Growth is slowing at British Columbia’s largest credit unions, according to data collected on Business in Vancouver’s Biggest Credit Unions in B.C. list (see biv.com/lists).

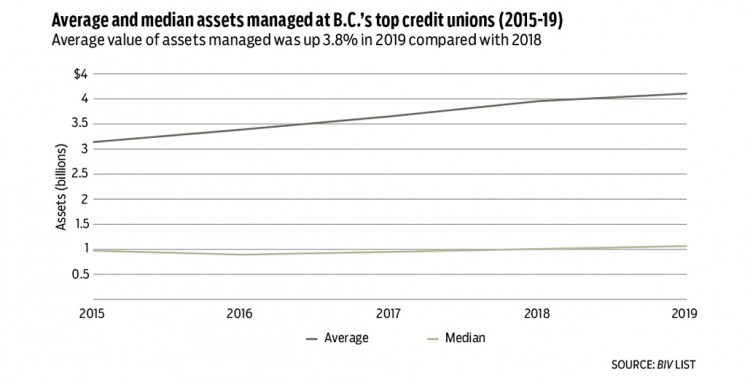

From 2015 to 2018, the value of assets managed by the province’s largest credit unions grew roughly 8% annually. But 2019 put the brakes on this trend, with asset values growing by less than half the rate of each of the previous four years.

Average assets managed grew 3.8% in 2019, to $4.1 billion from $3.96 billion in 2018.

The median asset value hit a five-year low in 2016 at $893.8 million and has grown 19% since then.

The growth in the median value of assets managed by B.C.’s top credit unions surpassed average growth, increasing 5.6% to $1.06 billion in 2019 from $1 billion in 2018. This suggests that smaller credit unions lower on the list grew faster than larger money sources higher on the list.

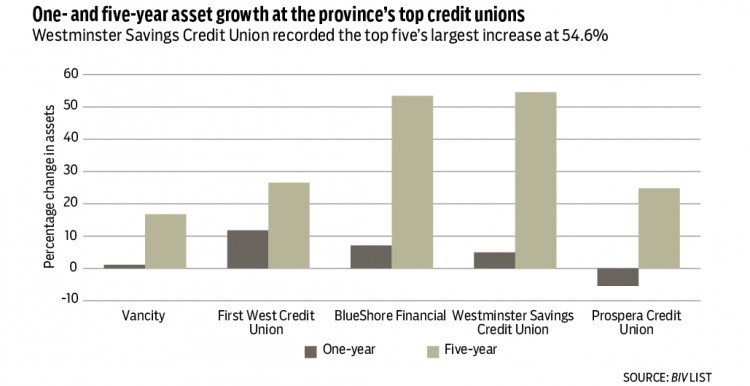

No. 9 G&F Financial Group recorded the most impressive five-year growth. Its assets under management increased by 66% to $2.33 billion in 2019 from $1.4 billion in 2015.

G&F also boasted the largest one-year growth in 2019 with a 12.9% increase in assets managed compared with $2.06 billion in 2018.

No. 19 North Peace Saving and Credit Union in Fort St. John had the largest one-year slump. The value of its assets dropped 7.2% to $438 million in 2019 from $472 million in 2018.

No. 15 Northern Savings Credit Union in Prince Rupert suffered the largest five-year decline in assets managed, falling 29.3% to $633 million in 2019 from $895.8 million in 2015. •