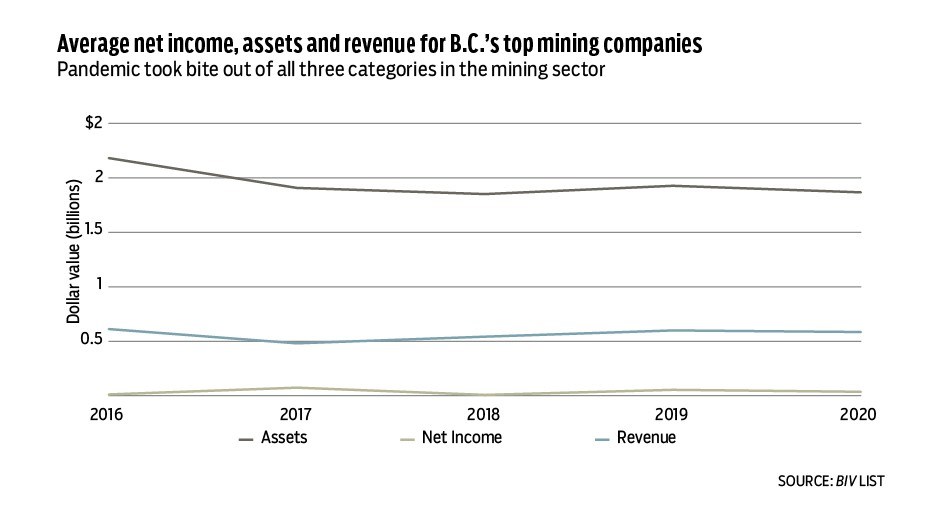

Two years ago, British Columbia’s top mining companies had finally recovered from a decline in average asset and average revenue suffered in 2017 and were able to return to roughly 2016 levels.

But in 2020, the pandemic largely wiped out all of the four-year growth the industry had achieved, according to data collected on Business in Vancouver’s Biggest Mining Companies in B.C. list (https://biv.com/lists).

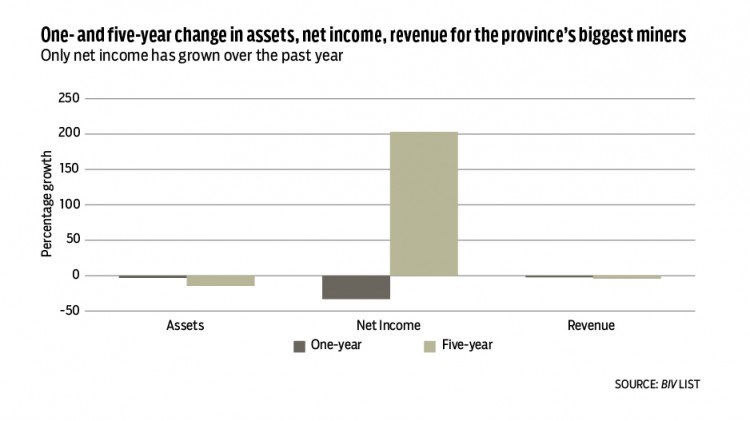

Average revenue fell 5.6% in 2017 to $1.32 billion from $1.4 billion in 2016. By 2019, B.C.’s biggest mining companies were able to more than make up for the loss, increasing revenue 30% to $1.7 billion over the next two years.

Most of that growth took place in 2019. However, the recovery was short-lived, as the 2020 pandemic year decreased average mining revenue for the province’s top miners by 30.3% to $1.2 billion.

Average asset value followed a similar trajectory. It fell 16.7% in 2017 to $6 billion from $7.3 billion in 2016.

In 2019, average asset value increased 16.8%, to $6.8 billion. However, it dropped 30.6% in 2020 to $4.8 billion.

Average net income for the province’s top mining companies followed a steeper decline trajectory. It peaked in 2018 and fell each year afterward. In 2019, average net income fell 70.2% ($318.1 million) to $135.3 million from $453.4 million in 2018.

The 2020 decrease was significantly less than the decline in average net income posted in the previous year. It fell 60.6% ($82 million) to $53.3 million.

The dramatic swings in mining company average revenue and asset values over the past five years were significantly influenced by the outlier of No. 1-ranked Teck Resources Ltd.

Declines in Teck’s median revenue and asset values were much less significant than those of other top mining companies in B.C., the median asset value of which fell 3.1% while the median revenue value fell 2.4%. •