British Columbia’s most profitable companies were more profitable this year.

According to data on Business in Vancouver’s Top 100 Most Profitable Companies in B.C. list (starting on page 17), the average company’s net income increased 12.7% to $159.2 million in 2018 from $141.2 million in 2017.

Teck Resources Ltd. (TSX:TECK.B) claimed the No. 1 spot for the second year in a row, increasing its net income 47%, or by $1.1 billion, to $3.5 billion in 2019 from $2.4 billion in 2018.

Despite the impressive average growth for the top 100, the median net income fell 37.7% to $16.7 million in 2018 from $26.9 million in 2017. This suggests that smaller companies lower on the list reported lower profit growth than more-profitable companies higher on the list.

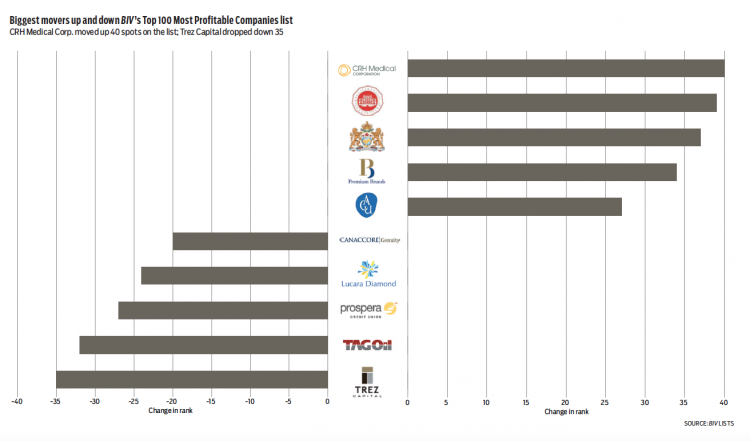

No. 50 CRH Medical Corp. (TSX:CRH) had the largest five-year movement up BIV’s list, jumping 40 places in 2019 from No. 90 in 2015. This was driven in part by a 919.2% net income growth to $16.9 million in 2018 from $1.7 million in 2014.

CRH’s net income grew more between 2014 and 2017, but its earnings fell 32.3% in 2018 from $24.9 million in 2017.

No. 89 Trez Capital Mortgage Investment Corp. (TSX:TZZ) dropped the furthest down BIV’s list, falling 35 places from 54th in 2015.

The drop resulted largely from Trez Capital’s net income, which fell 85.4% to $1.7 million in 2018 from $12 million in 2014. However, the company posted a 7.3% growth in net income in 2018 from $1.6 million in 2017.

No. 71 Tag Oil Ltd. (TSX:TAO) suffered an even larger net income decline than Trez Capital. It dropped 86.7% to $3.8 million in 2018 from $28.9 million in 2014. Despite that, Tag Oil fell just 32 spots from 39th in 2014.

Teck Resources posted the largest one-year net income growth, generating $1.1 billion of its $1.5 billion five-year growth over the past year.

No. 53 Pan American Silver Corp. (TSX:PAAS) recorded the largest one-year net income decline. It decreased $144.7 million to $15.6 million in 2018 from $160.3 million in 2017.

The mining sector contributed the most to the annual net income growth of the top 100 most profitable companies by generating $2.2 billion in additional income in 2018 or 37.3% of all the top 100’s additional income.

Media and entertainment came in second at $798 million in growth, and retail and wholesale finished third overall at $404 million.

The health industry suffered the largest net income decline, falling $8.3 million in 2018 from 2017.•