Coronavirus concerns are having a significant impact on global commodity markets.

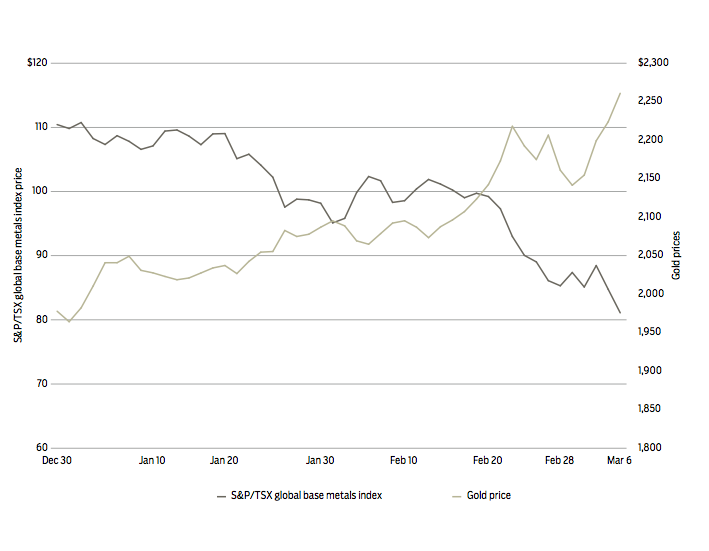

Since the first case of the COVID-19 virus was reported on December 31, 2019, the S&P/TSX global base metals index had fallen 37% to 69.28 as of March 9.

Despite the devastating blow to base metal prices, gold and other precious metals are benefiting from the pandemic. Gold has jumped 4.4% since December 30, climbing to US$1,637 per ounce on March 9 from US$1,569.

Rick Rule, president and CEO of Sprott U.S. Holdings, said investors’ experience with government’s previous reactions to liquidity concerns in the market, not COVID-19 fears, are driving the price of gold.

“What moves gold is the anticipation of the policy response by governments,” said Rule. “The policy response by governments to every financial panic in the last 25 years has been to provide liquidity into the system and further depress already low interest rates.”

While gold bugs might be happy, the rest of the economy is feeling the effects of the coronavirus.

In a note to investors, Beata Caranci, chief economist at TD Economics, said the coronavirus scare could spark a recession.

While Rule agreed that a recession is possible, he doesn’t think that this recession would have been avoided with or without the coronavirus.

“With regards to [commodities], the coronavirus was partly an excuse to be afraid of an already overvalued equities market and already overstretched financial situation,” said Rule.

Economic downturns happen roughly every 10 years, and some economists were warning about a recession on the horizon long before the word “coronavirus” was ever printed in a newspaper or uttered on TV.

In September in a note to investors, TD Bank warned that “history showed we were overdue for a recession.”

But fears of a recession were not present in the market before coronavirus concerns exploded.

Rule said that people’s fears were reduced by liquidity and well-performing capital markets. The coronavirus has allowed investors and the market to express those pent-up fears as evidenced by ailing stock, oil and base metal prices.

However, there could be a silver lining to falling base metal and industrial material prices, according to Rule.

Before COVID-19 shocked the market, many were expecting a long and slow correction with prices falling by smaller percentages over a longer period of time. But this would have meant that investors would not have seen a recovery and price increases for some time. Rule suggested that commodity prices likely needed to fall before they could start to recover, but the coronavirus may have significantly shortened that timeline.

“I had expected a slow unwinding of the 10-year economic recovery would slowly lower base metals and industrial materials prices over a two-to-three-year time frame, not two to three weeks,” said Rule. “I think that the coronavirus and the resulting economic slowdown in China has fast-forwarded that.”

Rule doubts that lower interest rates in Canada and the U.S. will slow the bear market in commodities. He said that in an economic environment flush with liquidity, where interest rates are already at historically low levels, the moves by the Bank of Canada and the U.S. Federal Reserve will have little impact.

If the number of coronavirus cases in Canada continues to grow, base metals and industrial materials could continue to slide.

If entire segments of the North American economy are shut down as they have been in China and Italy, aggregate demand will fall precipitously and demand-sensitive commodities like industrial materials, base metals and oil will continue to fall.

But the fall in industrial materials and base metals could be another silver lining for the economy. With the price of needed materials and inputs dropping, operating costs for other businesses fall and profits will increase once the economic demand shocks end. Higher operating margins for these business could lower consumer prices and the cost of living.

However, while this might be a silver lining for the global economy, Canada’s dependence on resource extraction means that plummeting commodity prices could have significant impacts on the country’s economy. •