Average revenue for the top 100 public companies in B.C. has surpassed $1 billion for the first time, according to data on BIV’s Top 100 Public Companies in B.C. list (pages 14, 16, 18, 19 and 20).

That figure increased by 8% year-over-year, up from $927 million. The average company on the list grew 17.5% in 2018 compared with growth of 11.2% for the median company.

Up from $856 million in 2014, the average revenue for the top 100 public companies boasted 17% growth over the five-year period. Although average revenue grew, the median revenue fell 3% to $202 million in 2018 from $209 million in 2014. This suggests that larger companies higher on the list grew more than smaller companies lower on the list.

The mining industry claimed the greatest number of positions on BIV’s list (35), followed by forestry (12) and tech (10). These numbers remain largely unchanged from 2015.

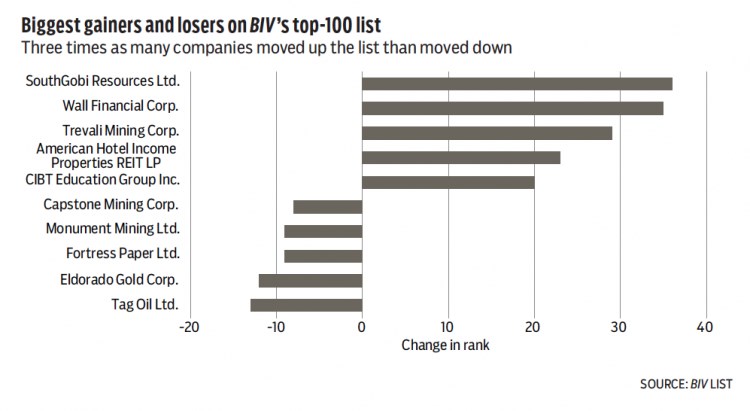

Of companies that were on the list in 2019 and 2015, three times as many moved up the list than moved down. Additionally, companies that moved up the list moved nearly twice as far (up 9.7 places on average) as those that moved down the list (down 5.9 places on average).

SouthGobi Resources Ltd. (TSX:SGQ) moved up the furthest this year, jumping 36 spots to place 62nd, up from 98 in 2015.

SouthGobi accomplished this by increasing its revenue 397.2% to $134.5 million in 2018 from $27 million in 2014.

The growth was tempered by a 14.4% decline in revenue over the past year. Excluding last year’s decline, SouthGobi grew 480.7% to $157.1 million in 2017 from 2014.

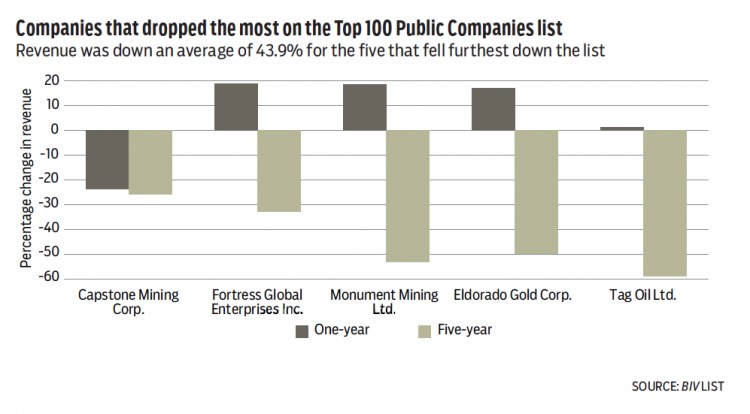

Tag Oil Ltd. (TSX:TAO) dropped down BIV’s list the furthest in 2019, falling 14 places to 91st from 77th. This was caused by a 58.9% decline in the company’s revenue to $23.7 million in 2018 from $57.5 million in 2014.

Companies often move down the list because of declining revenue over a five-year period. However, despite lower revenue in 2018 than in 2014, the companies that claim four of the five biggest slips down the list are showing signs of recovery. Revenue for these, including Tag Oil, grew over the past year.

The only company among the five biggest decliners that didn’t record one-year revenue growth was Capstone Mining Corp. (TSX:CS) which experienced most of its losses in 2018.

The amounts above have been rounded to the nearest decimal point. The percentages reflect changes based on full revenue figures. •