A mythical stock promoter who claims to live in B.C. has been aggressively promoting a junior gold exploration company listed on the Canadian Stock Exchange, and despite warnings issued by the securities commission, there appears to be plenty of dupes buying up its stock.

It is being described by junior mining investment experts as a brazen "textbook” pump and dump scheme.

The company that is the target of the aggressive stock promotion, Crestview Exploration Inc. (CSE:CRS), headquartered in Calgary, says it has no idea who the promoter is or why he has targeted them for their scheme

The B.C and Alberta securities commissions have issued warnings about it, and the publishers of the Mercenary Geologist and Caesar.s Report say there are red flags all over.

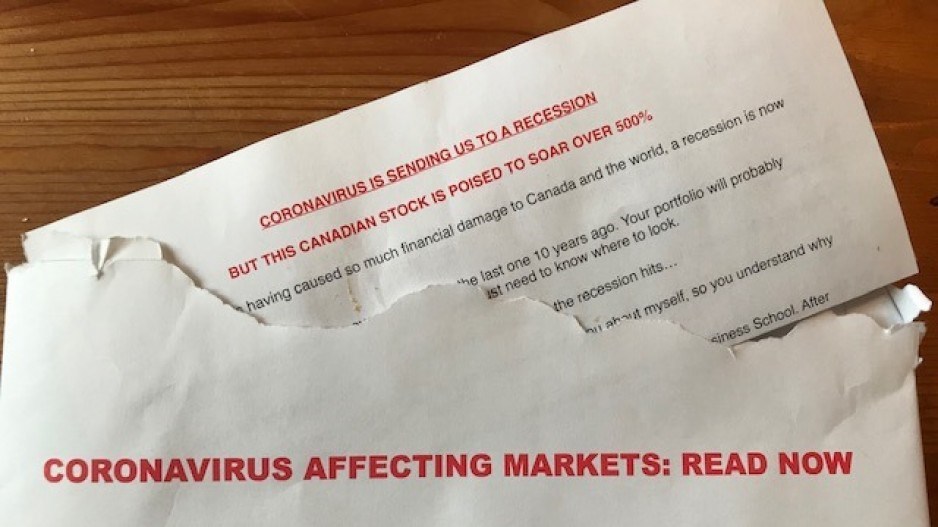

The letter that went out in recent days by snail mail, under the name James Campbell, was followed by an online promotion on equityresearchwire.com, but under a different name – Greg Wilson.

The letter that landed in mailboxes all over Canada is signed by James Campbell, who claims to be a geologist and stock analyst but who apparently has no public profile. Business in Vancouver is told that a million letters may have gone out via Canada Post.

Despite the warnings issued by securities commissions, Crestview’s stock has continued to climb, increasing more than 12% Tuesday, April 14, from $1.16 to $1.30 per share and another 8% so far this morning to $1.41.

Crestview today issued a press release announcing a $2 million equity financing deal, which might account for today's increase. But other spikes since January are harder to explain.

Since April 6, Crestview’s stock has doubled, from $0.73 to today’s $1.41 per share. There was also an even bigger spike in January, followed by a selloff.

In the snail mail letter, Campbell generously wants to let Canadians in on Crestview, saying that if they buy stock in the company, they could see short-term gains of 500% and 2,400% in the long-term.

The letter begins by saying investment portfolios will suffer as a result of a recessions caused by the COVID-19 virus.

“I am going to tell you about a Canadian stock which will soar as the recession hits,” Campbell writes.

He goes on to claim that investors who bought stocks that he recommended made profits of more than 1,000%.

In a blog post, Caesars Report suggests both James Campbell and Greg Wilson are fictitious and wonders why Crestview’s directors “didn’t get the memo” about its potential stock surge, since some of them have been selling off some of their own stock.

“In their defense, most of it was upon exercising options but apparently management didn’t get the memo about the 2,400% gains further down the road,” Caesars Report notes.

“There are simply way too many red flags to waste even one additional minute of our time on Crestview Exploration,” Caesars Report says.

Campbell’s website, ResearchReport.ca, has no contact information. It merely provides an email registration for people to receive stock reports.

The BC and Alberta securities commissions have issued warnings about Campbell’s letter, saying “these promotions may make false claims of large profits and baseless stock price projections.

“Most aggressive stock promotions in recent years have been done through unsolicited email or social media, but promotions delivered through the mail carry the same risks.”

Glen Watson, Crestview’s chief executive officer, said he’s not happy about the recent promotion. In a letter, he says that “to the best of the company’s knowledge, no officers and or directors were involved in disseminating this letter.

“Crestview has not paid any compensation, nor has it requested for this analyst to endorse the company nor its stock.”

The BC Securities Commission confirms that it is possible for market manipulation schemes to be run by company outsiders, who may simply acquire large amounts of stock in a company, promote it, and then sell when the stock prices rise.

“Generally speaking, anyone is able to carry out a promotion and they don’t have to be connected to the company,” the BCSC states in an email to Business in Vancouver.

Tommy Humphreys, an investor and co-founder of CEO.ca, which is an online platform for resource sector investors, said pump and dumps typically require either a current or former insider – someone who would have acquired a large amount of stock early on at low prices. That stock is then typically transferred through private transactions to a third party, who sells the stock when it peaks.

“It’s possible someone acquired a position in the market,” Humphreys said. “I think it’s more likely it was acquired in a secondary transaction from one of the known large shareholders.”

“The securities exchange is going to figure this out, if they really want,” Humphreys added.

The BCSC said it cannot disclose if an investigation is underway.

Crestview’s CEO, Glen Watson, is a Vancouver businessman who, according to his LinkedIn profile, is also president of smallcappower.com and Ubika Research, and CEO of Stockworks Agency.

On January 17, smallcappower.com included Crestview Exploration among six junior gold exploration companies with gold claims in Nevada to watch.

As it rightly pointed out, Crestview’s stock shot up 22% on January 16, after it put out a news release that it had identified two gold targets.

In fact, the company’s stock had already doubled a few days earlier – from $0.80 per share January 9 to $1.90 on January 15 – despite no news being issued by the company in that period that would account for such a dramatic increase.

After the company’s stock hit $2.32 on January 16 – the day the positive news about two gold targets being identified came out – six days of selling followed, whittling the share price down to $0.96 per share by January 24.

It fell to $0.57 per share by mid-March, but took off again in recent days, after the promotional mailer began landing in Western Canadian mailboxes, and “Greg Wilson’s” promo piece went online.

Watson told Business in Vancouver he has no idea why the mythical James Campbell is promoting Crestview.

“We tried to find out who he is,” Watson told Business in Vancouver. “It’s obviously fictitious.”

He added that, according to an online trading platform, someone appears to have accumulated about 1 million shares in the company in recent months.

“Whether it’s them or not -- don’t know,” Watson said.

He said there’s no way for Crestview to find out who may have acquired large amounts of Crestview shares with the purpose of market manipulation.

“The securities commission could do that, but we can’t,” Watson said.

Crestview was formed in 2017 and acquired mineral claims in Nevada in a region called the Rock Creek Project in the Carlin trend, which does have a history of rich gold finds.

Mickey Fulp, who publishes the Mercenary Geologist, said that Campbell’s promotion of Crestview “has the characteristics of a classic pump and dump.”

That is where a company either hires someone to aggressively promote the company’s stock, so they can sell their own stock after the share prices soar at a profit, or someone takes it upon themselves to buy up stock, promote the company, then sell.

“It is likely a pump and dump and others have already raised the alarm,” Fulp said. “No surprise that there is essentially no technical information on the website and that this happened on the CSE, as its regulations are even more lax than the TSX-V.”

According to Crestview’s most recent financial report, it had a deficit of $948,748 and $16,667 in cash, as of November 30, 2019.

“Crestview confirmed earlier in Q1 it is planning to drill the project in the third quarter of this year, but as the financial statements show, there simply is no money to drill the project,” Caesars Report notes.

That was written before today's announcement of a $2 million equity financing, however.

Ironically, the controversy over the company may actually be giving momentum to its stock.

“By being outrageous, people talk about it,” Humphreys said. “The message spreads by the sheer fact that it’s outrageous and it’s getting greater leverage than it would have.”