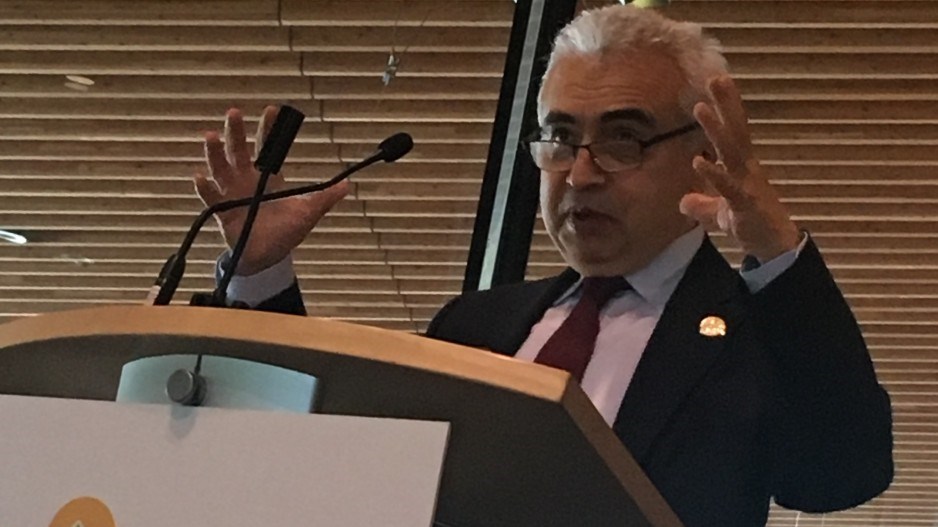

Two years ago, in May 2019, Fatih Birol, executive director of the International Energy Agency (IEA), stood in Vancouver at a Clean Energy Ministerial conference and told attendees that natural gas and LNG had entered a golden age.

He repeated the prediction in February 2020 at a conference in Florence: "We said the golden age of gas can be materialized through LNG, and it is what we are seeing today.”

Today, the IEA essentially declared that golden age already over. No new oil or natural gas field exploration is needed, and neither are any new LNG projects, according to the IEA’s new Net Zero by 2050 roadmap.

Many of the LNG projects under construction or in the planning stage won’t be needed, the report warns. LNG Canada’s $40 billion project, now under construction, is presumably one of the LNG projects the IEA thinks may become stranded assets.

The report assumes countries committing to producing zero greenhouse gas emissions by 2050 will live up to their pledges, and then sketches out a roadmap for how countries and industry might meet the targets, and explains the implications for fossil fuels, notably coal, oil and gas.

“The pathway laid out in our roadmap is global in scope, but each country will need to design its own strategy, taking into account its own specific circumstances,” Birol said in a press release.

The roadmap is based on holding global warming to 1.5 degrees and commitments being made by countries and businesses to produce zero greenhouse gas emissions by 2050.

Renewables – wind and solar – carbon capture and storage (CCS) and hydrogen play big roles in the IEA’s roadmap. Nuclear power plays a more minor role.

Given that Canada’s grid is already largely decarbonized, thanks to hydro and nuclear power, Canada has less work to do in that area than many countries that still rely on coal and natural gas to produce power.

Canada’s biggest liability in meeting net zero emissions targets by 2050 is its oil and gas industries and transportation.

Assuming that countries meet their targets, there will be a deep decline in global demand for oil and gas, the IEA forecasts.

“The trajectory of oil demand in the NZE (net zero emissions) means that no exploration for new resources is required and, other than fields already approved for development, no new oil fields are necessary,” the report states. “However, continued investments in existing sources of oil production are needed.”

The IEA projects lower demand will drive oil prices to $US35 per barrel by 2030 and US$25 per barrel by 2050. At those prices, only the lowest cost producers – OPEC nations – will be able to afford to still produce oil and gas.

The IEA envisions OPEC producing countries, which currently supply 37% of the global market, providing 52% of the global market by 2050.

"No new natural gas fields are needed in the NZE beyond those already under development," the report states. "Also not needed are many of the liquefied natural gas (LNG) liquefaction facilities currently under construction or at the beginning of the planning stage."

Just two years ago, Birol noted that global energy demand grew by 2.3% in 2018 – the largest single-year increase in a decade.

“We see that almost half of the growth in the world energy came from natural gas,” he said, “followed by renewables, oil, coal, nuclear and others. In other words, last year was a golden year for natural gas – huge growth – mainly driven by Asia.”

What has changed since 2019 is that 44 national governments, including Canada, and the European Union have committed to net zero targets by 2050. That can only be accomplished through an aggressive move away from coal, oil and natural gas.

BC Green Party Leader Sonia Furstenau seized on the report as evidence of the folly of the NDP government’s support for the $40 billion LNG Canada project.

“This landmark report that will inform how the world achieves net zero emissions shows a clear decline in the North American natural gas industry, since the gas is more costly to produce and transport,” Furstenau said in a news release.

“The report suggests that private finance will now need to recognize that these heavily subsidized megaprojects are at risk of becoming stranded assets. It is deeply reckless for this government to invest billions in LNG, which clearly represents a serious climate and financial risk.”

“We now have an analysis from the most authoritative energy body in the world that shows a direct link between a climate-safe future and a sharp decline in demand for oil and gas,” Chris Severson-Baker, Alberta director for the Pembina Institute, said in a news release.

“Within the decade, this will have a significant impact on the price and therefore production levels of oil and gas in Alberta. We can also expect that the purchasers of oil and gas products will increasingly direct their spending on oil and gas produced with the lowest upstream emissions.

“Alberta must take action to reduce emissions in the oil and gas sector to remain carbon-competitive as demand declines.”

Bryan Cox, CEO of the Canadian LNG Alliance, said there will still be a demand for LNG in the coming decades and thinks Canadian projects like LNG Canada have a competitive advantage because of their comparatively low greenhouse gas emissions intensity -- something partly attributable to the use of electricity in the upstream.

"When you look at how carbon intensity is being built into cargoes right now, I think that's where Canada's opportunity, and B.C.'s opportunity is when it comes to natural gas and LNG is around the emissions intensity that we've worked so hard on with our projects," Cox said.

He added that natural gas and LNG have a role to play in hydrogen production -- something that figures largely in in the IEA roadmap. The report estimates hydrogen use will rise from 90 million tonnes (MT) in 2020 to 200 MT in 2030.

"When you look at Japan and their recent announcements, when they increased their targets, they talked abouit how they're looking to LNG, not only for the applications regarding natural gas, but also as feed stock to their hydrogen opportunity as well. With our opportunity on lowest emission LNG, I think it still positions Canada in a place to provide to the market that lowest emission molecule."