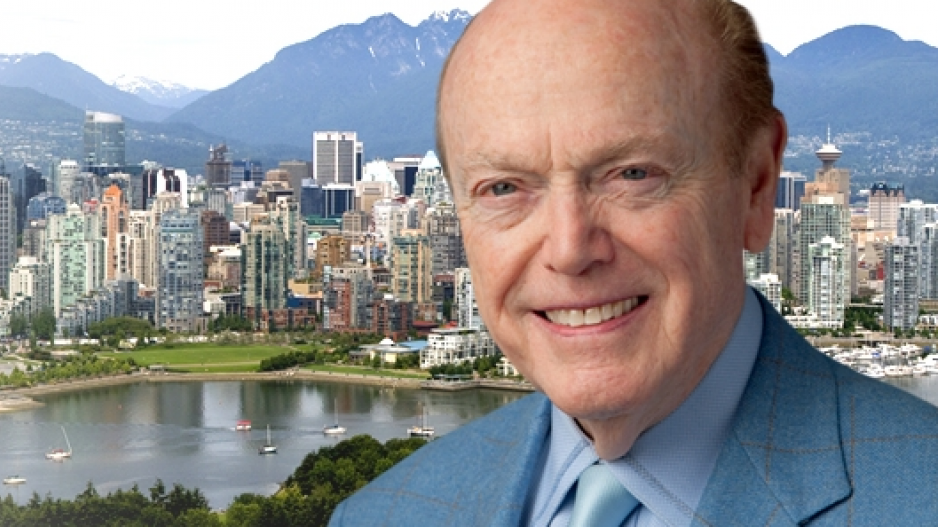

A special committee is recommending to shareholders that they approve a $1 billion offer from B.C. billionaire Jim Pattison to buy out Canfor Corporation (TSX:CFP) and take it private.

Earlier this year, Canfor received an unsolicited offer from Pattison’s Great Pacific Capital Corp. to buy out all remaining Canfor shares.

Great Pacific is already a major Canfor shareholder, holding 51% of Canfor stock. Pattison is offering a significant premium – 56% of the company’s share value – to buy out all remaining Canfor shares at $16 per share. That offer marks an 81% premium on the share value when Pattison first made the offer in August, at which point Canfor’s shares shot up 70%.

The offer comes at a time when B.C. forestry companies are facing significant “headwinds,” a special committee set up to review Pattison’s offer says.

“Ongoing industry headwinds in the forestry sector, including high log costs due to supply constraints and significant declines in benchmark price for both lumber and pulp, have had negative impacts on Canfor’s current financial results,” the committee said in a news release.

The offer would require the approval two-thirds of shareholders, and a simple majority of shareholders that are not part of the Great Pacific Capital Corp. The special committee is recommending shareholders approve the sale.

“The special committee believes that the transaction represents fair value for Shareholders and is the correct path forward for Canfor, Canfor employees, communities and shareholders."

Pattison's offer does not include Canfor's pulp and paper subsidiary, Canfor Pulp Products Inc. (TSX:CFX).