For the first time since 2014 and seemingly unfettered by the global pandemic, B.C.’s mining sector has posted multiple multibillion-dollar deals, as noted in Business in Vancouver’s Biggest Mining Mergers and Acquisitions of 2020 list (page 10).

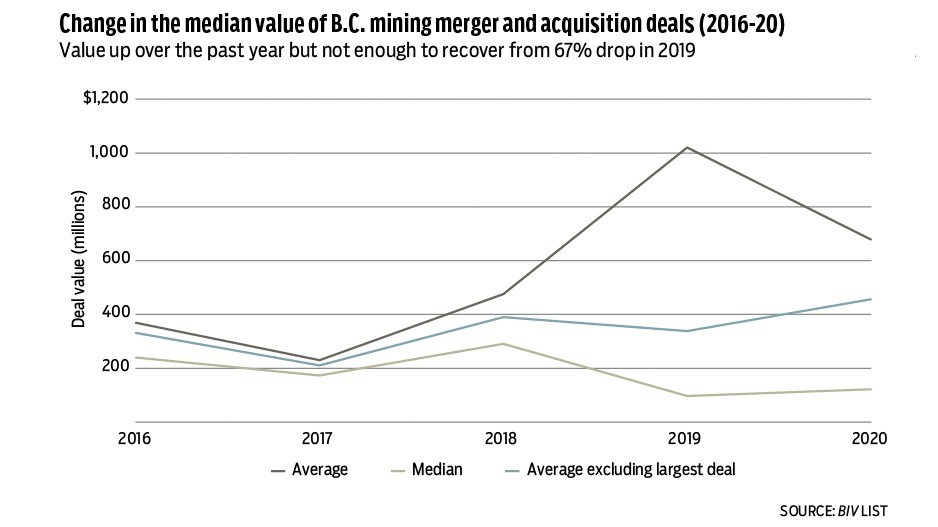

The median value of the largest mining mergers and acquisitions grew 25.7% over the past year, to $122.1 million in 2020 from $97.1 million in 2019.

This significant growth, however, was not enough to recover from the 66.6% drop in 2019 when the median M&A value plummeted from $290.9 million in 2018.

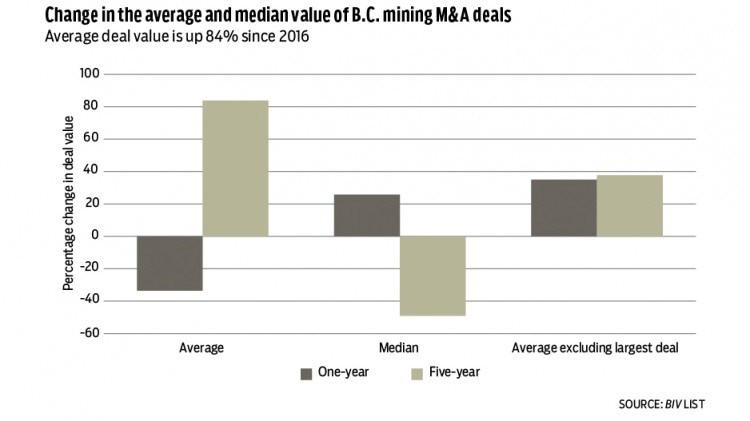

Although median deal value is up over the past year, a broader look over five years reveals that median deal values have fallen 49.1% from $240 million in 2016.

While the median deal value grew last year, the average deal value sank 33.5%.

The drop was cushioned by an outlier – a $13.3 billion Goldcorp Inc. (TSX:G) deal that boosted the average in 2019. When the largest deal is removed from 2020 and 2019, the average deal value grows 34.9%.

The median deal value growing faster than the average deal value over the past year would suggest that smaller deals lower on the list grew more than larger deals higher on the list.

In 2019, the 19th largest deal on the list was valued at $9 million; in 2020 the 19th largest deal was four times larger at $45 million.

The decline in average deal value for the biggest mining M&As in B.C. comes after average values skyrocketed over the two years prior, growing 343.4% to $1.02 billion in 2019 from $230.1 million in 2017.

However, the drop in average deal value last year, paired with a 37.7% decline in 2017, dampened the five-year growth in average deal value to 83.8%. •