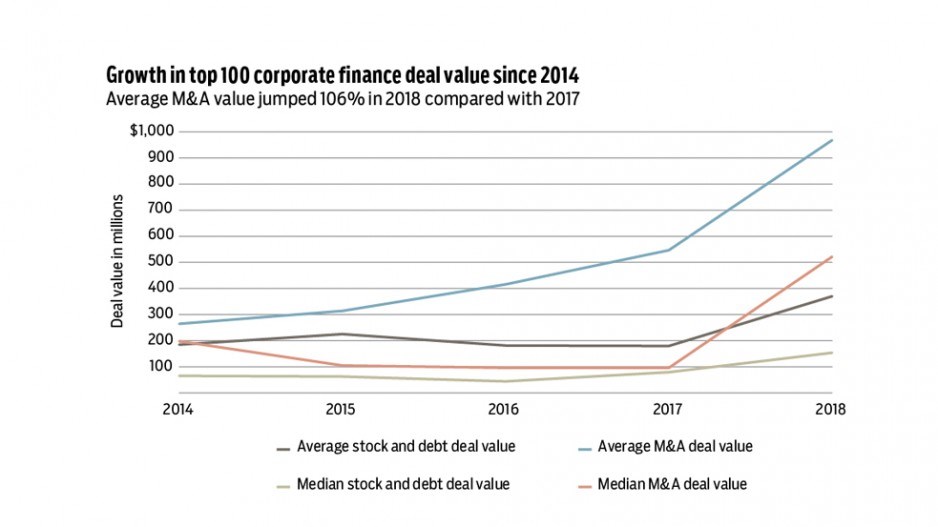

The average corporate stock and debt deal on Business in Vancouver’s top-100 list more than doubled in value in 2018, rising 106% to $369.9 million in 2018 from $179.6 million in 2017.

The median stock and debt deal had only a slightly lower one-year growth rate at 94%, suggesting that larger deals higher on the list grew at roughly the same rate as lower-ranking deals.

The top non-mining merger and acquisition (M&A) deals had an average growth of 77.1%, rising to $968.2 million in 2018 from $546.5 million in 2017. However, the median top non-mining M&A value grew 163.5% to $521.5 million in 2018 from $197.9 million in 2014. This suggests that smaller deals grew significantly faster than higher-ranking deals.

The largest M&A deal in 2018 was a $5.9 billion cannabis acquisition in which former junior exploration company Lead Ventures Inc., now called Curaleaf Holdings Inc. (CSE:CURA), did a reverse takeover of Curaleaf Inc., formerly PalliaTech Inc.

Last year’s largest M&A deal was more than five times the size of 2014’s largest M&A deal for $933 million, when Chip Wilson sold roughly half of his direct and indirect shares in Lululemon Athletica Inc. (Nasdaq:LULU). The largest stock and debt deal was a $5.3 billion revolving credit facility to Teck Resources Ltd. (TSX:TECK.B) that was 141% bigger than the largest stock and debt deal in 2014 ($2.2 billion).

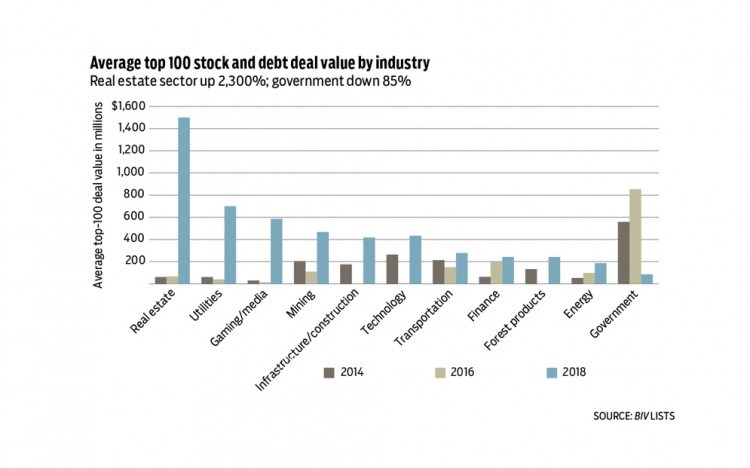

The real estate industry had the largest average stock or debt deal size in 2018 at $1.5 billion. However, that was mainly the result of a single large deal. The real estate industry also had the largest increase in average deal size: up 2,334% in 2018 compared with 2014.

The largest drop in average deal value was in the government sector. It fell 84.8% to $85 million in 2018 from $559 million in 2014, a significant reversal for the sector, which five years ago posted the largest corporate deal value.

With the recent legalization of marijuana, the cannabis industry now accounts for nine of the largest stock and debt deals in the province, second only to mining.