The global semiconductor shortage has rattled consumer markets much of the past year, putting the squeeze on everything from new cars to the latest PlayStation gaming consoles that all depend on computer chips manufactured in select locations.

“The world is worshipping the microprocessor. It’s everywhere, it’s in your smartphone, in your car, in the elevator,” said Wolf Richter, chief technology officer of Epic Semiconductors Inc.

“But these microprocessors, they can do nothing without software, and you know that software is buggy. Planes fall from heaven. Autonomous cars have big, big problems [being deployed] on the street.”

Richter’s Vancouver tech firm is seeking to change that by creating semiconductors that are self-powered and capable of self-learning. Or as Richter puts it, closer to brain cells than traditional computer chips.

The pressure is on global manufacturers to address the shortage, as B.C. startups like Epic face heightened demand to accelerate commercialization to meet unprecedented demand.

Last month, Epic was selected to join the country’s only semiconductor-focused incubator, ventureLAB’s Hardware Catalyst Initiative.

The incubator is offering specialized semiconductor lab equipment – the type startups typically can’t afford in the early stages – as well as industry mentorship.

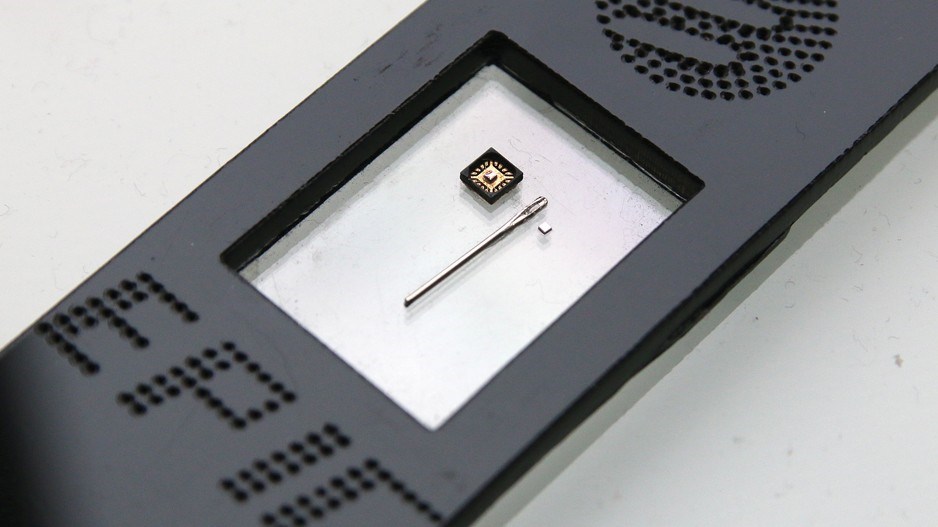

Epic’s technology – battery-free, microscopic AI chips known as “smart dust” – consume exponentially less energy and are exponentially smaller than standard semiconductors.

Epic’s chips function in much the same way as nerve cells and brain cells process electrochemical data, and they are less than a millimetre in size.

Manufacturing doesn’t rely on any third-party components, and the chips are produced using a variation of a laser printer tapping specialized ink.

“It’s really dust-sized, but it doesn’t float in the air. It’s always attached to something. That can be a label of a product or a flexible foil,” Richter said.

“The problem was always what to do with them because normal microprocessors have billions of transistors and [it’s] very difficult to print them on the foil. Our smart dust has only a few thousand transistors, so it’s much easier to realize printable or flexible electronics.”

Manufacturing will be easier and costs will be lower than standard chips, Richter added.

A September forecast released by market intelligence firm IDC pegged demand for semiconductors to grow 17.3% this year compared with 10.8% in 2020.

IDC’s outlook sees growth driven by automobiles, mobile phones, notebooks, servers, gaming and wearables.

Richter said Epic’s own technology can be applied to a broad range of devices and could, for example, save between US$250 and US$350 in the costs of producing a vehicle by reducing the number of cables and wires needed.

“We’re speaking and working with car manufacturers and suppliers. They roll out a million cars per year, so there’s enormous cost-savings, and this makes our technology very, very attractive for global players.”

Other B.C. semiconductor players have been drawing interest amid the global shortage.

Japanese multinational Canon Inc. (TYO:7751), best known for its cameras, acquired Redlen Technologies Inc. back in September in a deal valuing the Vancouver Island tech company at just north of $400 million.

Redlen specializes in manufacturing semiconductors used in medical imaging systems and baggage scanners.

Canon was a strategic partner prior to the acquisition deal and is now bankrolling Redlen’s $40 million plan to accelerate commercialization by doubling its 50,000-square-foot manufacturing facility just outside of downtown Victoria.

The West Coast company will also be expanding its head count to 450 workers by 2025 from the current 200 as it hires experts in everything from automation to product engineering.

Canon will be using Redlen’s cadmium zinc telluride chips as part of its efforts to launch the next-generation of CT (computer tomography) systems.

CEO Glenn Bindley likened current CT systems to a camera with one-megapixel capacity that can shoot only in black and white. The next generation, known as photon-counting CT scanners, would be the equivalent of upgrading to a camera with 10 megapixels that can shoot in full colour.

“If you think of the automobile industry, there’s a sea change from internal combustion to electric vehicles. CT is in a similar situation,” Bindley said.

Redlen’s chips would essentially allow Canon’s medical devices to take clearer images while exposing patients to lower X-ray radiation levels.

“It’s an exciting development for us because we can see how much they [Canon] can help us in the areas where we’re weak,” Bindley, who is sticking around to oversee the expansion, told BIV after the deal was announced.

“Now we really need to scale it up and drive the costs down, and they can really help us in that area.” •