The green energy investment arm of Macquarie Capital will finance a new $200-plus million renewable hydrogen plant in Chetwynd, says project developer Juergen Puetter of Renewable Hydrogen Canada (RH2C).

Macquarie Capital’s Green Investment Group is one of three partners in a consortium that includes FortisBC and RH2C.

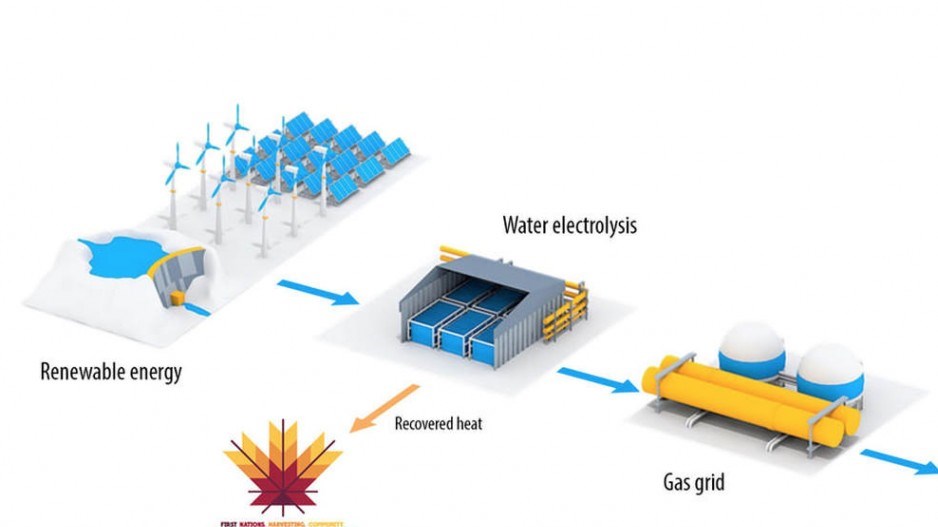

RH2C is also partnering with a First Nation greenhouse business – Sundance Produce – that will use waste heat from the electrolyzer plant in Chetwynd for greenhouses.

Under the consortium, RH2C will build an electrolyzer plant in Chewtwynd, at a cost more than $200 million, Puetter said. It would produce 60 tonnes of hydrogen per day.

FortisBC will be the customer for the renewable hydrogen produced, and Macquarie will provide the investment capital.

A dedicated wind farm will also be built to provide the power for the plant, said Puetter, who is also CEO of Aeolis Wind, which built the first wind farm in B.C. – Bear Mountain.

“There is a separate wind project that will supply the energy and that will be financed separately, and we have partners for that too,” Puetter said. “I have different partners. It won’t be Macquarie and it won’t be Fortis.”

Puetter said the dedicated wind farm would provide most of the power, but said the project would also need to buy hydro power from BC Hydro.

There is a potential new market in B.C. for renewable hydrogen, which the provincial government is expected to qualify under CleanBC’s renewable natural gas policies. Under those policies, suppliers like FortisBC will be required to increase the renewable content of its natural gas to 15%.

Renewable natural gas is currently produced primarily from landfills and dairy farms (biogas), and from wood waste (syngas). But hydrogen made from wind and water and then injected into the natural gas stream could also count as renewable.

Using electrolysis, with the electricity supplied from wind and hydro power, the hydrogen atoms are split off from water molecules to produce pure streams of hydrogen and oxygen.

This process for producing "green hydrogen" is much more expensive than producing "blue hydrogen" from natural gas, but it requires no fossil fuels, so various climate change policies – from carbon taxes to renewable content requirements, both of which will need to increase in stringency – are expected to eventually make green hydrogen competitive with blue hydrogen.

Puetter said the cost of wind power has come down to the point where a dedicated wind farm could produce power at a cost that is lower than what BC Hydro currently charges. And RH2C has a buyer – FortisBC. And since the electrolysis process generates heat, the waste heat will be tapped and supplied to Sundance Produce for new greenhouse development.

There is just one hurdle to clear before the project can move forward, Puetter said: The project needs Enbridge Inc. (TSX:ENB) to agree to allow hydrogen to be injected into their T-South pipeline, which supplies FortisBC with natural gas for southern B.C.

The hydrogen injected into the pipeline would represent 3% of the natural gas stream.

“Enbridge needs to agree, and the moment we have that, from that moment we are less than three years to having the gas in the pipeline,” Puetter said.