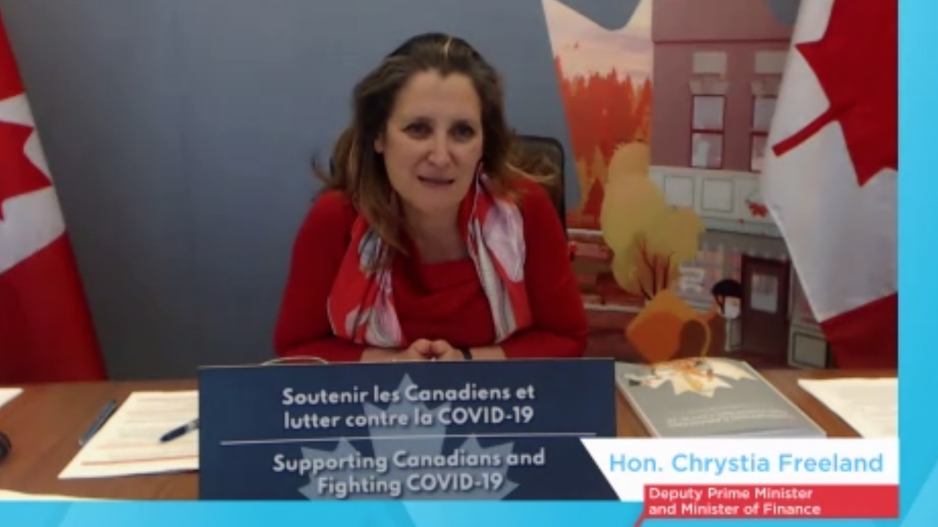

With a $381-billion deficit ahead for the fiscal year, Finance Minister Chrystia Freeland is looking to assuage B.C. business leaders about the state of the economy.

“We have already recovered, as an economy, meaningfully from the depths of the recession,” she said during a Thursday (December 3) address to the Greater Vancouver Board of Trade (GVBOT).

“But we still have a serious COVID recession to deal with.”

Freeland presented a fall economic update to Canadians on Monday ahead of her GVBOT engagement over Zoom.

“We have tried really hard to put in place a safety net for businesses and for Canadians that's going to get us through to the end,” she said during the virtual chat session.

The fiscal update would see the governing Liberals restore the maximum rate of the Canadian Emergency Wage Subsidy to 75% and embark on what the finance minister has described as a "Canada-wide early learning and child-care system."

Child care is the responsibility of provinces and details of the federal government’s plans were sparse.

The text of the Fall 2020 Economic Statement noted that Budget 2021 would provide a plan to “provide affordable, accessible and high-quality child care from ocean to ocean to ocean.”

When questioned by moderator and GVBOT CEO Bridgitte Anderson on Ottawa’s fiscal management, the finance minister declined to direct any remarks towards the Bank of Canada, citing the long-standing practice of keeping the central bank non-politicized.

“One of the reasons we can afford to do this is because interest rates are so low right now,” Freeland said.

“It is at a 100-year low. You heard me right.”

Regarding the potential for revenue growth to deal with the country’s growing debt, Freeland acknowledged ongoing concerns about Canada’s record on productivity.

“I think that growth starts with jobs,” she said, adding immigration will also be a driver of economic growth.

Ottawa revealed plans in late October to bring in 1.2 million immigrants over the next three years to address labour shortages and boost the economy.

“If we can increase women’s labour force participation, that’s a huge driver of growth and productivity,” the finance minister added.

The fiscal update also revealed the federal government’s intents to begin levying GST and HST on multinational web giants offering services within the country’s borders.

Ottawa said it favours a multilateral approach but that it would act unilaterally, if necessary, to apply a tax on corporations that provide digital services.

Those services would encompass everything from content streamed via Netflix Inc. (Nasdaq:NFLX) or rooms booked on Airbnb Inc.

The feds also wish to introduce a Highly Affected Sectors Credit Availability program for hard-hit industries such as tourism, hospitality and air travel.

The program offers 100% government-guaranteed financing and provides low-interest loans of up to $1 million over terms of up to 10 years.

“It is hard to make money when our public health advice is: People shouldn’t be moving around, people shouldn’t be going out,” Freeland said.

“I think this support will help push them through to the other side.”

Freeland said she considered support offered to airports and regional airlines in the economic update to be “significant.”

“When it comes to the big airlines, I think it is worth pointing out that they have, as they ought to have, benefitted significantly already from the wage subsidy program — more than $1 billion has gone to the airlines and that’s a good thing.”

The Canada Emergency Business Account, which offered $40,000 interest-free loans to qualified businesses, is also to be extended.

The government will begin offering an additional $20,000 to businesses, while up to $10,000 will be forgivable if repaid before December 31, 2022.

But further economic recovery will depend significantly on the wide distribution of COVID-19 vaccines.

Ottawa has secured or is in the midst of securing 429 million vaccine doses from seven companies.

For the country of 38 million, it may look like overkill but Prime Minister Justin Trudeau has said it was a measure meant to mitigate potential logistical problems if some vaccines don’t work out.

“We can be really confident that Canadians who want vaccines will get them and they’ll get the vaccines for free,” Freeland said.

Earlier in the day, Deputy Chief Public Health Officer Dr. Howard Njoo outlined some of the logistics involved in deploying vaccines across Canada.

“Although the initial supply of COVID-19 vaccines will be limited, I want to be clear that there will be enough vaccine for every Canadian. Having said that, in a country as geographically large and diverse as ours, we are facing some logistical complexities,” he said.

Those complexities include the need for ultra-cold storage for specific vaccines, reaching remote communities and co-ordinating between different levels of government.

The federal government had previously announced it’s establishing a National Operations Centre for vaccine distribution to be led by former Canadian NATO commander Maj.-Gen. Dany Fortin.

Freeland said she was “delighted” that the military would be playing a central role in getting vaccines distributed throughout the country.

“The tipping point with vaccination isn’t when you vaccinate the first Canadian. It’s going to be when you vaccinate enough Canadians that the virus stops spreading,” she said.