The value of the top corporate finance deals in British Columbia has skyrocketed in recent years, but that growth has almost vanished, according to data collected on Business in Vancouver’s top 100 corporate finance deals list (pages 8 and 10).

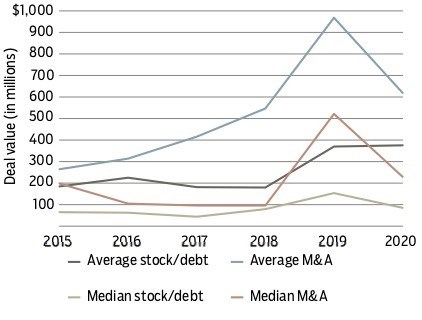

In 2018, the value of the average stock and debt deal increased 106% to $369.9 million compared with $179.6 million in 2017.

Over the past year, that growth slowed significantly to 1.5% as the total barely budged to $375.6 million. While the average deal value on the list grew, the median deal value as well as both the largest and smallest stock and debt deal value fell.

The median deal value dropped 44.4% to $85.3 million in 2019 from $153.6 million in 2018. This suggests that the list’s larger corporate deals grew while smaller deals lower on the list declined in value.

The value of the top mergers and acquisitions (M&As) suffered a similar fate.

Both their median and average values peaked in 2018 and fell last year. The average M&A deal value dropped 36% to $619.2 million in 2019 down from $968.2 million in 2018. The median M&A deal value fell 56% to $229.4 million in 2019 from $521.5 million in 2018.

The gap between the average M&A value and the median M&A value has grown since 2015, when the median deal value was 75% of the average deal value.

In 2019 the median deal value was 54% of the average deal value. This suggests that bigger deals are getting bigger while smaller deals have remained largely static.

Despite the large decline in the average and median value of the list’s M&As and the drop in the median value of the biggest stock and debt deals, the average and median value of these deals is still above 2017 levels.

Most of the growth in corporate finance deals occurred in 2018, where the average deal value surged compared with 2017.

The value of deals in 2019 could be a return to more typical levels. The year’s average M&A deal value was 49% larger than the average deal value in 2017.

The growth in that value from 2015 to 2017 was 57.1%.