More associates of former Vancouver lawyer Fred Sharp are going to court to resist the Canada Revenue Agency’s (CRA) efforts to gather financial information about them and their companies, claiming the agency is unconstitutionally using its civil audit powers for the “predominant purpose” of criminal tax-evasion investigations.

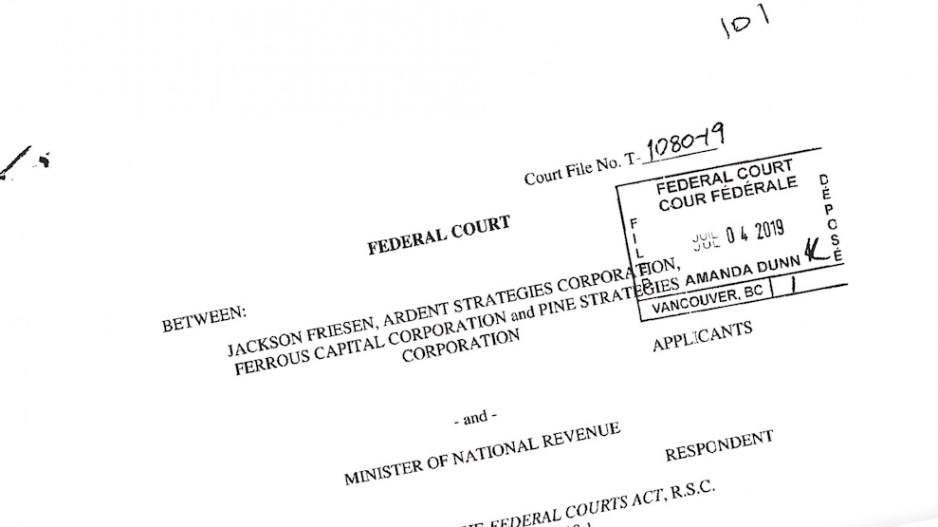

In three separate applications filed in the Federal Court of Canada in June and early July, Mike Veldhuis, Jackson Friesen and William Friesen claim their “perceived association” with Sharp put them on the radar of the CRA, which issued requirements for documents and information under the Income Tax Act.

“The applicants are being investigated by Canadian criminal law enforcement as a result of their perceived association with Frederick Sharp,” the applications state. “There is overwhelming evidence that Sharp is being investigated by Canadian and U.S. criminal law enforcement agencies and the respondent’s Criminal Investigations Program for the purpose of establishing criminal culpability.”

Sharp, a former lawyer, was revealed after the leak of the Panama Papers as the Vancouver point man for the Panamanian law firm at the centre of the leak, Mossack Fonseca, allegedly helping wealthy customers of his Corporate House firm to incorporate offshore entities to evade Canadian tax obligations.

Sharp and several others remain embroiled in their own legal battle with federal authorities on similar constitutional grounds, their next showdown scheduled in Federal Court for January 2020.

The latest applications do not detail the “perceived” links between the men, but private placement documents, for example, show that Jackson Friesen’s and Velduis’ companies were involved in a deal in 2009 where Fred Sharp’s brother, Tom Sharp, and his company, Quarry Bay Equity Inc., received a $44,000 finder’s fee.

Jackson Friesen’s application lists his firms Ardent Strategies Corp., Ferrous Capital Corp. and Pine Strategies Corp., and Veldhuis’ application concerns his companies Blackstone Capital Partners Inc. and RPC Strategies Inc., none of which have a substantial online presence. Veldhuis’ LinkedIn profile lists him as a managing partner of Venture Capital First LLC, and he has links to several public companies in the U.S. and Canada. In addition, Veldhuis is listed as “Diamond Match Maker” for a donation between $10,000 and $49,000 in 2015 to the Big Sisters of BC Lower Mainland, and his brother, prominent economist and Fraser Institute president Niels Veldhuis, is married to a Big Sisters board member.

The trio’s lawyer, Joe Arvay of Arvay Finlay LLP, stated in an email to BIV that the firm “will not comment on the matter that is now before the court.”

Now facing more than a dozen such challenges in Federal Court, the CRA’s limited power in fighting offshore tax evasion has come into sharp focus as detailed earlier this summer in an update by the federal government’s Offshore Compliance Advisory Committee. Helmed by Western University law professor Colin Campbell, the committee sent the update to Minister of National Revenue Diane Lebouthillier detailing challenges faced by the CRA since the Panama Papers and Paradise Papers leaks.

“Taxpayers engaged in aggressive tax avoidance or evasion typically use complex or opaque structures which may make it difficult and time-consuming either to identify the ultimate beneficial owner or to identify the precise way in which the tax laws are being disregarded,” the update states. “Once a high-risk taxpayer has been identified, it is often necessary to obtain further information in the course of an audit to support an accurate reassessment. While CRA has broad powers to audit taxpayers and demand information, taxpayers have the right to challenge CRA demands for information in the courts and, while CRA may prevail in the end, the process uses scarce resources and produces delay.”

Campbell, reached by phone in Ontario in early August, told Business in Vancouver that the CRA’s powers to catch offshore tax evaders are limited, its hands tied by the Charter of Rights and Freedoms, while the sheer volume of information in leaks like the Panama Papers makes it a herculean task for investigators to sift through and make solid cases.

In his years as the Liberal-appointed chairman of the Offshore Compliance Advisory Committee, Campbell said, he’s been left with a sense of “optimism tempered by realism,” hyper-aware of the difficulties faced by tax authorities the world over as they try to curb offshore and domestic tax evasion.

The CRA, he said, already receives a few million reports from the Financial Transactions and Reports Analysis Centre of Canada, while it also must contend with “many multiples” of that under the Organization for Economic Co-Operation and Development’s Common Reporting Standard.

“I think the CRA is making some very real efforts to come to grips with this. It’s very difficult to do,” he said. “You could expand CRA’s workforce from 50,000 to a million and you’d still have trouble going through every single piece of that. It’s just a mountain of information.”

Campbell added that public perception of the problem of offshore tax evasion is often misguided, because it’s easy to conflate illegal evasion with legal avoidance measures, while the country’s “tax gap” is much wider domestically than offshore.

“The biggest source of tax cheating in Canada is with the GST,” he said. “People would like to think that it’s mostly large-scale, offshore evaders that are costing the system tax money, but most of the money being lost is domestic.” •