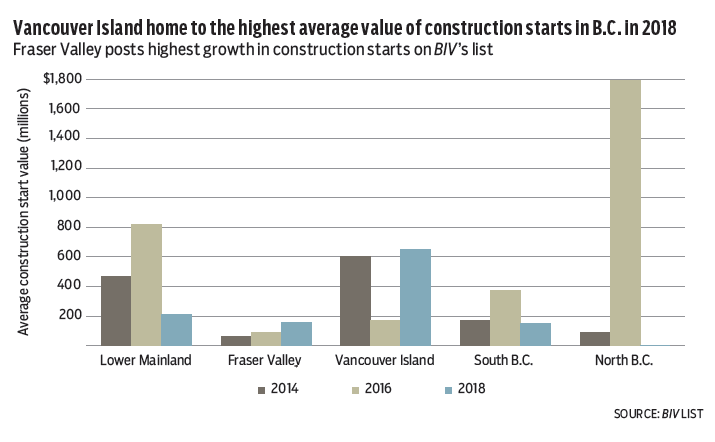

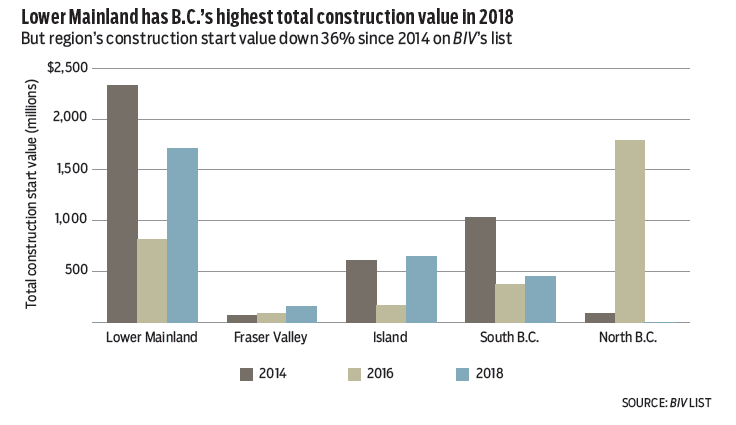

Typically, the Lower Mainland has most of B.C.’s high-value construction starts. As a result, the region usually has the highest total construction start value. This holds true with the exception of 2016, when a heavy concentration of high-value projects in northern B.C. allowed the region to boast the highest total value of construction starts at $1.79 billion. This more than doubled the Lower Mainland’s total construction start value of $816.4 million.

However, despite northern B.C.’s strong performance in 2016, it appears to have been an anomaly as the region had no high-value construction starts in 2018 and only one in 2014, valued at $90 million.

Although the Lower Mainland experiences, for the most part, the highest total value of construction starts, the average value tells a different story. Vancouver Island had the highest average construction start value in 2014 and 2018; Vancouver took second place.

The Fraser Valley posted both the lowest total and the lowest average values for construction starts. Nevertheless, it’s been the only region with consistent growth over the five-year period covered by BIV’s list. It can also claim to be the region with the greatest amount of growth, increasing 143% to $158 million in 2018 from $65 million in 2014. The Fraser Valley and Vancouver Island were the only regions to report average construction start value growth since 2016. •