While the top line for British Columbia’s largest cannabis companies is growing, so too are their annual losses, according to data collected on BIV’s list of the biggest cannabis companies in B.C. (page 12).

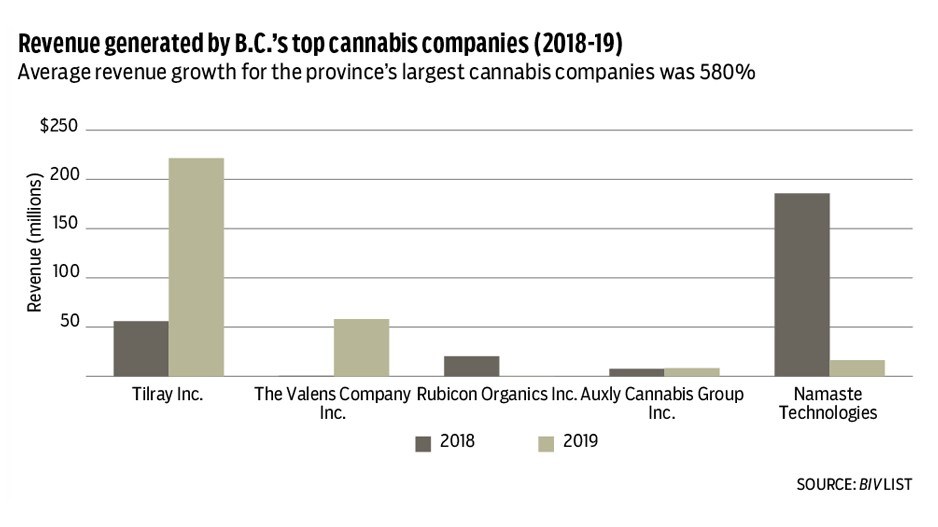

The average revenue growth for the largest cannabis companies was 580%.

No. 2 the Valens Company Inc. (TSX:VLNS) recorded the largest one-year revenue increase on the list: 112,670% to $58.1 million in 2019 from $51,526 in 2018. That revenue growth helped Valens improve its bottom line 58.9% by reducing its losses to $6.5 million in 2019 from $15.9 million in 2018.

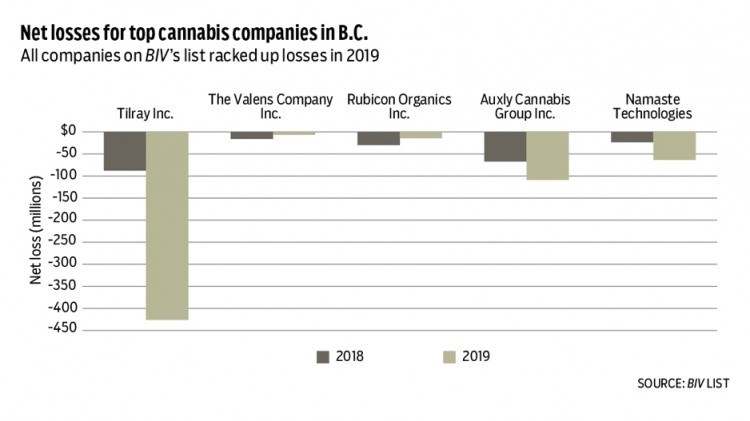

No. 1 Tilray Inc. (Nasdaq:TLRY) recorded the highest revenue at $221.6 million. That topped the company with the second-highest revenue, No. 5 Xphyto Therapeutics Corp. (CNSX:XPHY), by 6.5%. However Tilray’s losses of $426.2 million far exceed Xphyto’s losses of $7.7 million.

After being the only cannabis company on the list to have net income ($2.7 million) in 2018, Zenabis Global Inc. (TSX:ZENA) suffered the largest loss on the list ($125.3 million) in 2019.

No. 3 Namaste Technologies (CVE:N) was the only company on BIV’s list to report declining revenue. It dropped 12% to $16.3 million in 2019 from $18.6 million in 2018. Despite its revenue decrease, Namaste had the fourth smallest increase in losses (172%) on the list.

The average revenue for B.C.’s biggest cannabis companies was $32.9 million in 2019. That is 355% higher than their 2018 average revenue of $7.2 million.

However, a growth in losses accompanied the growth in revenue.

The average increase in net losses for the companies on BIV’s list more than tripled. In 2019, the average net loss was $58.1 million, 312% higher than the 2018 net loss of $18.7 million.

No. 18 World-Class Extractions (CNSX:PUMP) recorded the largest Jump in losses; however, that was likely because it had the lowest losses of the companies on the list in 2018.

World-Class lost $12.4 million in 2019, up 7,181% from its $169,681 loss in 2018. That, however, was still well below the list’s average net loss for the year. •